Dollar was sold off broadly overnight, as dragged down by falling treasury yields. Also, recent comments from Fed officials continued to affirm the “patient” monetary policy stance. While the greenback is trying to recover in Asian session today, there is no clear follow through buying. The greenback will look into FOMC minutes to be released later in US session. But the minutes are unlikely to provide any inspiration for a turnaround. Meanwhile, Yen is also under pressure today as Asian stocks extend recent rebound.

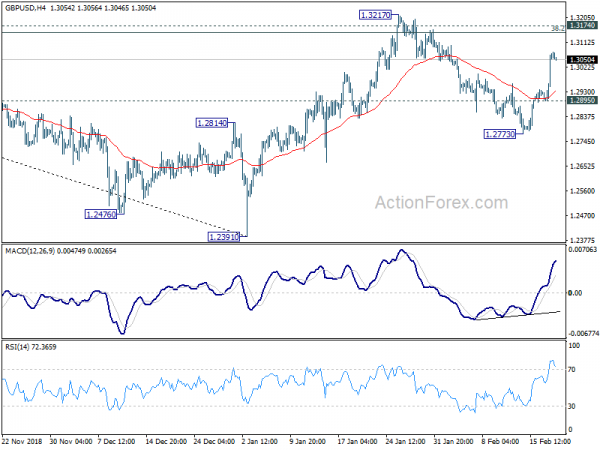

Technically, GBP/USD’s strong break of 1.2958 resistance suggests that pull back from 1.3217 has completed at 1.2773 already. Focus is back on 1.3174 key resistance. Decisive break there will be a strong sign of larger bullish reversal. EUR/USD’s break of 1.1341 minor resistance also suggests more rebound towards 1.1514. USD/CAD also breached 1.3196 support which opens deeper decline aback to 1.3068 low. Overall, near term outlook in Dollar is turning bearish.

In Asia, Nikkei closed up 0.60%. Hong Kong HSI is up 0.88%. China Shanghai SSE is up 0.16%. Singapore Strait Times is up 0.46%. Japan 10-year JGB yield is down -0.0037 at -0.033. Overnight, DOW rose 0.03%. S&P 500 rose 0.15%. NASDAQ rose 0.19%. 10-year yield dropped -0.019 to 2.647. 30-year yield dropped -0.006 to 2.991. One thing to note is that 5-year yield at 2.458, is below 6-month yield at 2.501. Yield curve is getting more inverted again.

Fed Williams: Monetary policy is where it should be

New York Fed President John Williams said in a Reuters interview that he’s comfortable with the current interest rate level. He described the current federal funds rate, at 2.25-2.50%, as being “around my view of what neutral interest rates are”. And “monetary policy is where it should be”.

He noted that a shift in economic outlook is needed for Fed to resume the rate hike cycle. Nevertheless, he added “I don’t think that it would take a big change, but it would be a different outlook either for growth or inflation”.

Regarding balance sheet reduction, Williams noted it could end when bank reserves hit “maybe $1 trillion of reserves or somewhat more than that”. That’s only around USD 600B below current levels. He added, the figure is “a guess today of the amount of reserves that will be held in the system in the future – but again we are learning and will get a finer touch on that.”

Fed Mester: Interest rate may need to rise a bit if most likely case realizes

Cleveland Fed President Loretta Mester said in a speech yesterday that the most likely case this year is that “the economy will transition toward a more sustainable pace of growth, with continued strength in labor markets and inflation near 2 percent.” And if this case realizes, “fed funds rate may need to move a bit higher than current levels.

Though, she also emphasized that Fed must “remain attentive to several risks to the outlook, including the slowdown in global growth, uncertainty over trade policy, tighter financial conditions, and the changes in business and consumer sentiment”. If some of the risks manifest themselves, and, economy turns out to be weaker than expected, she will need to adjust her outlook and policy views.

For now, federal funds rate are now at the lower end of the longer-run neutral level. Monetary policy is “neither ahead of nor behind the curve”. She said “we can take the time to make that assessment. ”

Trump on China trade talks: March 1 is not a magical date

Trump indicated once again in the oval office yesterday that he’s flexible to change the March 1 trade truce with China. He said the negotiations are “very complex talks” but they’re “going very well”. He added that “I can’t tell you exactly about timing, but the date (March 1) is not a magical date. A lot of things can happen.”

Regarding the possibility of raising tariffs on Chinese imports further, Trump said “I know that China would like not for that to happen, so I think they’re trying to move fast so that doesn’t happen.”

China Foreign Ministry emphasized in a statement that “The U.S. side should recognize that China’s development is in the world’s interest, as well as the United States’. Only by seeing China’s development as an opportunity for the United States can this help resolve certain problems, including trade and economic ones.”

And, “As long as China and the United States proactively meet each other halfway, then trade and economic cooperation can still play a role as a ballast stone in Sino-U.S. ties.”

UK PM May to visit Brussels again, but breakthrough unlikely

UK Prime Minister Theresa May is going to Brussels today to seek legal binding changes to Irish border backstop arrangement. But there is little chance for EU to change their stance. European Commission President Jean-Claude Juncker was quoted by an aide saying “I have great respect for Theresa May for her courage and her assertiveness. We will have friendly talk tomorrow but I don’t expect a breakthrough.”

UK Chancellor of Exchequer Philip Hammond was also quoted telling a manufacturing association that “the so-called ‘Malthouse’ initiative to explore possible alternative arrangements to the backstop is a valuable effort..”. However, he added, “it is clear that the EU will not consider replacing the backstop with such an alternative arrangement now in order to address our immediate challenge.”

On the data front

Australia wage price index rose 0.5% qoq in Q4, below expectation of 0.6% qoq. Westpac leading index was unchanged mom in January. New Zealand PPI output slowed to 0.8% qoq in Q4 versus expectation of 1.1% qoq. PPI input rose to 1.6% qoq, above expectation of 1.0% qoq.

Germany will release PPI today while Eurozone consumer confidence will also be featured. But main focus will be on FOMC minutes.

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.2948; (P) 1.3011; (R1) 1.3126; More….

GBP/USD’s break of 1.2957 minor resistance suggests that pull back from 1.3217 has completed at 1.2773 already. Intraday bias is turned back to the upside for retesting 1.3174/3217 key resistance zone. Decisive break there will complete a head and shoulder bottom pattern (ls: 1.2661, h: 1.2391, rs: 1.2773). That would indicate bullish reversal for 61.8% retracement of 1.4376 to 1.2391 at 1.3618 next. On the downside, break of 1.2895 minor support will turn bias back to the downside for 1.2773 instead.

In the bigger picture, focus is back on 1.3174 resistance with current rebound. Break will indicate completion of decline from 1.4376. Rise from 1.2391 would then be seen as the third leg of the corrective pattern from 1.1946 (2016 low). In that case, further rise could be seen through 1.4376 resistance. Nevertheless, rejection by 1.3174 again will extend the decline from 1.4376 through 1.2391 to 1.1946 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | PPI Output Q/Q Q4 | 0.80% | 1.10% | 1.50% | |

| 21:45 | NZD | PPI Input Q/Q Q4 | 1.60% | 1.00% | 1.40% | |

| 23:30 | AUD | Westpac Leading Index M/M Jan | 0.00% | -0.21% | -0.30% | |

| 23:50 | JPY | Trade Balance (JPY) Jan | -0.37T | 0.17T | -0.18T | -0.22T |

| 0:30 | AUD | Wage Price Index Q/Q Q4 | 0.50% | 0.60% | 0.60% | |

| 7:00 | EUR | German PPI M/M Jan | -0.10% | -0.40% | ||

| 7:00 | EUR | German PPI Y/Y Jan | 2.20% | 2.70% | ||

| 15:00 | EUR | Eurozone Consumer Confidence Feb A | -7.7 | -7.9 | ||

| 19:00 | USD | FOMC Minutes |

For traders: our Portfolio of forex robots for automated trading has low risk and stable profit. You can try to test results of our download forex ea

Signal2forex review

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals