Here are the latest developments in global markets:

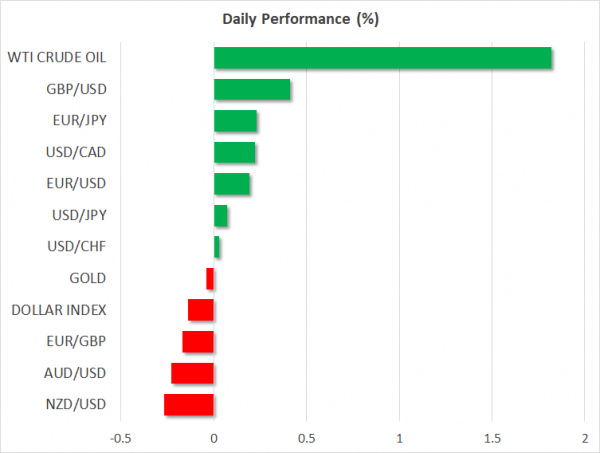

- FOREX: After China canceled planned trade talks with the US on Saturday and new import tariffs took effect, Chinese officials reiterated on Monday that Beijing is ready for a new round of negotiations only if the talks are based on mutual respect. Investors, though, remained positive on the dollar as they widely expected the Fed to shrug off trade risks and deliver another 25 bps rate hike on Wednesday, with dollar/yen trading higher but only modestly so, at 112.67 (+0.10%). US 10-year government yields peaked at 3.09%, the highest since May. The dollar index, however, started the week on the downside, easing to 94.11 (-0.12%) as the euro and the pound grabbed buying interest. Euro/dollar was set to recover Friday’s losses, rising to 1.1770 (+0.18%), finding some support from better-than-expected German Ifo readings; the German Ifo business climate index for the month of September increased to 103.7 compared to 103.2 forecasted, but stood slightly below the August mark of 103.9. Meanwhile in Britain, the UK Brexit Secretary gave some relief to the markets (see below) sending pound/dollar up to 1.3126 (+0.38%), helping it to recover some of Friday’s losses. Pound/yen increased to 147.91 (+0.50%) and euro/pound eased to 0.8965 (-0.17%). In the antipodean sphere, the trade-sensitive aussie/dollar and kiwi/dollar were on the backfoot at 0.7274 (-0.21%) and 0.6668 (-0.25%) respectively. Dollar/loonie edged up to 1.2938 (+0.24%) as last week’s NAFTA talks failed to deliver progress in US-Canadian trade relations ahead of an informal deadline on October 1. In emerging markets, the Turkish lira managed to rally by 1.38% versus the greenback despite the Turkish Ministry of Finance announcing lower growth forecasts for 2018 and 2019 last week. The ministry did not provide details on how it will assist the banking sector.

- STOCKS: New fears on the trade front bit European stocks on Monday, driving the pan-European STOXX 600 and the blue-chip Euro STOXX 50 down by 0.28% and 0.42% respectively at 1140 GMT. The German DAX 30 declined by 0.36%, the French CAC retreated by 0.25%, while UK’s FTSE 100 fell by 0.23%. The Italian FTSE MIB edged lower by 0.11%. In the US, futures tracking S&P 500, Dow Jones and Nasdaq 100 were heading down but marginally so, pointing to a modestly negative open.

- COMMODITIES: Oil prices were rising considerably early on Monday as concerns about US sanctions weighing on Iranian oil exports continued to support the market. Note that the US prepares a second round of sanctions against Iran in November. On Saturday, the OPEC and non-OPEC oil producers who agreed to raise supply in June met in Algiers to discuss the allocation of the supply increase. However, as expected the members did not concluded to reach a formal decision, while they also showed no pledge to hike supply even further unlike the US President’s demands. WTI crude jumped by 2.06% to $72.24/barrel and the London-based Brent surged by 2.45% to $80.76/barrel. In precious metals, gold was steady at $1,199/ounce.

Day Ahead: Monday light in terms of data releases; eyes on trade and Brexit negotiations

Monday will be relatively quiet in terms of economic releases as investors are turning their attention to the Federal Reserve policy meeting on Wednesday that is will widely expected to deliver a 25 bps rate hike for the third time this year. Markets are increasingly pricing another rate rise in December as well, currently assinging an 80% probability to such an outcome.

Any updates, however on the trade front and particularly on the US-Sino relations could prove crucial for the market sentiment as relevant talks were cancelled by China on Saturday, while both Washington and Beijing activated fresh tariffs on each other’s goods today. The US administration imposed an additional 10% tariff on $200 billion of Chinese goods spanning thousands of products. China retaliated immediately with new tariffs ranging between 5% to 10% on $60 billion of US products.

In the UK, Britain’s Secretary of State for Exiting the European Union Dominique Raab said that he was confident that the UK will achieve progress with the EU regarding the withdrawal plan, while saying that a no-deal Brexit is not the end of the world and the UK is ready to face such an outcome. Meanwhile, the Labour Party leader Jeremy Corbyn threatened to support a second Brexit referendum if the UK Prime Minister, Theresa May, fails to push her Brexit proposal through Parliament. May is scheduled to defend her Chequers plan today at a meeting with her Cabinet at 1300 GMT. Recall that the EU rejected May’s divorce proposals last week in Austria.

Looking at the calendar, Canadian wholesale trade data for the month of July are due for release at 1230 GMT. Yet the main focus will be on NAFTA negotiations between US and Canadian officials with the next deadline being October 1.

As for public appearances, President Mario Draghi will be speaking to the European Parliament’s ECON committee at 1300 GMT.

Overnight, the Bank of Japan will release minutes of its July 30-31 meeting at 2350 GMT, this being the meeting before the latest one. Note that on September 19 the central bank left rates unchanged at -0.1% and maintained its July pledge to keep borrowing costs low for an extended period of time. Still, policymakers remained optimistic on the path of the economy despite warning that US trade protectionism may cloud the outlook.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals