Here are the latest developments in global markets:

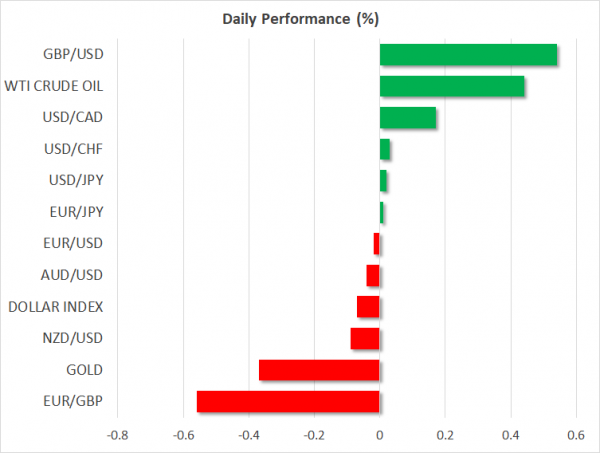

FOREX: Euro/dollar printed a 2 ½-month low at 1.1330 on Wednesday despite eurozone’s flash core inflation inching up to 1.3% y/y in October from 1.2% expected and 1.1% seen in September. The headline inflation remained unchanged at 2.2% y/y, at the strongest since 2012 but buying interest was subdued as concerns over the budget battle between Italy and the eurozone as well as uncertainty about how political conditions will evolve in Germany after Chancellor Merkel leaves the office in 2021 shifted funds out of the market. Meanwhile, the ECB member Ewald Nowotny said that the central bank could revise economic forecasts slightly to the downside at the December meeting, adding some pressure to the common currency. In the UK, pound/dollar was slowly recovering Tuesday’s losses triggered after the ratings agency S&P said that a no-deal Brexit could dip the country into recession for more than a year. The pair was last seen at 1.2741 (+0.30%), not far above the 2 ½ -month low of 1.2692 tracked yesterday. Dollar/yen flattened around 113.14 after hitting a 3-week high at 113.32 early today, while the dollar index also moved sideways around 97. US 10-year government bond yields climbed as high as 3.15%, the highest in a week. In antipodean currencies, aussie/dollar weakened to 0.7094 (-0.15%) as Australian Q3 inflation figures eased in line with forecasts but Chinese NBS manufacturing PMIs slowed more than forecasts suggested. Kiwi/dollar was on the back foot as well, losing 0.20%. In emerging markets, People’s Bank of China set its official yuan midpoint at a a new decade low, while informing that it will issue a 20 billion yuan of bills out of Hong Kong, the bisggest offshore yuan centre.

STOCKS: Upbeat earnings releases drove European stocks overwhelmingly higher at 0830 GMT. The pan-European STOXX 600 and the blue-chip Euro STOXX 50 were up by 1.49% and 1.59% respectively, though they both poised for a strong monthly loss. The German DAX 30 rose by 1.40%, the British FTSE 100 and the Spanish IBEX 35 were gaining 1.52%, while the Italian FTSE MIB was increasing by 0.79%. The French CAC 40 overperformed its peers, jumping by 2.0% after the cosmetics Loreal French company and the French pharmaceutical firm Sanofi unveiled upbeat profit results. The banking sector was also a positive spot. In Asia, stocks closed in the green, with Japanese equities performing the best. In the US, futures tracking S&P 500, Dow Jones and Nasdaq 100 were holding moderate gains.

COMMODITIES: Crude prices managed to recoup yesterday’s losses as the focus turned to Iran which is set to face a second round of US sanctions on November 4. Although the API weekly oil report showed a stronger build-up in US inventories and data indicated early this month that production in Russia, Saudi Arabia and the US are near record highs, WTI crude found the opportunity to climb by 0.54% to $66.54/barrel today. The London-based Brent also advanced, crawling up by 0.71% to $76.45/barrel. The recovery in stock markets provided support to the market as well. In precious metals, gold extended losses towards $1216/ounce (-0.48%) increasing speculation that a peak at $1243 has been reached.

Day Ahead: All eyes on US ADP employment report and Canadian GDP

The release of the ADP nonfarm employment report out of the US and monthly Canadian GDP growth figures are expected to be the main highlights later on Wednesday.

In the US, the ADP employment report for October is predicted to be released at 1215 GMT. Forecasts are for the private sector to have gained 189K jobs, less than 230K in the preceding month, which could raise speculation that the NFP report on Friday, could be near its expectation of 189K. The US dollar has edged sharply higher over the last few days against a basket of major currencies, jumping to 1 ½-year highs, while the US stock indices regained some ground. Today’s data could drive the greenback slightly higher if the data come in better than expected.

At 1230 GMT the focus will turn to Canada and monthly GDP growth data. The Canadian economy is expected to show no expansion in August after improving by 0.2% m/m in July. Any upside surprise could be loonie-positive and vice versa. Producer prices for the month of September will be also eyed at the same time.

Meanwhile any potential developments in US-Sino trade relations and updates in Italian and German politics will be valuable to markets. Brexit headlines will be closely watched as well, as the British Prime Minister Theresa May and Finance Minister Philip Hammond will meet around 120 chief executives and international investors to discuss the exit from eurozone and the budget.

In terms of other public appearances, Bank of Canada Governor Stephen Poloz and the Senior Deputy Governor Carolyn Wilkins will appear before a Senate Committee at 2015 GMT.

In energy markets, investors will look through the EIA report on US crude oil inventories. According to forecasts, crude inventories have dropped by 4.110 million barrels in the week ending October 26 compared to 6.346 million in the preceding week. On the other hand, gasoline inventories and distillate stocks are anticipated to increase though not by much.

Overnight, China will see the release of the October Caixin Manufacturing PMI at 0145 GMT. Manufacturing PMI is expected to inch marginally down by 49.9 versus 50.0 in the previous month. Should the numbers show a bigger deterioration in manufacturing activities the aussie which is sensitive to Chinese economic conditions could move south.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals