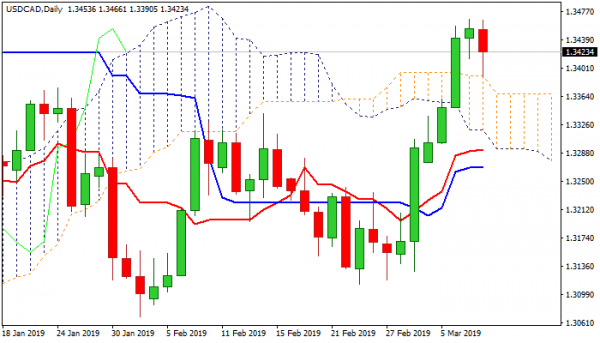

The pair fell some 50 pips in an immediate reaction on US NFP surprise and upbeat Canada’s employment figures. Data on Friday showed that US job growth reached levels close to stall, as the economy created only 20K new jobs in Feb, falling strongly below expectations 181K and well below January’s upward-revised 311K. US unemployment fell to 3.8% in Feb from 4.0% in Jan and below 3.9% consensus, with negative signals being partially offset by Average Hourly earnings which rose 0.4% in Feb from 0.1% in Jan and above 0.3% forecast. On the other side, Canada’s new jobs creation figure rose well above expectations Feb 55.9K vs 0.3K f/c that further boosted demand for loonie as the greenback was lower across the board after data. Fresh weakness dented initial support at 1.3391 (daily cloud top) and signal formation of reversal pattern on daily chart. Penetration of daily cloud and first bearish daily close after six straight days in green would add to negative signals and push the price lower as traders took profit from steep ascend from 1.3112 (25 Feb low). Stronger reversal signal could be expected on extension below 1.3331 (Fibo 38.2% of 1.3112/1.3467), while break below the base of thickening daily cloud (1.3294) would confirm scenario.

Res: 1.3445; 1.3467; 1.3500; 1.3524

Sup: 1.3390; 1.3348; 1.3331; 1.3294

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals