Key Highlights

The Euro formed a short-term top at 1.1733 and declined against the US Dollar.

There was a break below a connecting bullish trend line with support at 1.1630 on the 4-hour chart of EUR/USD.

The US NFP in August 2018 increased 201K, more than the 191K forecast.

Today, the UK GDP for July 2018 will be released, which is forecasted to rise 0.3% (MoM).

EURUSD Technical Analysis

After trading above the 1.1700 level, the Euro failed to hold gains against the US Dollar. The EUR/USD pair formed a short-term top at 1.1733 and declined below the 1.1650 support area

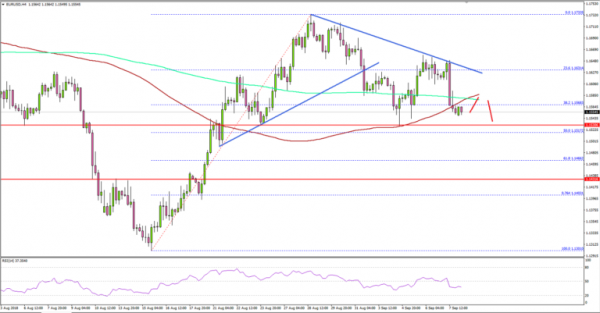

Looking at the 4-hours chart, the pair started a downward move and broke the 23.6% Fib retracement level of the last wave from the 1.1301 low to 1.1733 high. The pair also settled below the 1.1620 pivot area, opening the doors for more losses.

Moreover, there was a break below a connecting bullish trend line with support at 1.1630. At the outset, the pair seems to struggling to remain above the 100 simple moving average (red, 4-hours) and 1.1560.

Therefore, there is a risk of more losses towards the next major support at 1.1515 and the 50% Fib retracement level of the last wave from the 1.1301 low to 1.1733 high. If there are more declines, the pair could decline back towards the 1.1430 support area.

On the upside, there is a bearish trend line formed with resistance at 1.1610. To recover, EUR/USD must break the trend line and the 1.1620 pivot area.

This past Friday, the US nonfarm payrolls report for August 2018 was released by the US Department of Labor. The market was looking for a rise of 191K compared with the last 157K.

The actual result was better than the forecast as total nonfarm payroll employment increased by 201K, but the last reading was revised down to 147K. Looking at the unemployment rate, there was no change from 3.9%.

The report added that:

The number of long-term unemployed (those jobless for 27 weeks or more) was little changed in August at 1.3 million and accounted for 21.5 percent of the unemployed. Over the year, the number of long-term unemployed has declined by 403,000.

Overall, the US Dollar buyers remain in control and major pairs like EUR/USD and GBP/USD could continue to face sellers in the near term.

Economic Releases to Watch Today

- UK GDP for July 2018 (MoM) – Forecast +0.3% versus +0.1% previous.

- UK Industrial Production for July 2018 (MoM) – Forecast +0.4%, versus +0.4% previous.

- UK Manufacturing Production for July 2018 (MoM) – Forecast +0.3%, versus +0.4% previous.

- UK Trade Balance non-EU for June 2018 – Forecast £-3.791B, versus £-2.940B previous.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals