Dollar is paring some gains today after yesterday’s rally, but remains the strongest one for the week. A temporary agreement was reached in the US Congress to avert another government shut down. Focus is turning back to trade negotiation with China in Beijing. There is little news regarding the actual mid-level discussions. But words coming out of the White House and Trump have been positive.

As of now, Australia Dollar is the strongest one for today, as lifted by another day of rebound in Chinese stocks. Japanese Nikkei also came back from holiday with a strong rise. But upside momentum in Aussie is so far capped by dovish RBA expectations. Canadian Dollar follows as the second strongest one. WTI crude oil drew support from 51.37 support and is recovering, back at 52.8. Yen and Swiss Franc are the weakest ones at this point.

Looking ahead, the economic calendar is relatively empty today. Bundesbank head Jens Weidmann, BoE Governor Mark Carney and Fed Chair Jerome Powell will speak. UK Prime Minister Theresa May will also deliver a statement on Brexit in the Commons.

Technically, USD/CHF and USD/JPY resumed recent rebound yesterday and are both heading higher. EUR/USD’s break of 1.1289 support should now bring deeper fall to 1.1215 low. GBP/USD breached 1.2854 temporary low and further decline is now tentatively in favor, towards 1.2391 low. AUD/USD breached 0.7060 temporary low earlier but quickly recovered. Focus will be on whether it’s rebounding from here, or selloff will resume soon.

In Asia, Nikkei closed up 2.61%. Hong Kong HSI is up 0.09%. China Shanghai SSE is up 0.53%. Singapore Strait Times is down -0.01%. Japan 10-year JGB yield is up 0.0113 at -0.017, staying negative. Overnight, DOW closed down -0.21%. S&P 500 rose 0.07%. NASDAQ rose 0.13%. 10-year yield rose 0.029 to 2.661. 30-year yield rose 0.023 to 2.999, just failed to reclaim 3% handle.

Tentative deal reached to avert another US government shutdown, with border fencing

A tentative deal was agreed yesterday between the Republicans and Democrats to avert another partial government shutdown this Saturday. But the agreement does not include the USD 5.7B funding for the border wall that Trump demanded. No detail is provided for the deal yet. But based on unnamed source, there would be USD 1.375B in funding for new fencing along the southern border of the US. That is around the same amount the Congress allocated last year. Also, it’s reported that only currently deployed design could be used for 90km of additional barriers, which might include steel bollard fencing.

White House Conway: Trump wants to meet Xi very soon

Mid-level trade negotiations between US and China continue in Beijing today. That’s supposed to lead up to high level meeting between USTR Robert Lighthizer, Treasury Secretary Steven Mnuchin and Chinese Vice Premier Liu He on Thursday and Friday. So far, little news is reported regarding the actual talks. It’s believed that the teams are only in the stage of drafting a common document that addresses the issues. But they’re still struggling to find concrete ways on the main issue, enforcement of the agreement.

White House adviser Kellyanne Conway said yesterday that Trump “wants to meet with President Xi very soon.” She added that This president wants a deal. He wants it to be fair to Americans and American workers and American interests.” Also, Trump has “forged a mutually respectful relationship with President Xi,” and “they will meet again soon.” However, Conway also noted that no deal will be final until the Trump-Xi meeting happens.

As the March 1 trade truce deadline is approaching, time is running out for the talks. It’s reported that an option for the US is to extend the period. However, to maintain pressure on China and urgency on the negotiations, any extensions won’t be open-ended. And based on unnamed sources, the US side intend not to let the Trump-Xi meeting slip much past end of March.

EU Barnier and UK Barclay held constructive meeting on next step for Brexit

EU chief Brexit negotiator Michel Barnier had a meeting with UK Brexit Minister Stephen Barclay in Brussels on Monday evening. A UK government spokesman said the two had a “constructive” meeting.

And they met to “discuss the next steps in the UK’s withdrawal from the EU and explore whether a way through can be found that would be acceptable to the UK Parliament and to the European Union”.

UK Prime Minister Theresa May is scheduled to make a statement on Brexit today. Without any progress, there will not be another meaningful vote on her withdrawal agreement. Instead, debate will resume on Thursday in the Commons, with some lawmakers pushing for shift control of the negotiation from the government to the parliament.

NAB on RBA: Next rate move could be down rather than up

Australia NAB Business Condition staged a moderate rebound in January up from 2 to 7 and beat expectation of 4. That came after the sharp decline from 11 to 3 in December. Business Confidence also rose slightly from 3 to 4. NAB noted that even after the recovery, “conditions and forward orders continue to trend lower and still show a sizeable decline over the past 6 months.”

Alan Oster, NAB Group Chief Economist noted that “Based on the confirmation that conditions have deteriorated further and our current set of forecasts we now see the RBA staying in neutral for the foreseeable future, though think the next move could be down rather than up based on the current trajectory of growth and growing downside risks”.

Also from Australia, home loans dropped -6.1% mom in December versus expectation of -2.0% mom.

RBNZ survey: Inflation, house price and GDP expectations dropped

RBNZ quarterly survey showed inflation expectation for a year ahead dropped from 2.09% to 1.82%. One-year house price expectations dropped sharply from 2.86% to 1.91%. One-year rolling annual GDP expectation dropped slightly from 2.44% to 2.38%. Regarding RBNZ monetary policy, a net 75.6% of respondents believe monetary conditions in one year’s time will be easier than neutral.

China MOFCOM: Consumption faces more challenges in 2019 after slowdown last year

Chinese Commerce Department’s Deputy Director of the Market Operation Wang Bin admitted that consumption growth in 2018 has slowed down. In particular, growth in products related to automobiles and housing have been weak. Additionally, there will be more challenges for consumption growth in 2019 than expected.

Wang added that there will be measures to boost consumption in five aspects. Those include polices on urban consumptions, rural consumptions, service consumptions, product circulations and consumption environments.

Elsewhere

Japan M2 rose 2.4% yoy in January. Tertiary industry index dropped -0.3% mom. Machine tool orders dropped -18.8% yoy.

EUR/USD Daily Outlook

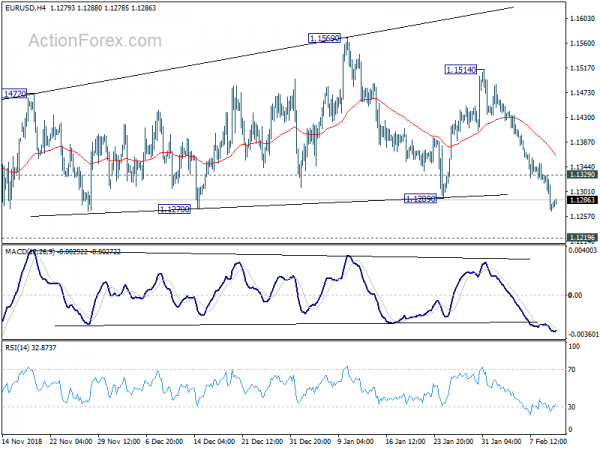

Daily Pivots: (S1) 1.1249; (P) 1.1290; (R1) 1.1315; More…..

Intraday bias in EUR/USD remains on the downside at this point. Current development suggests that corrective pattern from 1.1215 has completed already. Further decline should be seen through 1.1215 low to 1.1186 fibonacci level. On the upside, break of 1.1329 minor resistance will turn intraday bias neutral and bring consolidations first, before staging another decline.

In the bigger picture, as long as 1.1814 resistance holds, down trend down trend from 1.2555 medium term top is still in progress and should target 61.8% retracement of 1.0339 (2017 low) to 1.2555 at 1.1186 next. Sustained break there will pave the way to retest 1.0339. However, break of 1.1814 will confirm completion of such down trend and turn medium term outlook bullish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Japan Money Stock M2+CD Y/Y Jan | 2.40% | 2.40% | 2.40% | |

| 0:30 | AUD | Home Loans M/M Dec | -6.10% | -2.00% | -0.90% | |

| 0:30 | AUD | NAB Business Confidence Jan | 4 | 3 | 3 | |

| 0:30 | AUD | NAB Business Conditions Jan | 7 | 4 | 2 | |

| 4:30 | JPY | Tertiary Industry Index M/M Dec | -0.30% | -0.10% | -0.30% | |

| 6:00 | JPY | Machine Tool Orders Y/Y Jan P | -18.80% | -18.30% | ||

| 11:00 | USD | NFIB Small Business Optimism Jan | 103 | 104.4 |

For traders: our Portfolio of forex robots for automated trading has low risk and stable profit. You can try to test results of our download forex ea

Signal2forex review

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals