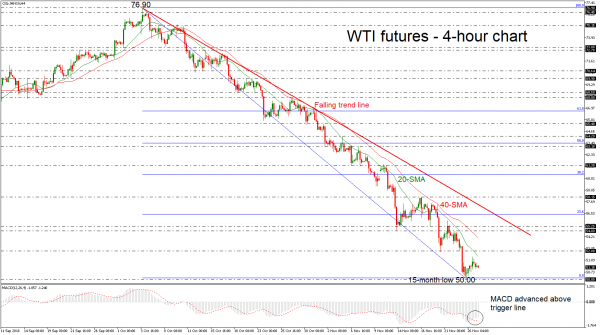

West Texas Intermediate (WTI) crude oil futures are trying to pare some of the previous month’s heavy losses, however the momentum is still too weak. During Monday’s session, the price completed a fresh 15-month low around the 50.00 handle, recording a significant bearish day. The MACD oscillator seems to be ready for a potential upside retracement in the near term as it climbed above the trigger line in the negative zone.

If the price continues to move slightly higher, immediate resistance is coming from the 20-simple moving average (SMA) around 52.26, before touching the 52.80 barrier. Even higher, oil could trade towards the 40-SMA near 54.10. Furthermore, the next area within 54.80 – 55.25 could be the next resistance zone to look for.

Alternatively, the price could re-touch the 50.00 handle again, taken from the latest lows, while the 49.00 obstacle, identified by the trough on October 2017, could be another significant stop for investors. Further declines could lead oil until 47.80, taken from the low on September 2017.

Overall, WTI crude has been developing in a strong bearish tendency after the bounce off the 76.90 resistance, failing to post a significant upside retracement.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals