The Fed will release the minutes of its September meeting, where policymakers raised rates for a third time this year, on Wednesday at 1800 GMT. Investors may focus mainly on the discussion around how far above “neutral” officials are willing to raise rates. Considering current market pricing, a confident tone that reaffirms the Fed remains on track to meet its own rate projections could help the dollar rebound, and in turn spell more trouble for stocks.

Back at the September gathering, the Fed raised interest rates by 25bps, though it maintained its future rate-path projections largely unchanged and delivered almost no new fresh policy signals. Of note was the removal of a phrase that previously read “policy remains accommodative”, which initially generated worries that the pace of hikes may slow. While Chairman Powell later downplayed this change as merely cosmetic and not a signal per se, investors will still scrutinize the minutes for some more color on that debate.

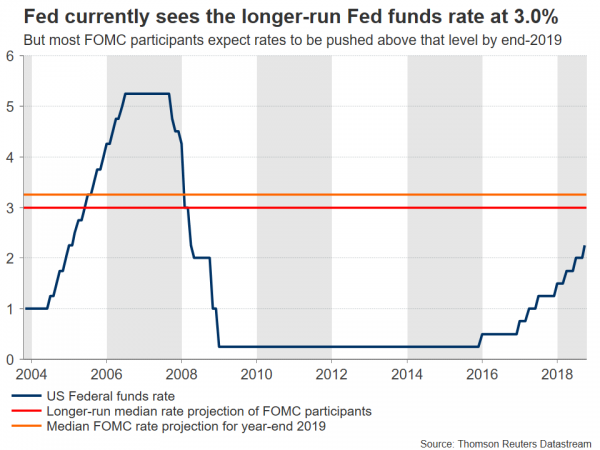

Another discussion markets will focus on is what officials consider to be the “neutral” rate of interest, whether most participants are willing to raise rates above it – and if so, by how much. To put things into context, “neutral” is theoretically the interest level that neither stimulates nor restricts economic activity, which most Fed calculations place around the 2.5% – 3.5% neighborhood. Once that level is reached, any rate increases beyond it to keep inflation under control would be seen as posing risks to growth, implying policymakers may start becoming hesitant to pull the hike trigger.

The latest rate-path projections show nearly all officials expect policy rates to be in restrictive territory by 2020, though there’s considerable dispersion among them on how much higher rates should go. In this respect, it’s noteworthy that Chicago Fed President Charles Evans – a typically dovish official – recently said he thinks two 25bps hikes above “neutral” would be appropriate. It will be interesting to see whether something similar is echoed by the broader Committee, with the risk being that most members are even more hawkish in their views.

On a different note, the conversation around trade tensions and the risks they pose could also attract attention. That said, judging by how Chair Powell brushed them aside during the press conference as being merely a risk that hasn’t actually shown up in the data yet, the Fed doesn’t appear to be particularly worried thus far.

All in all, the key message may be that the Fed remains committed to raising rates in a gradual manner – perhaps once per quarter – until it has a reason not to, and that trade risks are not dire enough (yet) to delay these plans. Market participants don’t seem quite as confident though, having priced in only two quarter-point hikes between now and June 2019, which implies they expect the Fed to pause for one quarter in the meantime. Hence, a confident tone in the minutes that reaffirms the Committee remains on track to meet its own rate projections could push US bond yields higher, potentially helping the dollar to claw back some of its latest losses.

Technically, advances in dollar/yen could encounter a first wave of resistance near 112.80, the inside swing low of October 8. An upside break may open the way for a test of 113.50, the area that halted the decline on October 2, before the one-year high of 114.54 comes into view.

On the contrary, declines in the pair – perhaps on a Fed that focuses more on trade risks or downplays hiking beyond “neutral” – may stall initially around 111.60, the October 15 low. Even lower, the September 12 trough of 111.10 may attract attention, ahead of the September 7 bottom of 110.35.

Beyond the dollar, US stocks will also be in the spotlight, considering that the recent bout of equity-weakness was brought about by a surge in US bond yields. Bonds are considered safer than stocks, and as they begin to offer a higher return they become more attractive to hold relative to equities. Hence, a confident tone by the Fed that boosts bond yields could spell more pain for stocks, whereas a more cautious-sounding narrative could help US indices to recover.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals