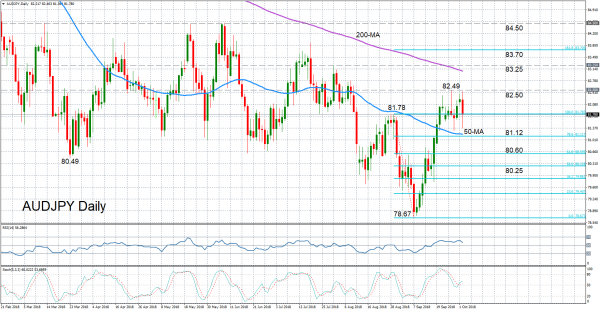

AUDJPY has posted a strong rebound from the 22-month low of 78.68 hit on September 7, making a higher high in the process. However, the pair hit a wall at just below the 82.50 level, putting into doubt the sustainability of the latest uptrend as technical indicators have since weakened.

The RSI is pointing down, having peaked at below the 70-overbought level, but it remains comfortably in positive territory. The stochastics have turned higher again, with the %K line recording a bullish crossover with its %D line, though the upside momentum is weak.

Should the pair manage to break above the nearest resistance at 82.50, a reach for 83.25 (taken from the July 31 high) could be possible. A jump higher would take prices towards the 161.8% Fibonacci extension of the downleg from 81.78 to 78.67, at 83.70. Further gains would see the 84.50 level coming into range, which acted as strong resistance in May and June.

If today’s losses were to be extended, however, support is likely to come from the 78.6% Fibonacci retracement of 81.12. The 78.6% Fibonacci level is just below the 50-day moving average so a drop below it would shift the focus back to the downside. Deeper losses would bring into view the 61.8% and 50% Fibonacci levels, at 80.60 and 80.23, respectively. A breach of the 50% Fibonacci could accelerate the declines towards the 22-month low of 78.68, risking a resumption of the longer-term downtrend.

In the more medium-term picture, the bearish outlook has eased substantially following the bounce in price action back above the 50-day moving average.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals