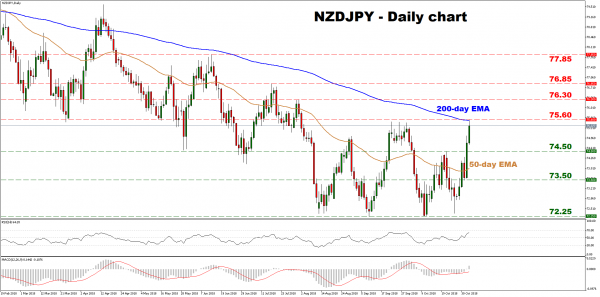

NZDJPY soared in recent sessions, before it met resistance near the crossroads of the 75.60 zone and its 200-day exponential moving average (EMA), and subsequently pulled back somewhat. The inability of the bulls to break above this crossroads suggests that the short-term outlook is still neutral, with a break above that zone needed to shift it to positive.

Taking a look at short-term momentum oscillators, they detect accelerating upside speed. The RSI – already above its neutral 50 line – is pointing higher and looks to be headed for a test of its overbought 70 level. Similarly, the MACD is both in positive territory and above its red trigger line.

Further advances in the pair could encounter immediate resistance near the intersection of the 75.60 barrier and the 200-day EMA that is currently a few pips below, at 75.56. An upside break may shift the near-term bias to positive, setting the stage for a test of the 76.30 area, marked by the July 31 peaks. Even higher, the bulls could stall around 76.85 – this being the June 13 high.

On the flipside, a pullback in the pair could meet a first wave of support at 74.50, defined by the inside swing high on October 23. If the bears pierce below it, the next obstacle may be the October 31 low of 73.50 (that is much more visible on the 4-hour chart), assuming the 50-day EMA at 73.90 is violated first. Lower still, buy orders may be found around 72.25, a two-year low and a territory which capped several declines in recent months.

Overall, the short-term bias is still neutral, with a clear close above 75.60 and the 200-day EMA needed to turn it positive.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals