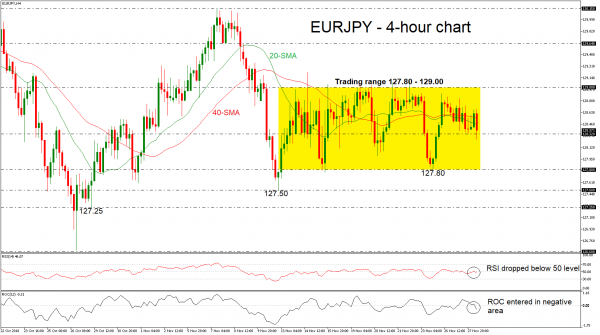

EURJPY has been trading within a consolidation area over the last couple of weeks, with upper boundary the 129.00 resistance barrier, and the 127.80 support level. Technically, in the 4-hour chart, the RSI indicator is moving slightly lower below the threshold of 50, and the ROC indicator slipped below the zero line, suggesting more losses in the trading range.

If prices drop below the 128.32 mid-level of the channel, they could re-test the 127.80 hurdle. More bearish pressures could shift the outlook from neutral to negative and send prices until the 127.50 support, identified by the low on November 13 and then towards the 127.25 trough.

Alternatively, if the market manages to turn to the upside and overcome the 20- and 40-simple moving averages (SMAs), resistance could be met at the upper boundary of 129.00. A clear run above this strong area, the pair could touch the 129.64 barrier, taken from the inside swing bottom of November 8.

Concluding, the market is expected to hold neutral in both the short-term and medium-term.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals