As long as the Bank Of Japan is inactive there is a potential risk of the USDJPY currency pair going downside. In addition, Prime Minister (PM) Abe’s victory at the LDP election is probably priced by the markets. Traders should also consider paying attention to the resumption of US-Japan trade talks on Friday, and the US-Japan Summit on September 25. Today, there are no major news in the USD except for Flash Manufacturing PMI and Services light data that is going to be released in the afternoon. Flash Manufacturing PMI measures a level of a diffusion index based on surveyed purchasing managers in the manufacturing industry. It’s a good indicator of economic health, as businesses react quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company’s view of the economy.

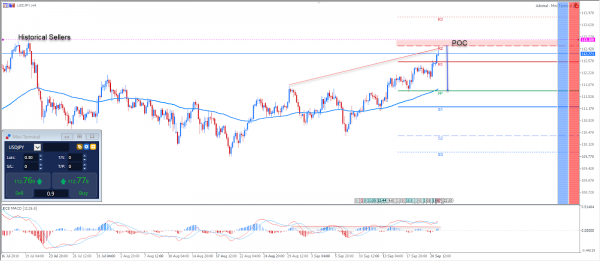

Technically, the USD/JPY currency pair has developed a form of bearish divergence, with the price making a higher high while the MACD is a bit flat. The MACD flatness could result in a lower high soon, and the divergence will be complete by then. We can also see the price near an important pivot point, that has been within the vicinity of historical sellers. We could see also see a rejection soon. The POC zone for short trades is between 113.00-113.20. However, a strong close above 113.40 prompts a further risk-on in the markets. Traders should consider paying close attention to these levels and possibly apply a divergence trend line break or a MACD cross strategy for a potential short trade.

Short Pivot Lines – Daily Support and Resistance

Long Pivot Lines – Weekly Support and Resistance

POC – POC – Point Of Confluence (The zone where we expect the price to react – aka the entry zone)

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals