Sterling trades broadly lower today and suffers fresh selling in early US session. Some attributes the decline to reports that UK Attorney General Geoffrey Cox and Brexit Minister Stephen Barclay won’t get any breakthrough on Irish backstop in Brussels today. But it is actually hardly any news. UK government is seeking some legally binded assurances on the temporary nature of the backstop. Meanwhile, EU showed no indication on back down from the principle of avoiding hard Irish border. Pound’s could be partly due to weak PMI data. Or, it’s just reversing the rally on fading risks of no-deal Brexit. There is just no fresh development for Sterling bulls to cheer for.

Meanwhile, Dollar is the strongest one for today as treasury yield regains strength. USD/CAD breached 1.3340 resistance but there is again no follow through buying. The greenback also fails to break through near term resistance against Euro, Aussie and Swiss. Dollar might look into Boston Fed Eric Rosengren’s speech provides little inspiration. And the greenback might look into ISM services. Meanwhile, Euro is the second strongest one, followed by Swiss Franc. Data from Eurozone continue to paint a picture that the worst is behind. The common currency is also helped by rebound in German treasury yields.

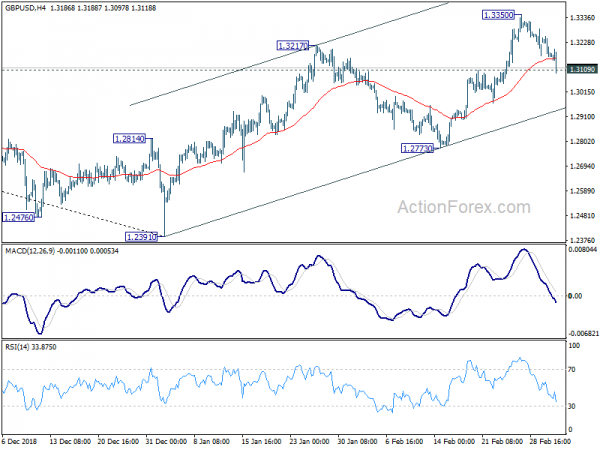

Technically, GBP/USD’s breach of 1.3109 minor support suggests near term topping and deeper pull back could be seen. 1.1316 support in EUR/USD, 1.0024 resistance in USD/CHF, 0.7054 support in AUD/USD and 1.3440 in USD/CAD will be watched in US session.

In Europe, currently, FTSE is up 0.66%. DAX is down -0.15%. CAC is down -0.15%. German 10-year yield is up 0.0121 at 0.174. Earlier in Asia:, Nikkei dropped -0.44%. Hong Kong HSI rose 0.01%. China Shanghai SSE rose 0.88%. Singapore Strait Times dropped -0.52%. Japan 10-year JGB yield rose 0.008 to 0.009.

Fed Rosengren: May take several FOMC meetings to see how much economy will slow

Boston Fed President Eric Rosengren said in a speech that “the most likely outcome for 2019 is relatively healthy U.S. economic growth somewhat above 2 percent over the course of the year, with inflation very close to Fed policymakers’ 2 percent target, and a U.S. labor market that continues to tighten somewhat.” But he also warned that “policymakers cannot place complete faith in what they believe is the most likely outcome”.

US growth would slow due to “diminishing fiscal stimulus” and the “effects of four increases” in interest rates last year. But to Rosengren, growth above 2% would still be “sufficient to bring additional improvements to labor markets, without much risk of higher inflation”, which is a “very welcome outcome”. He also noted “some risk that more pronounced slowdowns in the rest of the world could dampen U.S. growth more than I am forecasting.”

Meanwhile, there is “less reason to fear overheating”, with “somewhat greater risks to the outlook”. That justifies a pause in recent monetary tightening cycle. And, “It remains to be seen whether the few signs of weakness at the turn of the year reflect an underlying slowdown in the economy, or a response to a variety of temporary concerns that may fade.” It may be “several meetings” of FOMC before “Fed policymakers have a clearer read on whether the risks are becoming reality – and by how much the economy will slow compared to last year.”

Trump to end preferential trade treatment to India and Turkey

Trump sent a letter to Congressional leaders notifying his intention to end preferential trade treatment to India. He complained that “I am taking this step because, after intensive engagement between the United States and the Government of India, I have determined that India has not assured the United States that it will provide equitable and reasonable access to the markets of India.”

Under Trump’s instruction, the US Trade Representative also issued a statement on its intention to terminate Generalized System of Preferences (GSP) designation of both India and Turkey. The statement noted that “India’s termination from GSP follows its failure to provide the United States with assurances that it will provide equitable and reasonable access to its markets in numerous sectors. Turkey’s termination from GSP follows a finding that it is sufficiently economically developed and should no longer benefit from preferential market access to the United States market.”

And, “by statute, these changes may not take effect until at least 60 days after the notifications to Congress and the governments of India and Turkey, and will be enacted by a Presidential Proclamation.”

India Commerce Secretary Anup Wadhawan said US ending the preferential treatment to India has “relatively limited impact. The duty benefits were just at USD 190m even though it’s the largest beneficiary of the GSP with $5.7 billion in imports to the U.S. given duty-free status. Also, Wadhawan said India doesn’t plan to impose retaliatory tariffs on US goods. Both countries have been working on a trade package to address each other’s concerns.

BoE: UK financial system can withstand worst case disorderly Brexit

BoE noted in the Financial Policy Summary that the core of the financial system is prepared for wide range of risks it could face. And it could withstand even “a worst case disorderly Brexit”. In such case, there will be a “sudden imposition of trade barriers with the EU; loss of existing trade agreements with other countries; severe customs disruption; a sharp increase in the risk premium on UK assets; and negative spillovers to wider UK financial markets.”

But, major UK banks’ capital ratios are more than three times higher than before the global financial crisis. Thus, these banks have “large buffers of capital” to absorb losses. The capital is even sufficient to withstand severe global stresses happening at the same time of worst case disorderly Brexit.

ECB and BOE activate currency swap arrangements

ECB and BoE announced to activate currency swap arrangements ahead of Brexit. Under the arrangement, BoC will offer to lend Euro to UK banks on a weekly basis. BoE will also obtain Euro from ECB in exchange for Sterling. Also, Eurosystem would stand ready to lend Sterling to Eurozone banks if needed.

ECB said “the activation marks a prudent and precautionary step by the Bank of England to provide additional flexibility in its provision of liquidity insurance, supporting the functioning of markets that serve households and businesses.”

UK PMI services rose to 51.3, suggest just 0.1% GDP growth in Q1

UK PMI services rose to 51.3 in February, up from 50.1 and beat expectation of 50.0. Markit noted “modest upturn in service sector output”. But there was “slight fall in new work” and “staffing levels drop to greatest extent for over seven years”.

Chris Williamson, Chief Business Economist at IHS Markit, noted “UK economy remained close to stagnation” despite a “flurry of activity” ahead of Brexit. And, the data suggests UK is ” on course to grow by just 0.1% in the first quarter”.

He also warned that “worse may be to come when pre-Brexit preparatory activities move into reverse. Many Brexit-related headwinds and uncertainties also look set to linger in coming months even in the case of PM May’s deal going through. Global economic growth meanwhile remains sluggish, adding an increasingly gloomy backdrop to the UK’s current problems.

Eurozone PMI composite finalized at 51.9, easing of one-off dampening factors

Eurozone PMI services was revised up to 52.8 in February, from initial reading of 52.3. It’s also an improvement from January’s final reading of 51.2. PMI composite was finalized at 51.9, up from prior month’s 51.0. Improvements were also seen across the countries. Italy PMI composite rose to 2-month high of 49.6. France reading rose to 3-month high of 50.4. Germany reading rose to 4-month high of 52.8.

Chris Williamson at IHS Markit noted the reads was lifted “in part due to the further easing of one-off dampening factors such as the yellow vest protests in France and new auto sector emissions rules. ” However, ” the survey remained subdued as other headwinds continued to increasingly constrain business activity”. Risk include, “slowing global economic growth, rising geopolitical concerns, trade wars, Brexit and tightening financial conditions.”

Overall, the survey indicates 0.2% growth in Q1 GDP. That is, ” first quarter could see the eurozone economy struggle to beat the 0.2% expansion seen in the fourth quarter of last year.”

Also released in European session, Eurozone retail sales rose 1.3% mom in January, matched expectations. Swis CPI was unchanged at 0.6% yoy in February, matched expectations.

RBA kept cash rate at 1.50%, central scenarios of growth, inflation, employment unchanged

RBA left cash rate unchanged at 1.50% today as widely expected. The message of the accompanying statement is largely unchanged. RBA maintained the central scenarios of growth, inflation, employment outlook. And continued to expect the “gradual” progress of reducing unemployment and inflation returning to target.

The central back acknowledged that “economy slowed over the second half of 2018”. But it maintained the “central scenario” is still to grow by around 3% this year. The outlook is supported by “rising business investment, higher levels of spending on public infrastructure and increased employment.” Inflation remains “low and stable”. The central scenario is for underlying inflation to be at 2% in 2019 and 2.25% in 2020. Labor markets remains “strong” and further decline in unemployment rate to 4.75% is expected over the next couple of years.

Main domestic uncertainty remains the “strength of household consumption in the context of weak growth in household income and falling housing prices in some cities.” But RBA expects household income growth to pick-up and support spending over the next year. On housing markets, it’s noted that adjustment in Sydney and Melbourne is continuing. Conditions remains “soft” in both markets with low rent inflation. Credit demand by investors slowed noticeably. And growth in owner-occupiers eased further.

Also from Australia, AiG Performance of Services rose 0.2 to 44.5 in February. Australia current account deficit narrowed to AUD -7.2B in Q4. New Zealand ANZ commodity price rose 2.8% in February.

China, facing tough struggle, lowers 2019 growth target to 6-6.5%

Chinese Premier Li Keqiang delivered his annual work report to the National People’s Congress today. Li warned that “China will face a graver and more complicated environment as well as risks and challenges that are greater in number and size”. And he emphasized “China must be fully prepared for a tough struggle.”

GDP growth target for 2019 is lowered to 6-6.5%, notably down from 2018’s target of around 6.5%. The lower bound at 6% would be the slowest pace of growth in nearly three decades.

To help the manufacturing sector, a 3% cut to top bracket of VAT was announced, from from 16% to 13%. Also, there will be with 1% cut to the 10% VAT bracket for transport and construction sectors, down from 10% to 9%. It’s estimated the cuts are equivalent to as much as CNY 800B. Social security fees paid by businesses will be reduced to 16%.

Budget deficit for 2019 was set at 2.8% of GDP, larger than 2018 target of 2.6%. Total reduction in tax and social security fees would add up to CNY 2T.

Also from China, Caixin PMI services dropped to 51.1 in February, down from 53.6 and missed expectation of 53.5.

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.3146; (P) 1.3201; (R1) 1.3237; More….

GBP/USD’s fall from 1.3350 extends to as low as 1.3097 so far today. The breach of 1.3109 support now raises chance of near term reversal. Intraday bias is mildly on the downside for trend line support (now at 1.2944). Break will target 1.2774 support to confirm completion of rebound from 1.2391. Nevertheless, rebound from current level, followed by break of 1.3350, will resume rise from 1.2391 to 61.8% retracement of 1.4376 to 1.2391 at 1.3618 next.

In the bigger picture, medium term decline from 1.4376 (2018 high) should have completed at 1.2391. Rise from 1.2391 is now seen as the third leg of the corrective pattern from 1.1946 (2016 low). Further rise could be seen through 1.4376 in medium term. On the downside, though, break of 1.2773 support will turn focus back to 1.2391 low and then 1.1946.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | AUD | AiG Performance of Service Index Feb | 44.5 | 44.3 | ||

| 0:00 | NZD | ANZ Commodity Price Feb | 2.80% | 2.10% | 2.00% | |

| 0:01 | GBP | BRC Retail Sales Monitor Y/Y Feb | -0.10% | 0.10% | 1.80% | |

| 0:30 | AUD | Current Account (AUD) Q4 | -7.2B | -9.1B | -10.7B | -10.8B |

| 1:45 | CNY | Caixin China PMI Services Feb | 51.1 | 53.5 | 53.6 | |

| 3:30 | AUD | RBA Rate Decision | 1.50% | 1.50% | 1.50% | |

| 7:30 | CHF | CPI M/M Feb | 0.40% | 0.40% | -0.30% | |

| 7:30 | CHF | CPI Y/Y Feb | 0.60% | 0.60% | 0.60% | |

| 8:45 | EUR | Italy Services PMI Feb | 50.4 | 49.5 | 49.7 | |

| 8:50 | EUR | France Services PMI Feb F | 50.2 | 49.8 | 49.8 | |

| 8:55 | EUR | Germany Services PMI Feb F | 55.3 | 55.1 | 55.1 | |

| 9:00 | EUR | Eurozone Services PMI Feb F | 52.8 | 52.3 | 52.3 | |

| 9:30 | GBP | Services PMI Feb | 51.3 | 50 | 50.1 | |

| 10:00 | EUR | Eurozone Retail Sales M/M Jan | 1.30% | 1.30% | -1.60% | -1.40% |

| 14:45 | USD | Services PMI Feb F | 56.2 | 56.2 | ||

| 15:00 | USD | ISM Non-Manufacturing/Services Composite Feb | 57.3 | 56.7 | ||

| 15:00 | USD | New Home Sales Dec | 590K | 657K |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals