Yen and Dollar are the strongest ones today as global stock markets are back in selloff mode. Sentiments turned sour after weaker than expected Chinese sales and production data. Adding to that, Eurozone came showed further decline in growth momentum, verifying ECB’s concerns. China’s concessions on retaliation tariffs on US autos are a positive news, but couldn’t turn things around.

Dollar is gaining a bit extra advantage after slightly better than expected retail sales data. But that’s just a matter of 0.2% growth versus 0.1%. DOW futures are pointing to lower open, and we’ll see if selling would intensify onwards. Staying in the currency markets, New Zealand and Australian Dollar are the weakest ones on risk aversion naturally, in particular on Asian slowdown. Sterling is the third weakest today on Brexit worries. Euro isn’t too far away though.

In other markets, FTSE is currently down -0.66%, DAX is down -0.65% and CAC is down -1.05%. German 10 year yield is down -0.024 % 0.262. Italian 10 year yield is up 0.006 at 2.975. Earlier today, Nikkei closed down -2.02%, Hong Kong HSI closed down -1.62%, China Shanghai SSE dropped -1.53%. Singapore Strait Times dropped -1.09%. Japan 10 year JGB yield dropped again by -0.0191 to 0.035.

Technically, AUD/USD is finally moving away from 0.7199 support, confirming near term reversal. Retest on 0.7020 low should be seen next. Steep selloff is seen in EUR/USD and EUR/JPY and they are likely having downside breakout finally. 1.1267 support and 124.79 support should be watched closely to confirm.

Released from the US, retail sale rose 0.2% mom in November versus expectation of 0.1% mom. Ex-auto sales rose 0.2% mom, matched expectations.

China announced to suspend retaliatory tariffs on 211 items of US autos and parts for 3 months

China Ministry of Finance announced to suspend retaliation tariffs on US autos and parts for 30 days, as a result of the meeting between Xi and Trump in Argentina. The statement noted that important consensus was reached between the two heads of state. And in order to implement the consensus, China will suspend the additional tariffs imposed this year on 211 items for three months from January 1 to March 31, 2019. The lists include 25% tariffs on 28 items in list 1, 25% tariffs on 116 items in list 2, and 5% tariffs on 67 items in list 3.

Also from China, retail sales rose 8.1% yoy in November, below expectation of 8.8%. Industrial production rose 5.4% yoy, below expectation of 5.9%. Fixed assets investments rose 5.9% ytd yoy, matched expectations.

Eurozone PMI composite dropped to 49-month low, underlying growth rate slowed across Eurozone

Eurozone PMI manufacturing dropped to 51.4 in December, down from 51.8, missed expectation of 51.9. It’s a 34-month low. PMI services dropped to 51.4, down from 53.4, missed expectation of 53.4. It’s a 49-month low. PMI composite dropped to 51.3, down from 52.7, a 49-month low.

Chris Williamson, Chief Business Economist at IHS Markit said in the release that “While some of the slowdown reflected disruptions to business and travel arising from the ‘yellow vest’ protests in France, the weaker picture also reflects growing evidence that the underlying rate of economic growth has slowed across the euro area as a whole.”

And, “While GDP growth in the fourth quarter as a whole is indicated at almost 0.3%, the surveys point to quarterly GDP growth momentum slipping closer to 0.1% in December alone. Forward-looking indicators such as new orders and future expectations remaining subdued suggest that demand growth is stalling, adding to downside risks to the immediate outlook.

Germany PMI manufacturing dropped to 51.5, down from 51.8, missed expectation of 51.7. It’s a 33-month low. PMI services dropped to 52.5, down from 45.5, missed expectation of 53.5. It’s the lowest in 7 months. PMI composite dropped to 52.2, down from 52.3, a 48-month low.

France PMI manufacturing dropped to 49.7 in December, down from 50.8, and missed expectation of 50.7. It’s the worst reading in 27 months. France PMI services dropped to 59.6, down from 55.1 and missed expectation of 54.8. It’s the lowest level in 34 months. PMI composite dropped to 49.3, down from 54.2. It’s a 30-month low and the first contraction reading in 2 1/2 years.

Comments from ECB de Guindos, Vasiliauskas and Nowotny

ECB Vice President Luis de Guindos defended the central bank’s decision to ended the asset purchase program this month, without any further stimulus exit said. He said that “We’re in a dark room that sometimes gets a bit darker, and when you are in a dark room you have to be very cautious and try to keep your optionality at the maximum level,”

Governing Council member Vitas Vasiliauskas warned of growing risks in 2019. He said “next year the balance of risk is more likely to turn in a negative direction but for the moment, because risks and economic data are quite mixed, yesterday’s meeting still described the risk outlook as balanced,”

Another Governing Council member Ewald Nowotny said the central bank should ends the negative deposit rate policy as son as possible. He said, “My personal view is that specifically this rate, that is this phenomenon of negative interest rates, should be reconsidered as soon as economically possible.” He added, “It is also a specificity of the ECB. The U.S. never had a negative rate.”

Japan tankan capex surged, PMI manufacturing improved

Economic data released from Japan today are not bad. Based on the results of the Tankan survey, it’s unlikely for BoJ to ease monetary further. Yet, it’s not time for the central bank to start stimulus exit too.

- Large manufacturing index was unchanged at 19 versus expectation of a drop to 17.

- Large manufacturing outlook dropped notably by -4 to 15, missed expectation of 16.

- Large non-manufacturing index rose 2pts to 24, above expectation of 21.

- Large non-manufacturing outlook also rose 2pts to 24, above expectation of 20.

- Large all industry capex rose 14.3% in Q4, beat expectation of 12.7%.

PMI manufacturing improved to 52.4, up from 52.2 and beat expectation of 52.3. Markit noted that “new order growth accelerates despite exports declining to sharpest extent in over two years”. However, “business confidence drops for seventh straight month to lowest since October 2016”.

Joe Hayes, Economist at IHS Markit, said in the release that “Japan’s manufacturing sector closed 2018 with a strong finish.” But the data also “bring some cautious undertones to the fore,”. In particular “Export orders declined at the fastest pace in over two years, while total demand picked up only modestly. Confidence also continued to fall, a seventh straight month in which this has now occurred.” He added “the prospects heading into 2019 ahead of the sales tax hike still appear skewed to the downside.”

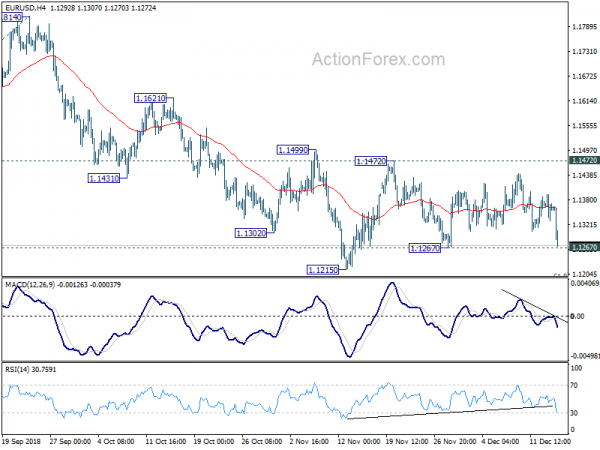

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1328; (P) 1.1361; (R1) 1.1391; More…..

EUR/USD drops sharply today and focus is now on 1.1267 support. Break will suggest that larger decline is resuming and target 1.1251 low next. Decisive break there will confirm this bearish case. EUR/USD should drop through 1.1186 fibonacci level to 61.8% projection of 1.2555 to 1.1300 from 1.1814 at 1.1038 next.

In the bigger picture, as long as 1.1814 resistance holds, down trend down trend from 1.2555 medium term top is still in progress and should target 61.8% retracement of 1.0339 (2017 low) to 1.2555 at 1.1186 next. Sustained break there will pave the way to retest 1.0339. However, break of 1.1814 will confirm completion of such down trend and turn medium term outlook bullish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | NZD | BusinessNZ Manufacturing PMI Nov | 53.5 | 53.5 | 53.7 | |

| 23:50 | JPY | Tankan Large Manufacturing Index Q4 | 19 | 17 | 19 | |

| 23:50 | JPY | Tankan Large Manufacturers Outlook Q4 | 15 | 16 | 19 | |

| 23:50 | JPY | Tankan Large Non-Manufacturing Index Q4 | 24 | 21 | 22 | |

| 23:50 | JPY | Tankan Large Non-Manufacturing Outlook Q4 | 24 | 20 | 22 | |

| 23:50 | JPY | Tankan Small Manufacturing Index Q4 | 14 | 13 | 14 | |

| 23:50 | JPY | Tankan Small Manufacturing Outlook Q4 | 8 | 11 | 11 | |

| 23:50 | JPY | Tankan Small Non-Manufacturing Index Q4 | 11 | 9 | 10 | |

| 23:50 | JPY | Tankan Small Non-Manufacturing Outlook Q4 | 5 | 6 | 5 | |

| 23:50 | JPY | Tankan Large All Industry Capex Q4 | 14.30% | 12.70% | 13.40% | |

| 00:30 | JPY | PMI Manufacturing Dec P | 52.4 | 52.3 | 52.2 | |

| 02:00 | CNY | Retail Sales Y/Y Nov | 8.10% | 8.80% | 8.60% | |

| 02:00 | CNY | Industrial Production Y/Y Nov | 5.40% | 5.90% | 5.90% | |

| 02:00 | CNY | Fixed Assets Ex Rural YTD Y/Y Nov | 5.90% | 5.90% | 5.70% | |

| 04:30 | JPY | Industrial Production Y/Y Oct F | 4.20% | 5.90% | 5.90% | |

| 08:15 | EUR | France Manufacturing PMI Dec P | 49.7 | 50.7 | 50.8 | |

| 08:15 | EUR | France Services PMI Dec P | 49.6 | 54.8 | 55.1 | |

| 08:30 | EUR | Germany Manufacturing PMI Dec P | 51.5 | 51.7 | 51.8 | |

| 08:30 | EUR | Germany Services PMI Dec P | 52.5 | 53.5 | 53.3 | |

| 09:00 | EUR | Eurozone Manufacturing PMI Dec P | 51.4 | 51.9 | 51.8 | |

| 09:00 | EUR | Eurozone Services PMI Dec P | 51.4 | 53.4 | 53.4 | |

| 13:30 | USD | Retail Sales Advance M/M Nov | 0.20% | 0.10% | 0.80% | 1.10% |

| 13:30 | USD | Retail Sales Ex Auto M/M Nov | 0.20% | 0.20% | 0.70% | 1.00% |

| 14:15 | USD | Industrial Production M/M Nov | 0.30% | 0.10% | ||

| 14:15 | USD | Capacity Utilization Nov | 78.60% | 78.40% | ||

| 14:45 | USD | Manufacturing PMI Dec P | 55.1 | 55.3 | ||

| 14:45 | USD | Services PMI Dec P | 55 | 54.7 | ||

| 15:00 | USD | Business Inventories Oct | 0.50% | 0.30% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals