Australia’s employment report for September is likely to attract investors’ attention and is scheduled for release on Thursday at 0030 GMT. The aussie is on the receiving end of considerable downside pressure stemming from growing concerns about a full-blown trade war between the US and China, as well as on the back of domestic drivers. Stronger data later in the week may provide some short-term relief to the currency.

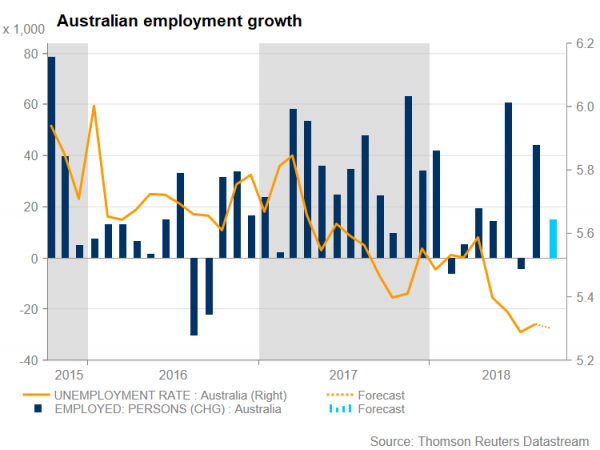

The Australian economy is anticipated to have created 15,200 jobs in September, 28,800 jobs less than the previous month. Moreover, the unemployment rate matched a low last experienced in November 2012 in the previously tracked month and is forecast to remain at the same 5.3% level in August, as the previous two months. This is positive, given that the participation rate is predicted to hold steady at 65.7% in September.

Stronger than expected figures on Thursday may provide a lift to the aussie, which is trading slightly above the 32-month low levels versus the greenback. Minutes of the monetary policy meeting of the Reserve Bank of Australia (RBA) that took place on October 2 referred that the GDP inched up by 0.9% in the quarter, and the upward revision to growth in earlier quarters drove GDP growth to the June quarter to 3.4%, which was the highest year-ended rate of growth since 2012. Also, members mentioned that “employment had risen strongly in August, driven by full-time employment, and employment growth had been stronger than population growth over the year”.

Turning to monetary policy in Australia, the minutes mentioned that the Australian dollar had tumbled more than 8% versus the US dollar during 2018 so far. This was the result of US long-term bond yields having moved above those in Australia over this period despite the rise in commodity prices recently. Meanwhile, the RBA kept the cash rate at a record low of 1.5% at its October meeting, as widely expected, extending its record period of policy inaction beyond two years, amid sluggishness in inflation and wages as well as the risk to global growth from trade policy by the US.

From the technical point of view, upbeat numbers on employment are likely to propel AUDUSD higher. Resistance to a rising pair may take place around the 0.72 round figure, which coincides with the 40-day SMA. More bullish movement would shift the focus to the region around the 0.7300 psychological level, which stands above the medium-term descending trend line that has been holding since January 26.

On the downside and in case of disappointing figures or rising trade risks, price action is likely to challenge again the 32-month low (0.7040). A drop below this level would reinforce the downside risk and send prices until the 0.7000 round number, last reached in January 2016, creating a lower low in the downward trend.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals