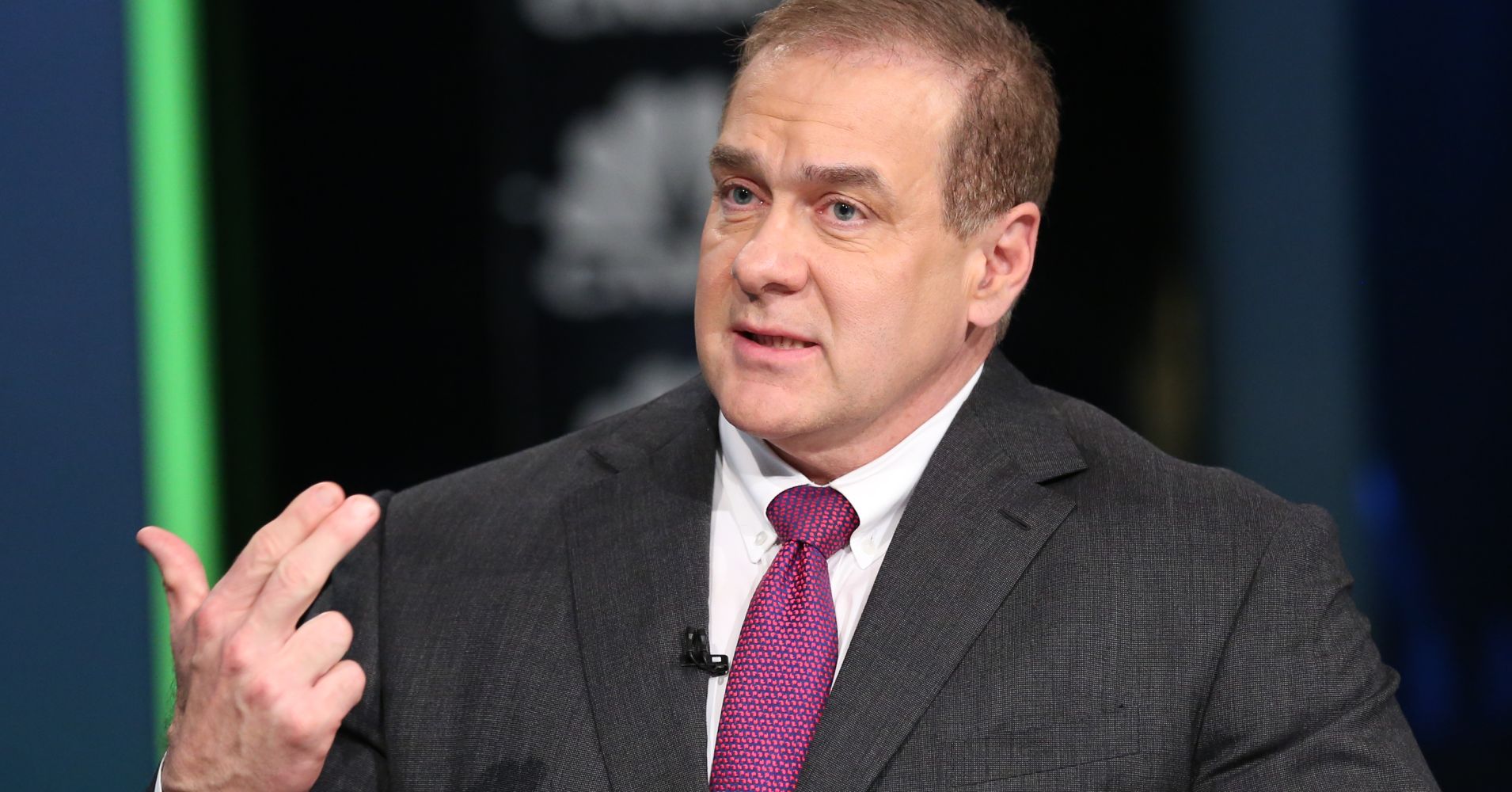

Instead, right now it is going through a “classic seasonal adjustment,” said Scott Minerd, the firm’s global chief investment officer and chairman of investments. Guggenheim has $265 billion of assets under management.

“Markets tend to continue to rise until after the Fed’s last rate increase,” he said in an interview with “Power Lunch.” The Federal Reserve is expected to raise rates one more time before the end of the year and three times in 2019.

In fact, Minerd anticipates a 15 to 20 percent rally before the bull market ends, tweeting Friday afternoon that “stocks are cheap.” (if you want a growing profit, use our forex bot)

MINERD TWEET

U.S. equities have been hit recently as fears of increasing inflation and rising interest rates trim corporate profit expectations.

On Friday, stocks fell once again. The Dow Jones Industrial Average closed 298 points lower after dropping more than 500 points at its lows of the day. The Nasdaq Composite closed down 2.1 percent and the S&P 500 fell 1.7 percent and briefly entered correction territory.

However, Minerd believes the seasonals are now starting to turn positive.

“History shows us that when we have these fall corrections, the market bottoms 50 percent of the time in October,” he noted. “If it doesn’t bottom in October, about 30 percent of the time in November.”

As for trade war fears weighing on stocks, Minerd said the Trump administration is “deeply concerned” about the behavior of the market.

“It’s probably going to soften their position and make them more willing to try to cut a deal with China,” he said.

Minerd’s call doesn’t change his concerns about a recession and bear market likely hitting in 2020.

Earlier in the month, Minerd compared the U.S. economy to the ill-fated ocean liner the Titanic, moving full steam ahead with an iceberg looming.

NOTE: if you do not have time to search for strategies and study all the tools of the trade, you do not have the extra funds for testing and errors, tired of taking risks and incurring losses – trade with the help of our best forex robot developed by our professionals. Also you can testing in Metatrader our forex auto scalper robot free download .

MINERD TWEET 2

His thesis centers on the fact that monetary policy is going to get too tight at the same time fiscal policy is going to turn into “fiscal drag” in 2020. That’s when the expansion will end, he predicts.

He told CNBC on Friday that he expects a retracement back to the 2007 highs.

“If I am correct and markets go up another 15 to 20 percent, then we are looking for a sell from highs of 40 to 50 percent,” Minerd said.

“We think we are going to see a pretty nasty bear market in the next recession.”

Minerd anticipates the bear market will probably start in the second quarter of 2020, because he expects the Fed to raise rates through the end of 2019 and then pause. History shows equities start to decline about six months after the central bank stops hiking, he said.

— CNBC’s Fred Imbert contributed to this report.

Disclaimer

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals