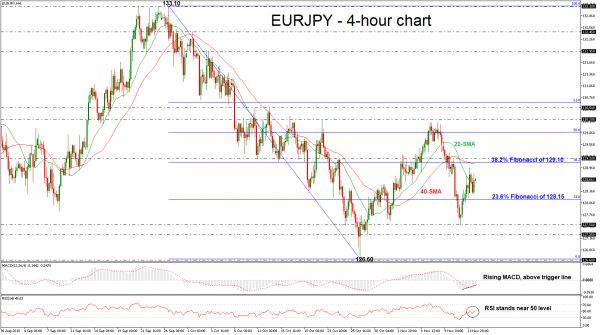

EURJPY has been trading within the 23.6% Fibonacci retracement level and the 38.2% Fibonacci mark of the downleg from 133.10 to 126.60, between 128.15 and 129.10 over the last 4-hour sessions. The MACD oscillator is moving higher in the negative zone, above its trigger line, and the RSI indicator is pointing up near the threshold of 50.

If prices are able to continue to move higher and overcome 38.2% Fibonacci of 129.10 and the 129.20 resistance, the next obstacle for traders to watch is the 50.0% Fibonacci of 129.86. Even higher, the price could meet the 130.20 hurdle, before being able to hit the 130.50 hurdle, taken from the high on October 12.

Alternatively, if the market manages to turn to the downside again below the 23.6% Fibonacci, this could open the way towards the 127.50, taken from the latest lows. Moving lower, the market could decline further until the 127.25 barrier.

To sum up, the market is expected to hold neutral in both the short-term and medium-term.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals