ECB Reduces PEPP Purchases, Upgrades Inflation forecasts

BOE Hikes Bank Rate, Surprising the Market Two Months in a Row

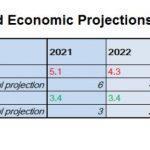

Hawkish monetary policy. Fed Anticipates Rate Hikes Next Year

ECB Preview – Phase-Out of PEPP by March as Scheduled

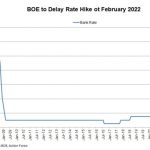

BOE Preview – Delaying Rate Hike to February 2022

FOMC Preview – Fed to Double Size of QE Tapering

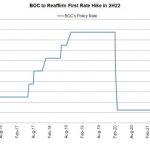

BOC Preview – Reiterating Rate Hike in First Half 2022 amidst Strong Economic Data

RBA Stayed Put, Cautiously Optimistic Over Domestic Economy

RBA Preview – Keeping Powder Dry on Mixed Data and Omicron Uncertainty

Hawkish Powell Expects Fed to End QE Tapering a Few Months Earlier than Previously Anticipated

RBNZ Hiked Rate but More Cautious about Economic Outlook

RBNZ To Lift Policy Rate Again after Strong Inflation

Rate Hike Speculations Heighten as Eurozone’s Inflation Accelerates Further

Market Disappointed at BOE Left Bank at Historic Low. Downgraded Growth Forecast

Fed Will Start Reducing Asset Purchases in Coming Weeks. Not in a Rush to Raise Rate

RBA Review – Ending Yield Curve Control and Pushed Forward First Rate Hike to 2023

BOE Preview – Rate Hike Cycle to Begin?

FOMC Preview – Tapering to Formally Being

ECB Downplayed Urgency of Rate Hike to Tame Inflation

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals