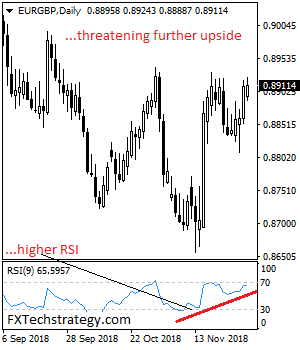

EURGBP Remains On Offensive With Further Recovery Threats

EURGBP remains on offensive with further recovery threats. On the downside, support stands at the 0.8900 level where a violation will turn focus to the 0.8850 level. A break below here will aim at the 0.8800 level. On the upside,...

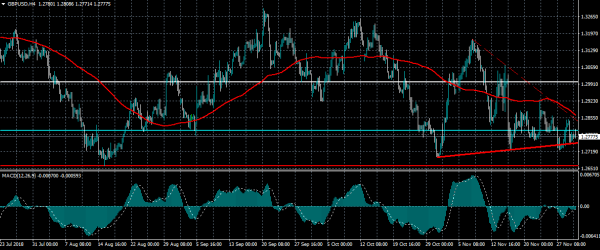

GBPUSD Struggling With 1.2800 Resistance Level

The British pound is trading back towards the 1.2800 resistance level against the US dollar after sellers failed to move price below key trendline support, at 1.2750 level. The next short-term directional move in the GBPUSD pair will likely come...

EURUSD Trading Under Trendline Support

The euro currency is trading lower against the US dollar, after breaching trendline support during the European trading session. Failure to once again break the 1.1400 resistance level prompted the move lower, with short-term sellers taking control. The EURUSD pair...

Facebook Stock Rebounds Off Two-Year Lows, But Still Negative

Facebook’s stock saw a dramatic collapse after touching an all-time high of 218.44 in late July, falling below its 50- and 200-day simple moving averages (SMAs) to find support near the two-year low of 128.00 on November 20, and subsequently...

Amazon Stock Struggles Below 200-Day SMA In Near Term

Amazon stock price rebounded after touching a seven-month low on November 20, however it still trades below the 200-day simple moving average (SMA). Having a look at the momentum indicators, they are giving mixed signals. On the one hand the...

Fed’s Kashkari says rates should not go up when job creation is strong and inflation is tame

Minneapolis Federal Reserve President Neel Kashkari told CNBC on Friday that central bankers should not be raising rates while job creation continues to be strong and inflation remains tame. “For the three years since I’ve been at the Fed, we...

USD/JPY Outlook: Thursday’s Hammer Suggest Pullback Might Be Over, G20 Summit Would Provide Stronger Direction Signal

Firmer tone on Friday increases hopes of recovery as Thursday’s strong downside rejection left hammer candle, signaling that two-day pullback might be over. Dip was contained by 10SMA (113.15) and subsequent bounce resulted in daily close above 20SMA (113.38) on...

Elliott Wave Analysis: EURUSD Update

EURUSD has turned nicely higher recently from the 1.127 level which was quite expected as we were tracking a minor pullback labelled as wave 2. Current rally we now labelled as start of a new, five-wave cycle which can unfold...

GBP/USD Outlook: Directionless Mode After Brexit/Fed Eyes G20 Meeting For Fresh Signals

Cable trades in narrow-range directionless mode on Friday and holding within larger range which extends into third straight week and on track to end the third week in Doji candle. Quiet mode comes after bumpy ride in past three days,...

Bank stability risk is higher than EBA’s stress tests suggest

The EBA’s stress tests don’t stack up – allow ECR to enlighten you The EU-wide stress tests for 2018, published by the European Banking Authority (EBA) early in November, are an attempt to assess the resilience of banks to a...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals