Key Points Discussed in this interview

- Jeremy’s early trading experience

- Why Jeremy pays little attention to the news

- Student to master: overcoming the initial challenges of Elliott wave analysis

This article presents the highlights of the podcast so be sure to listen to the full interview.

Listen to the podcast here:

Stitcher: https://www.stitcher.com/podcast/trading-global-markets-decoded-with-dailyfx/e/57431393?autoplay=true

iTunes: https://itunes.apple.com/us/podcast/trading-global-markets-decoded/id1440995971

Google Play and Soundcloud links provided at the end of the article.

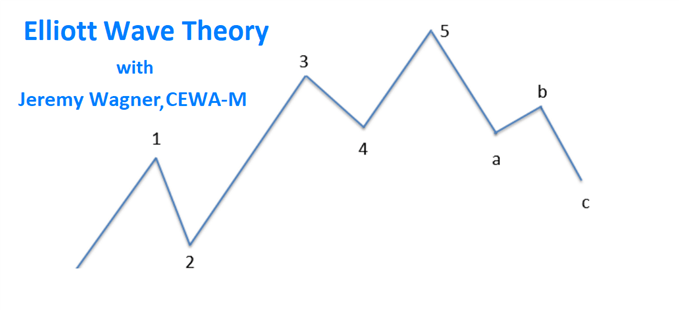

Jeremy Wagner is unique in many ways but most notably through his expertise in Elliott wave theory. He holds the Certified Elliott Wave Analyst Master (CEWA-M) designation and anyone who has attempted Elliott wave will certainly understand the value it holds. This interview provides insight into Jeremy’s personal trading journey, from disbelief in technical analysis to becoming “one hundred percent technical”.

Jeremy’s early trading experience

Tyler Yell: How has your approach to markets and trading evolved over the years?

Jeremy Wagner: That’s a good question, when I was first interested in trading back in the late nineties I thought technical analysis as voodoo and I laugh at this now. You would hear analysts saying the market is at the 200 period moving average and I would wonder why the market had to go up or down at the 200 day MA. I then thought being a good trader simply meant finding the companies that are good companies, buy them and they will appreciate over the long run. The downside to this is that even the good companies go through corrections.

Then, one day Investor’s Business Daily caught my eye and they presented a little bit more of a mechanical approach, a softer side to technical analysis. That is where I really began to appreciate the charts.

After that, I would say January 2008 was when my trading style started to take a turn, becoming even more technically oriented. The economy was thriving, and it was at this stage that an economist used the word “deflation”. “Deflation” was not really used in the modern era – it was used with respect to the 1930s in the US. I found this odd and out of place as the economy was operating well on the surface, but we were actually on the forefront of a large correction.

My research then led me to Elliott Wave International where I began to understand and appreciate Elliott wave analysis. So, in the last 10 years it’s very interesting to see how I started out having no appreciation for technical analysis and now I am one hundred percent technical.

Why Jeremy pays little attention to the news

TY:In your opinion, is there a particular aspect of the market that you feel traders place too much emphasis on?

JW: I think people overestimate the importance of news. News as it refers to longer term trends can be useful. For example, news on how an ageing population among other factors is causing pensions to be underfunded. On the other hand, placing significant importance on short term news such as the recent non-farm payrolls release is just noise. I would say 99% of short term news is noise and mostly meaningless.

TY: What’s happening in the market can shape the news depending on whether you are in an uptrend or a downtrend. The news can be an echo of the sentiment of where the market is, would you agree?

JW: Yes, we tend to retro-fit market movements to the day’s news. An illustration that springs to mind is when someone throws a rock into a pond and imagine you are standing on the edge of the pond seeing the ripples reach the edge of the pond. You may reason that the ripples were caused by the worsening weather if the clouds roll in and the wind picks up. This is however, not true as we know the ripples were the result of the rock breaking the water’s surface.

Student to master: overcoming the initial challenges of Elliott wave analysis

TY: Going back to Elliott wave, when did you come to appreciate and acknowledge Elliott wave as the uniquely useful tool that it is.

JW: I didn’t appreciate Elliott wave as much in the beginning but the more I persevered with it, I eventually began to see its powerful forecasting ability. In the beginning and for whatever reason, I personally had a difficult time putting Elliott wave into practice, but I stuck with it. I think this was because I had a math background, so naturally I was attuned to finding patterns, which is the basis of Elliott wave and that helped me to persevere and keep going. Learning the patterns, characteristics and guidelines at a deeper level set the foundation for a deeper understanding, which ultimately led to an improvement in my forecasting ability through Elliott wave.

When I describe the forecasting aspect of Elliott wave during my webinars, I look at the chart as a spaghetti pattern, as I call it. You will have seen this pattern when a weather man shows the various paths that a hurricane may take when approaching the shore. There will be 6 or 7 lines with some being close together and outliers spinning off that do not reach the shore and that’s how I look at the charts.

I look at a primary count and consider what the alternate patterns are. In my mind I begin to develop this spaghetti chart and when many of these strands point in the same direction that’s when I know there is a good opportunity regardless of the wave count. Then, at this point, it’s more about deciphering where to set profit targets and stop levels.

More Resources from Jeremy

Author bio and Twitter handle

- Stay up to date with all of Jeremy’s latest articles and analysis via his bio page.

- Jeremy also posts market related material on Twitter: @JWagnerFXTrader

If you found this article useful, you should follow our weekly podcasts. Whether you are looking for market analysis, trading education or interviews with well-known industry professionals, we have you covered.

Follow our podcasts on the following platforms:

Soundcloud:https://soundcloud.com/user-943631370

Google Play:https://play.google.com/music/listen?u=0

iTunes:https://itunes.apple.com/us/podcast/trading-global-markets-decoded/id1440995971

Stitcher:https://www.stitcher.com/podcast/trading-global-markets-decoded-with-dailyfx/e/57431393?autoplay=true

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals