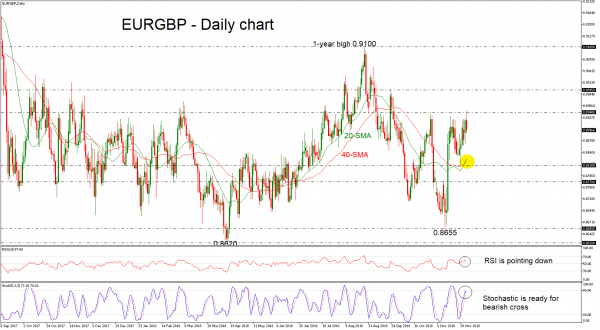

EURGBP has had a strong bearish rally this morning after the bounce off the 0.8940 resistance level. Neutral to negative risks remain in the background as the RSI decreases momentum to the downside in the positive region, while the %K line of the stochastic oscillator turned lower and is ready to create a bearish cross with the %D line in the oversold zone.

A decline in the price may retest the 20- and 40-simple moving averages (SMAs), which hold near the 0.8820 critical level. Immediate support level could come from the 0.8810 barrier, before heading even lower towards the inside swing top of 0.8770, identified by the peak on November 12. Any violation of this area would resume the bearish movement from 0.9100, towards the 0.8655 hurdle.

An advance in the price may retest the 0.8940 resistance level, identified by the high on October 30. A break higher would turn focus to 0.8995, registered on September 21, which tried to halt upside movements several times in the past. Above that, investors would be interested to see whether bullish dynamics can overcome the previous peak and meet the one-year high of 0.9100.

To conclude, both the short- and medium-term outlooks are looking neutral at the moment.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals