Sterling opens the week lower and stays generally weak today. As the crucial Brexit votes loom there is no breakthrough on the issue of Irish backstop. EU’s so called “concessions” were rejected by the UK government. And there is practically no chance of getting the same Brexit deal through the parliament. Seeking an Article 50 extension is the likely outcome after the week. But no one actually knows what’s next with the extensions, and what for. Staying in the currency markets, Yen is the strongest one so far even though Asian markets recovered from Friday’s steep losses. The markets are generally mixed though.

Technically, Yen will be a key to watch this week. After the strong rebound last week, Yen is pressing key near term resistance, and break will indicate near term bullish reversal. The levels include 124.23 in EUR/JPY, 77.44 in AUD/JPY, 82.26 in CAD/JPY. 110.35 support in USD/JPY is a bit farther away but it’s still worth watching. Dollar retreated mildly after poor job data on Friday. But there is no follow through selling. The greenback remains bullish in near term against most currencies except Yen. 1.1176 in EUR/USD, 0.7003 in AUD/USD, 1.0124 in USD/CHF and 1.3467 in USD/CAD will also be watched to track when Dollar resumes rally.

In Asia, Nikkei closed up 0.35%. Hong Kong HSI is up 0.63%. China Shanghai SSE is up 1.38% at 3010, back above 3000 handle. Singapore Strait Times is down -0.07%. Japan 10-year JGB yield is down -0.0007 at -0.033.

UK Hunt warns of no Brexit, EU urges a clear decision

UK now enters into a crucial week with important Brexit votes. Prime Minister Theresa May failed to secure the needed changes to Irish backstop. EU chief negotiator Michel Barnier threw out a package of “concessions” that was rejected bluntly by the UK government. Foreign Minister Jeremy Hunt insisted that the meaningful vote on the Brexit deal will still go ahead on Tuesday, March 12. But the Sunday Times predicted that May will lose by 230 votes again, the same margin of defeat as in January for effective the same deal in the Commons.

Hunt now turned to Brexiteer Tories and threatened that vote down the deal would open the door to no Brexit. He said, “If you want to stop Brexit you only need to do three things: kill this deal, get an extension, and then have a second referendum. Within three weeks those people could have two of those three things … and quite possibly the third one could be on the way.”

On the other hand, the EU is trying to push the UK to make up it’s mind clearly, rather that getting an extension with no purpose. France’s EU affairs minister Nathalie Loiseau said “More time, to do what? We’ve had two years … If there’s nothing new, more time will not do anything other than usher in more uncertainty, and uncertainty just creates anxiety… It’s not time that we need, but a decision.”

Manfred Weber, the chairman of the European People’s Party in the European Parliament also said “May should end her zigzag course.” Also, “British politicians, and I mean Labour leader Jeremy Corbyn in particular, must finally put their own careers and party considerations behind them and look at the country’s interests again.”

In short, there will be another parliamentary vote on the Brexit deal on March 12, next Tuesday. As it’s defeated, a vote on no-deal Brexit will then be held on March 13 to see if there is explicit consent on this path. If not, there will be another vote on Article 50 extension on March 14.

Fed Powell: Roughly neutral interest rate appropriate with muted inflation

In CBS’s 60 Minutes show, Fed Chair Jerome Powell reiterated that current interest rates are “appropriate” while inflation is “muted”. He also described the current rate setting as “roughly neutral”. Fed is patient regarding policy adjustment and that means “we don’t feel any hurry to change our interest rate policy”.

On the economy, he said “the outlook for the U.S. economy is favorable.” And, “the principal risks to our economy now seem to be coming from slower growth in China and Europe and also risk events such as Brexit.”

Powell added that “what’s happened in the last 90 or so days is that we’ve seen increasing evidence of the global economy slowing down” and “we’re going to wait and see how those conditions evolve before we make any changes to our interest-rate policy.”

China pushes back on currency pledge while WH Kudlow bullish on trade deal

Comments from Chinese officials over the weekend suggested they’re trying to push back on US demand regarding currency manipulation. China PBoC Governor Yi Gang said over the weekend that both sides reached consensus of many important issues, including competitive devaluation of currencies. But he also emphasized that yuan exchange-rate formation mechanism is in line with G20 standard.

Yi went further to noted that US and China discussed respecting the “autonomy” of each other’s monetary policy. Vice Commerce Minister Wang Shouwen also said on Saturday that any “enforcement mechanism for a prospective trade deal must be “two way, fair and equal.” Apparently, Chinese officials were avoiding any mention of one-sided pledge on currency.

On the other hand, White House economic advisor Larry Kudlow said there was a breakthrough with China agreeing to promote “stable currency and avoid competitive devaluation. He’s “positive and bullish” on a US-China trade deal. And he expects the agreement to be finalized by April. He also hailed that Trump administration is making “headway” in the negotiations and is “making great progress”. Currently, Kudlow added that negotiators are “working out some of the difficult final points” And, “it’s got to be good, it’s got to be fair and reciprocal, and it has got to be enforceable — that’s an important point.”

Looking ahead – Brexit votes, trade talks and growth data watched

Brexit votes in UK is a major focus this week. While it’s getting unlikely to have a US-China trade deal within March, any development will still be watched closely. In addition, the main theme stay on growth data for clues on how deep the global slow down would be. Key data include US retail sales, durables goods orders and CPI. UK GDP, trade balance and productions. Eurozone industrial production. China industrial production, retail sales and fixed asset investment.

Here are some highlights for the week:

- Monday: Germany industry production, trade balance; US retail sales, business inventories

- Tuesday: Australia home loans, NAB business confidence; UK GDP, productions, trade balance; US CPI

- Wednesday: Australia Westpac consumer sentiment; Japan machine orders, PPI, tertiary industry index; Eurozone industrial production; US durable goods orders, PPI, construction spending

- Thursday: UK RICS house price balance; China industrial production, retail sales, fixed asset investment; German CPI final; Swiss PPI, SECO economic forecasts; Canada new housing price index; US import prices, jobless claims, new home sales

- Friday: New Zealand business NZ manufacturing index; BoJ rate decision; Eurozone CPI final; Canada manufacturing sales; US Empire state manufacturing, industrial production, U of Michigan consumer sentiment

GBP/USD Daily Outlook

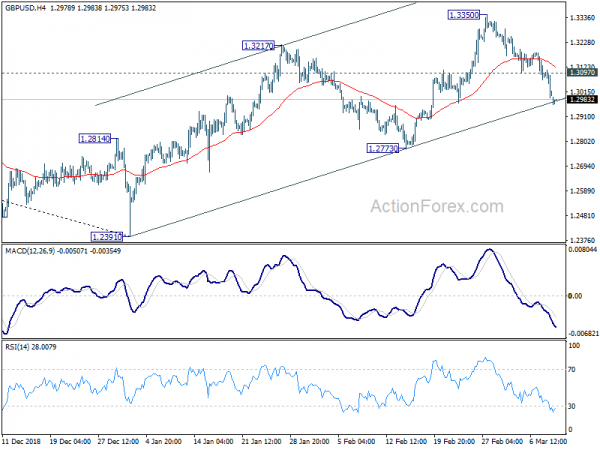

Daily Pivots: (S1) 1.2968; (P) 1.3038; (R1) 1.3087; More….

Intraday bias in GBP/USD remains on the downside as decline from 1.3350 is in progress. Sustained break of trend line support (now at 1.2973) will argue that rebound from 1.2391 has completed earlier than expected at 1.3350. Deeper fall would then be seen to 1.2773 support for confirmation. On the upside, above 1.3184 minor resistance will suggest that the pull back has completed. Intraday bias will be turned back to the upside for 1.3350.

In the bigger picture, medium term decline from 1.4376 (2018 high) should have completed at 1.2391. Rise from 1.2391 is now seen as the third leg of the corrective pattern from 1.1946 (2016 low). Further rise could be seen through 1.4376 in medium term. On the downside, though, break of 1.2773 support will dampen this view. Focus will be turned back to 1.2391 low and break will resume the fall from 1.4376 to 1.1946.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Japan Money Stock M2+CD Y/Y Feb | 2.40% | 2.40% | 2.40% | |

| 06:00 | JPY | Machine Tool Orders Y/Y Feb P | -29.3% | -18.80% | ||

| 07:00 | EUR | German Industrial Production M/M Jan | 0.50% | -0.40% | ||

| 07:00 | EUR | German Trade Balance (EUR) Jan | 21.2B | 19.4B | ||

| 12:30 | USD | Retail Sales Advance M/M Jan | -0.10% | -1.20% | ||

| 12:30 | USD | Retail Sales Ex Auto M/M Jan | 0.30% | -1.80% | ||

| 14:00 | USD | Business Inventories Dec | 0.60% | -0.10% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals