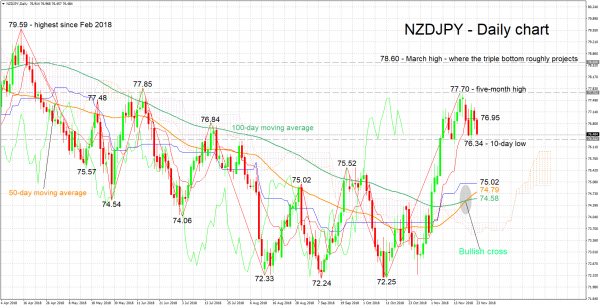

NZDJPY retreated after touching a five-month high of 77.70 last week. Still, the pair’s remarkable recovery after coming close to more than two-year lows in early October remains largely intact.

The Tenkan- and Kijun-sen lines are positively aligned in support of a bullish bias in the short term. However, notice that the two have flatlined, indicating weakening positive momentum.

A move up could meet resistance around the current level of the Tenkan-sen at 76.95; the 76.84 top and the 0.77 handle are also part of the area around this point. Further above, last week’s multi-month high of 77.70 would be eyed, with a couple of peaks from the past at 77.48 and 77.85 also being part of the region around this level. Even higher, the attention would turn to the March high of 78.60, which is also where the triple bottom reversal pattern completed in October approximately projects to.

On the way down, immediate support could occur around the 10-day low of 76.34. Lower, the area around the 75.53 top would come in focus, with steeper losses bringing the region between 75.02 and 74.58 within scope. This area encapsulates the Kijun-sen, a previous peak, and the current levels of the 50- and 100-day moving average lines.

The medium-term picture looks predominantly bullish, with price action taking place above the 50- and 100-day moving average lines, as well as above the Ichimoku cloud. It is of note that the two MAs recently recorded a bullish cross.

To conclude, the short-term bullish bias is looking fragile at the moment, while the medium-term outlook looks positive.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals