Australian Dollar jumps broadly today after RBA rate decision. While growth and inflation forecasts are downgraded, the overall announcement suggests that RBA is maintaining tightening bias. The next move on interest rate is still a hike even though it may take longer to happen. The positive impact of RBA is more than enough to offset rather poor economic data from Australia. Strength in the Aussie takes New Zealand Dollar up too.

The currency markets are rather mixed elsewhere though, as part of Asia is on lunar new year holiday. Mild risk appetite keeps Yen and Swiss Franc weak but there is no follow through selling yet. Dollar’s rebound attempt fades ahead of near term resistance against Euro, Sterling, Australian and Canadian. But at the same, no particular strength is seen in others. The markets are generally waiting for fresh inspirations.

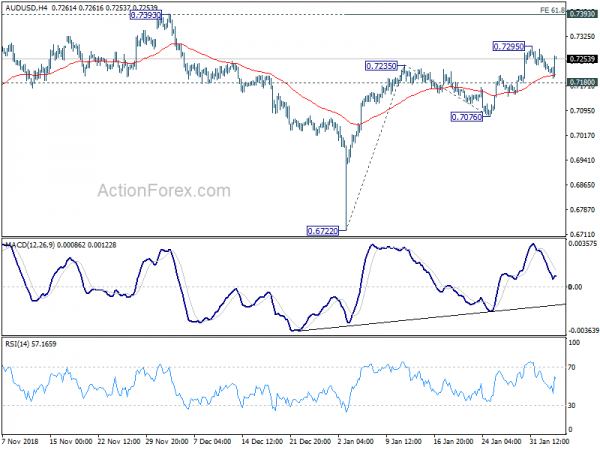

Technically, with today’s rebound in Aussie, AUD/USD is now looking at 0.7295 resistance and break will resume recent rebound from 0.6722 flash crash low. EUR/AUD is also looking at 1.5721 and break will resume fall from 1.6765 high. EUR/USD is approaching 1.1407 minor support while GBP/USD is close to 1.3012. Break of these levels will solidify the case for Dollar rebound. But as long as these supports hold, more downside remains in favor in Dollar.

In other markets, Nikkei closed down -0.19% at 20844.45. Japan 10-year JGB yield is down -0.0032 at -0.015, staying negative. China, Hong Kong and Singapore are on lunar new year holiday. Overnight, DOW rose 0.7%. S&P 500 rose 0.68%. NASDAQ rose 1.15%. 10 year yield rose 0.033 to 2.724, back above 2.7 handle.

RBA downgrades growth and inflation forecast, cites increased risks

Australian Dollar jumps after RBA left cash rate unchanged at 1.50% as widely expected. The conclusion of the statement was kept totally unchanged. And most importantly, RBA maintained “further progress in reducing unemployment and having inflation return to target is expected, although this progress is likely to be gradual.”

There are some dovish tweaks in the statement, including mentioning of increased risks, downgrade of growth and inflation forecasts. But for now, the statement still suggests the next move is a hike rather than a cut. Just that it may take longer to happen.

Globally, RBA said growth “remains reasonable” but “downside risks have increased”. In particular “trade tensions are affecting global trade and some investment decisions”. Headline inflation also “moved lower” due to fall in oil prices. Regarding financial markets, RBA also noted government bond yields have declined in most countries including Australia. Australia’s terms of trade are “expected to decline over time”

Domestically, RBA expects Australian economy to growth by around 3% in 2019 and a little less in 2020. That’s a downward revision from prior expectation of growth at 3.5% in 2019. Further than that, RBA acknowledged weaker than expected growth in Q3 and said “some downside risks have increased”. And, “the main domestic uncertainty remains around the outlook for household spending and the effect of falling housing prices in some cities.”

On inflation, RBA now expects underlying inflation to hit 2% in 2019 and 2.25% in 2020. Headline inflation is also expected to decline in the near term due to petrol prices. That’s also a downgrade as in previously, RBA expected inflation to hit 2.25% in 2019 and a bit higher in 2020.

Fed Powell told Trump directly: We set policy based on non-political analysis

Fed Chair Jerome Powell met Trump at an informal dinner meeting at the White House yesterday to discuss the economy. Treasury Secretary Steven Mnuchin and Fed Vice Chair Richard Clarida was also present. Fed said in a statement that the meeting was as Trump’s invitation. The purpose was to “discuss recent economic developments and the outlook for growth, employment and inflation.”

Powell’s comments were “consistent with his remarks at his press conference of last week.” And he “did not discuss his expectations for monetary policy”. Powell also emphasized that “the path of policy will depend entirely on incoming economic information and what that means for the outlook.”

Powell also told Trump that Fed will set monetary policy “based solely on careful, objective and non-political analysis.”

Fed Mester: Interest rate at lower end of neutral range

Cleveland Fed President Loretta Mester said more rate hikes are still needed if the economy develops as she expected. She tweeted that “If economy performs as I expect, fed funds rate may need to move a bit higher. But if downside risks come to pass and economy is weaker than expected, I will adjust my outlook and policy views.”

However, in a speech “Perspectives on the Economic Outlook and Monetary Policy in the Coming Year“, Mester said interest rate is already “at the lower end” of the longer-run neutral rate. It’s at a level that neither stimulates nor restricts the economy, and recent rate hikes are still working themselves through the economy. In the coming meetings, Fed will also finalize the plan for ending the balance-sheet runoff and completing balance-sheet normalization.

Mester also noted that the economy is a “very good spot”. While growth is slowing from an above-trend pace, labor markets are strong. Inflation is near 2% with no signs of appreciably rising. So, in her view “monetary policy does not appear to be far behind or far ahead of the curve”. And that gives Fed the opportunity to ” gather information on the economy and assess our forecast and the risks, before making any further adjustments in the policy rate.”

On the data front

Australian AiG performance of services dropped sharply from 52.1 to 44.3 in January. Retail sales dropped -0.4% mom in December versus expectation of 0.0%. Trade surplus widened to AUD 3.68B in December versus expectation of AUD 2.25B. UK BRC retail sales monitor rose 2.1% yoy in January.

Looking ahead, Eurozone PMI services final and retail sales will be released in European session. UK will also release PMI services. Later in the day, US will release ISM non-manufacturing.

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.7205; (P) 0.7230; (R1) 0.7249; More…

AUD/USD rebounds strongly today but stays below 0.7295 temporary top. Intraday bias remains neutral first and outlook is unchanged. Another rise could be seen with 0.7180 minor support intact. On the upside, above 0.7295 will target 0.7393 cluster resistance (61.8% projection of 0.6722 to 0.7235 from 0.7076 at 0.7393). We’d expect strong resistance from there to limit upside to complete the rebound from 0.6722. On the downside, break of 0.7180 minor support will turn bias back to the downside for 0.7076 support. However, sustained break of 0.7393 will indicate bullish reversal and target 100% projection at 0.7589 next.

In the bigger picture, as long as 0.7393 resistance holds, we’d treat fall from 0.8135 as resuming long term down trend from 1.1079 (2011 high). Decisive break of 0.6826 (2016 low) will confirm this bearish view and resume the down trend to 0.6008 (2008 low). However, firm break of 0.7393 will argue that fall from 0.8135 has completed. And corrective pattern from 0.6826 has started the third leg, targeting 0.8135 again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | AUD | AiG Performance of Service Index Jan | 44.3 | 52.1 | ||

| 0:01 | GBP | BRC Retail Sales Monitor Y/Y Jan | 2.10% | -0.20% | -0.70% | |

| 0:30 | AUD | Trade Balance (AUD) Dec | 3.68B | 2.25B | 1.93B | 2.26B |

| 0:30 | AUD | Retail Sales M/M Dec | -0.40% | 0.00% | 0.40% | 0.50% |

| 3:30 | AUD | RBA Rate Decision | 1.50% | 1.50% | 1.50% | |

| 8:45 | EUR | Italy Services PMI Jan | 50 | 50.5 | ||

| 8:50 | EUR | France Services PMI Jan F | 47.5 | 47.5 | ||

| 8:55 | EUR | Germany Services PMI Jan F | 53.1 | 53.1 | ||

| 9:00 | EUR | Eurozone Services PMI Jan F | 50.8 | 50.8 | ||

| 9:30 | GBP | Services PMI Jan | 51.1 | 51.2 | ||

| 10:00 | EUR | Eurozone Retail Sales M/M Dec | -1.60% | 0.60% | ||

| 14:45 | USD | US Services PMI Jan F | 54.2 | 54.2 | ||

| 15:00 | USD | ISM Non-Manufacturing/Services Composite Jan | 57 | 57.6 |

For traders: our Portfolio of forex robots for automated trading has low risk and stable profit. You can try to test results of our download forex ea

Signal2forex review

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals