The G20 Summit is about to kick start in Buenos Aires, Argentina, today and world leaders have started to arrive. In the summit a number of issues are to be discussed, including the future of work, economic sustainability, climate change and digital economy. On the sidelines of the summit, important meetings are to take place, with the highlight being the Trump-Xi meeting. The two leaders are expected to discuss the tensions in the US-Sino trade relationships and should there be a positive outcome we could see risk sentiment returning to the markets. Also on the sidelines, US president Trump is expected to meet Russian president Putin to discuss the situation in the Middle East and Ukraine. A meeting between Russian president Putin and Saudi Prince Mohammed bin Salman, could have an effect on oil prices, ahead of the OPEC meeting on the 6th of December in Vienna. We wouldn’t be surprised to see the Russian and Saudi energy minister exchanging notes on possible oil production cut levels. The summit could have an effect on a number of currencies, however the USD may experience increased volatility.

USD/JPY remained rather stable yesterday, testing the 113.25 (S1) support line. We could see the pair’s direction being influenced by any headlines regarding the G20 Summit. Should the bears take over, we could see the pair breaking the 113.25 (S1) support line and aim for the 112.72 (S2) support barrier. Should on the other hand the bulls take over we could see the pair breaking the 113.95 (R1) resistance level.

Pound weakens as Theresa May insists that no extension will be given to Brexit deadline

The pound weakened yesterday against the USD, as market worries intensified for a hard Brexit. UK’s PM, Theresa May stated that any extension of the Brexit deadline in March, would cause the negotiations to restart and that she is not willing to seek any extension. Also, she stated that she remains focused on passing the deal through the UK parliament on the 11th of December and not on the alternatives. A rejection of the deal by the UK parliament seems more than possible at the moment, as no majority is currently available for the deal to pass. We expect the pound to remain under pressure today, as further Brexit headlines are expected.

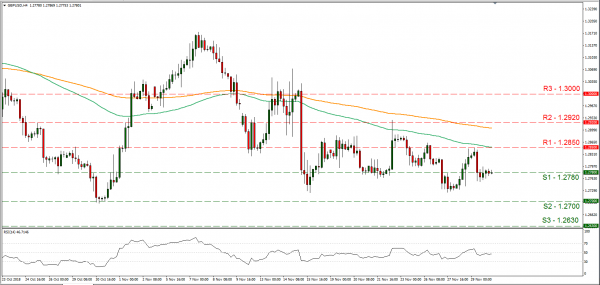

Cable dropped yesterday testing the 1.2780 (S1) support line. Should the pound remain under pressure, or should there be further negative headlines about Brexit, we could see the pair experiencing some bearish tendencies and vice versa. If the market favors the pair’s long positions, we could see it reaching if not breaking the 1.2850 (R1) resistance line and aim for higher grounds. Should on the other hand, the pair come under the market’s selling interest, we could see the pair, breaking the 1.2780 (S1) support line and aim if not break the 1.2700 (S2) support area.

In today’s other economic highlights:

On a busy Friday, in the European session, we get Germany’s retail sales growth rate for October, UK’s house prices growth rate for November, France’s preliminary CPI (EU Normalised) for November, Eurozone’s preliminary headline and core HICP rates for November as well as Eurozone’s unemployment rate for October. In the American session we get Canada’s GDP growth rates for September and Q3 and later on the US Baker Hughes oil rig count. As for speakers ECB’s Yves Mersch will be speaking.

GBP/USD H4

Support: 1.2780(S1), 1.2700 (S2), 1.2630 (S3)

Resistance: 1.2850 (R1), 1.2920 (R2), 1.3000 (R3)

USD/JPY H4

Support: 113.25 (S1), 112.72 (S2), 112.15 (S3)

Resistance: 113.95 (R1), 114.50 (R2), 115.10 (R3)

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals