November’s eurozone flash manufacturing and services PMIs, as well as the composite measure that blends the two sectors, are due on Friday at 0900 GMT. The prints are not expected to reflect a pickup in euro area economic activity during Q4, while another disappointment in the figures will likely spur speculation for a relatively dovish ECB during its December meeting. Such an outcome would be euro-negative, to state the obvious.

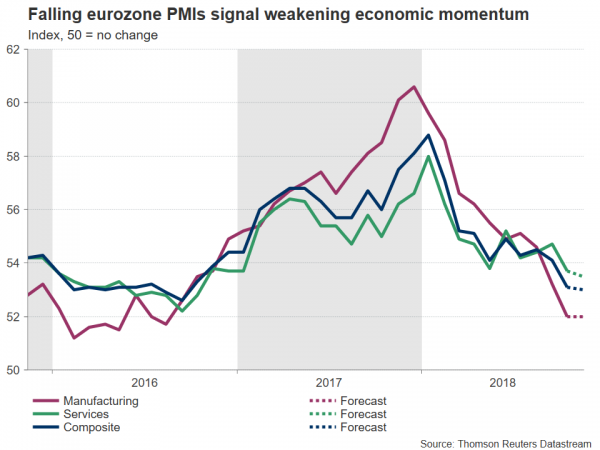

Analysts’ preliminary estimates call for the manufacturing PMI to remain at 52.0 in November, its lowest since August 2016. The services and composite PMIs – the latter is viewed as a good overall growth indicator for euro area economies – are forecast at 53.5 and 53.0 respectively, which reflects marginal weakening compared to October’s 53.7 and 53.1. These would also constitute their lowest in more than two years. Overall, all three measures are anticipated to remain in expansion territory, though fail to deviate from the negative trend established in the beginning of 2018.

The Sino-US trade dispute and seemingly easing global growth have been seen as weighing on gauges such as the PMIs. Adding to these factors Brexit complications that further cloud the outlook for eurozone businesses, as well as the ongoing EU-Italy budget standoff, and the risk may be tilted to the downside as regards Friday’s data.

On the monetary policy front, should the readings project a gloomier-than-expected picture on Friday, then this could feed into the narrative of an ECB that is unable to begin its rate normalization process during the latter part of 2019, thus hurting the single currency. The ECB meeting on December 13 will provide more insights on the Bank’s thinking, with fresh staff forecasts being made public during the gathering as well; downbeat PMIs may exert pressure on policymakers to downgrade their growth forecasts.

Diverting back into economic releases, it should be kept in mind that Germany (0830 GMT) and France (0815 GMT), the two largest economies in the eurozone, will also see the release if their corresponding flash PMI readings on Friday. It is not unusual for traders to use these numbers to speculate on how the euro-wide figures will come out a few minutes later, positioning themselves accordingly.

In FX markets, disappointing data may spur a decisive move below the 1.14 handle for EURUSD. In this case, the 1.13 mark would come in focus as potential support, with the area around it capturing a couple of bottoms from previous months at 1.1297 and 1.1299. Lower still, 1.1213, the pair’s lowest since June 2017 hit on November 12 would come within scope. Conversely, upbeat numbers spurring long positions in EURUSD may see the pair finding resistance around 1.1492, the current level of the 50-day moving average line; the region around this point captures a top (1.15) and a bottom from the recent past (1.1524), while not far above lies the 100-day MA at 1.1551. Higher still, a zone of congestion previously in 2018 around 1.1675 would increasingly come in focus.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals