Strong risk appetite dominates Asian markets today on trade optimism after WSJ said a deal could be sealed by the end of the month. In particular Chinese Shanghai SSE surged through 3000 handle for the first time since June 2018. Japan 10-year JGB yield also turned positive again at the time of writing. Though, the currency markets are rather quiet as major pairs and crosses are bounded inside Friday’s range. Sterling is the strongest one so far while Swiss Franc and Yen are weakest. But the picture could easily change as the session goes.

Technically, USD/JPY, EUR/JPY and GBP/JPY are some intraday upside moment on overbought condition. But there is no change in the near term bullish outlook after recent breakout. We’d likely see further upside in these pairs, should German and UK yields rise again in European session. Dollar remains mixed in general. There is prospect for the greenback to regain near term bullishness. But EUR/USD has to break 1.1316 minor support first. AUD/USD needs to break 0.7054 support while USD/CAD needs to break 1.3340 resistance.

In other markets, Nikkei is currently up 1.09%. Hong Kong HSI is up 1.16%. China Shanghai SSE is up 2.64% at 3073. Singapore Strait Times is up 0.74%. Japan 10 year JGB yield is up 0.010 at 0.001.

US and China could sign trade deal on March 27

The WSJ reported that US and China are close in on a trade agreement, which could be signed on March 27 between Trump and Chinese President Xi Jinping.

In the agreement, China would offer to lower tariffs and restrictions on US agricultural, chemical, auto and other products. Specific to the car industries, tariffs on imported vehicles would be lowered from the current 15%. China would also speed up removal of foreign ownership limitations on car joint ventures. As a sweetener, China would also buy USD 18B natural case from Cheniere Energy as part of the deal. On the other hand, US will lift most, if not all, of the punitive tariffs on Chinese imports imposed last year.

But so far there are practically no details on the core issues of intellectual property theft, forced technology transfer and state-owned enterprises.

UK Cox given up Irish backstop time limit or unilateral exit

The Telegraph reported that UK Attorney General Geoffrey Cox has given up the request on a time-limit on the Irish backstop or unilateral exit mechanism. Cox wanted to push for an independent arbitration mechanism which both UK and EU could give formal notice to end the backstop. But such independent arbitration would be outside the jurisdiction of the European Court of Justice. That is seen as totally unacceptable by the EU.

Separately, Trade Minister Liam Fox said he would be “shocked” if EU would insist on a delay of 21 months or two years extension of Article 50, if requested. He said “the European Union does not want Britain to fight the European elections.” Fox added it’s still “entirely possible” for leave EU on March 29. But a short extension to Article 50 may be needed to deliver a smoother exit.

BoJ Kuroda: Will debate exit strategy when appropriate time comes

BoJ Governor Haruhiko Kuroda said there is no specific stimulus exit strategy yet as it would take “significant time” to achieve the 2% inflation target. For now, BoJ will “patiently” maintain current monetary easing while “the economy is sustaining momentum for achieving the BOJ’s price target.”

Though, he acknowledged that “to ensure markets remain stable, it’s important to come up with a strategy and guidance at an appropriate timing on how to proceed with an exit”. And, “when the appropriate time comes, we will debate at our policy meetings an exit strategy and guidance, and communicate them appropriately.”

Looking ahead: RBA, BoC and ECB to meet, NFP featured too

Three central banks will meet this week. RBA, BoC and ECB are all expected to keep interest rates unchanged. RBA turned neutral in February meeting as it indicated that the chance for next move as hike or cut are now more “evenly balanced”. We don’t expect RBA to change its rhetoric. But in any case, it’s a big week for Australian Dollar as building approvals, GDP, retail sales and trade balance will be featured.

BoC Governor Stephen Poloz’s recent comments indicated that the central bank is maintaining tightening bias. The main question is timing of the next hike and that would very much depend on how the impact of oil price slump and housing markets play out. Meanwhile, Q4 GDP as released last week was shockingly poor, showing only 0.4% qoq growth. It’s well short of market expectation of 1.0%. There is room for BoC to turn a bit more neutral in this week’s announce. Canada employment data will also be market moving.

New staff economic projections will be the main focus in ECB’s announcement. January ECB meeting turned out to be more dovish than expected. The central bank noted that “the risks surrounding the Euro area growth outlook have moved to the downside”. This is the first time since April 2017 that the central bank admitted that risks are to the downside. But generally speaking, policy makers have been waiting for the upcoming projections to assess the outlook. This week’s announcement could shape Euro’s path for the rest of first half.

In addition, there will be heavy weight economic data including US non-farm payroll and ISM services, UK PMI services, as well as China trade balance.

Here are some highlights for the week:

- Monday: Australia building approvals, company operating profits; Eurozone Sentix investor confidence, PPI; UK construction PMI; US construction spending

- Tuesday: Australia current account, RBA rate decision; Eurozone PMI services final, retail sales; UK PMI services; US ISM services, new home sales

- Wednesday: Australian GDP; US ADP employment, trade balance; Canada trade balance, Ivey PMI, BoC rate decision, Fed’s Beige Book

- Thursday: Australia retail sales, trade balance; Japan leading indicators; Swiss unemployment rate, foreign currency reserves; Eurozone GDP revision, ECB rate decision, US jobless claims

- Friday: New Zealand manufacturing sales; Japan household spending, current account, average cash earnings, GDP final; China trade balance; German factory orders; Canada employment; US non-farm payrolls, housing starts and building permits

AUD/USD Daily Outlook

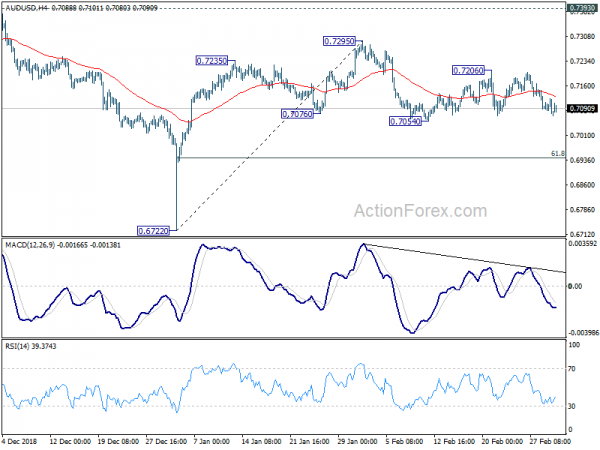

Daily Pivots: (S1) 0.7059; (P) 0.7091; (R1) 0.7112; More…

Intraday bias in AUD/USD remains neutral with focus on 0.7054 support. Decisive break of 0.7054 support will confirm completion of a head and shoulder top pattern (ls: 0.7235, h: 0.7295, rs: 0.7206). That should confirm completion of rebound from 0.6722. Further decline should then be seen to 61.8% retracement of 0.6722 to 0.7295 at 0.6941 next. On the upside, though, break of 0.7206 will turn focus back to 0.7295 resistance instead.

In the bigger picture, as long as 0.7393 resistance holds, we’d treat fall from 0.8135 as resuming long term down trend from 1.1079 (2011 high). Decisive break of 0.6826 (2016 low) will confirm this bearish view and resume the down trend to 0.6008 (2008 low). However, firm break of 0.7393 will argue that fall from 0.8135 has completed. And corrective pattern from 0.6826 has started the third leg, targeting 0.8135 again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Monetary Base Y/Y Feb | 4.60% | 4.50% | 4.70% | |

| 0:00 | AUD | TD Securities Inflation M/M Feb | 0.10% | -0.10% | ||

| 0:30 | AUD | Company Operating Profit Q/Q Q4 | 0.80% | 3.00% | 1.90% | 1.20% |

| 0:30 | AUD | Building Approvals M/M Jan | 2.50% | 1.50% | -8.40% | -8.10% |

| 9:30 | EUR | Eurozone Sentix Investor Confidence Mar | -3.1 | -3.7 | ||

| 9:30 | GBP | Construction PMI Feb | 50.5 | 50.6 | ||

| 10:00 | EUR | Eurozone PPI M/M Jan | 0.30% | -0.80% | ||

| 10:00 | EUR | Eurozone PPI Y/Y Jan | 2.90% | 3.00% | ||

| 15:00 | USD | Construction Spending M/M Dec | 0.20% | 0.80% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals