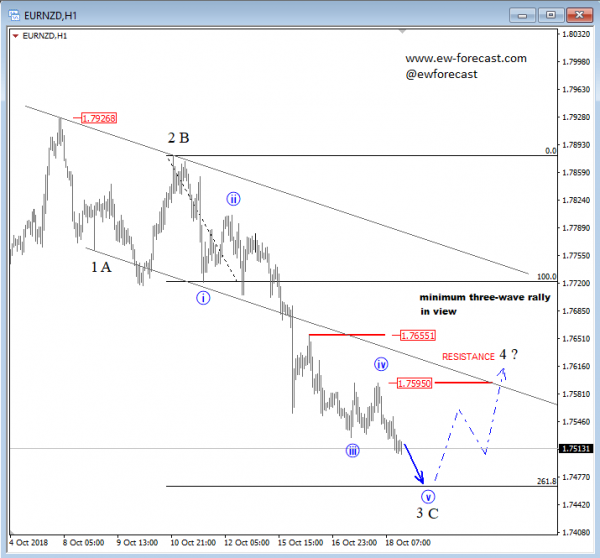

EURNZD is currently unfolding a third wave of a bigger decline from the 1.7927 area. We labelled this drop as an A-B-C/1-2-3 movement, which can now be ready to face temporary support. We are talking about 1.7470 region, where a minor five-legged drop of wave 3 or C can be coming to an end, and where the Fibonacci projection zone of 261.8 can offer support. From the mentioned zone a minimum three-wave reversal may follow, which could later look for resistance near the 1.759/1.765 area, region of former swing highs. Also the lower base channel line, connected from end of wave 1/A can offer resistance and a turning point for lower prices.

If price manages to turn lower in impulsive fashion, below the 1.7500 region then this would favor a 1-2-3-4-5 bearish view, however, if price manages to rally further, above the 1.7720 area, then this would put an A-B-C low in place and would favor the bulls.

EURNZD, 1h

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals