Sterling turns mixed as markets await yet another vote about Brexit in the Commons today. MPs is now given a chance to vote for delaying Brexit beyond March 29. The question is whether it would be a short delay with a plan, a short delay without a plan, or a long delay without a plan. We’ll soon find out. After the vote, Prime Minister Theresa May will write to the President of the European Council to request for Article 50 extension, with reason and time.

For now, Australian Dollar is the weakest one for today, followed by New Zealand Dollar. Dollar is the strongest one, followed by Swiss Franc. Weak data from China which suggests longer slowdown weighed slightly on sentiment. Also, there are reports that the trade negotiation with US is dragging on. The anticipated Trump-Xi summit is postponed to April at least. Euro is firm as the third strongest even though both German Economy Ministry and Ifo institute expect just modest growth in the country ahead.

Technically, there is no special development so far. The recovery in Dollar is not strong enough to warrant completion of recent corrective pull back yet. Though, USD/CHF is recovering ahead of 1.0027 minor support. Also, USD/CAD also recovers after breaching 1.3301 minor support. More upside in these two pair will reinforce near term bullishness in the greenback.

In Europe, FTSE is up 0.46%. DAX is up 0.40%. CAC is up 0.65%. German 10-year yield is up 0.0095 at 0.075. Earlier in Asia, Nikkei dropped -0.02%. Hong Kong HSI rose 0.15%. China Shanghai SSE dropped -1.20% to 2990.69, below 3000. Singapore Strait Times rose 0.07%, Japan 10-year JGB yield rose 0.0053 to -0.04.

US initial jobless claims rose 9k to 229k, import price rose 0.6% mom

US initial jobless claims rose 6k to 229k in the week ending March 9, above expectation of 225k. Four-week moving average of initial claims dropped -2.5k to 223.75k. Continuing claims rose 18k to 1.776M in the week ending March 2. Four-week moving average of continuing claims dropped -1k to 1.766M. Import price index rose 0.6% mom in February, fasting in 9 months, well above expectation of 0.3% mom.

Trump-Xi summit reported to be postponed to April

Bloomberg reports that the planned summit between Trump and Chinese President Xi Jinping to seal the trade deal would be postponed to April. One of the reason is that China prefers a formal state visit rather than a low-profile appearance just to sign the deal.

But more importantly, as US Trade Representative Robert Lighthizer said earlier this week that there are still unresolved major issues”. We’ve repeatedly pointed out that there has been no concrete details on the core issues, including IP theft, forced technology transfer and market distortion by state-owned enterprises.

Trump has also tried to tone down on the agreement yesterday as he said “I’m in no rush. I want the deal to be right. … I am not in a rush whatsoever. It’s got to be the right deal. It’s got to be a good deal for us and if it’s not, we’re not going to make that deal.” And, he is also open to complete the trade agreement before or after the summit.

Former head of National Economic Council Gary Cohn said in a Freakonomics interview that Trump “needs a win” and he is “desperate right now” for a trade deal with China. Cohn added, “the only big open issue right now that he could claim as a big win that he’d hope would have a big impact on the stock market would be a Chinese resolution.”

UK Hammond said EU may insist on long Brexit delay, German Altmaier said no artificial boundaries

The vote on delaying Brexit in the Commons is the major focus today. A big question is… for how long. Chancellor of the Exchequer Philip Hammond said, “this is not in our control and the European Union is signaling that only if we have a deal is it likely to be willing to grant a short technical extension to get the legislation through.” He added “if we don’t have a deal, and if we’re still discussing among ourselves what is the right way to go forward, then it’s quite possible that the EU may insist on a significantly longer period”.

Opposition Labour Party’s finance spokesman John McDonnell said “we will be putting an amendment down to ensure parliament considers an extension, it doesn’t necessarily have to be a long extension”. He added “we will go for a limited extension today.”

German Economy Minister Peter Altmaier urged the EU to discuss “constructively” with UK on the question of delaying Brexit. He emphasized “we urgently need clarity, we need clarity fast, but we will not make this by always criticizing our British friends and partners from a high moral standpoint, but only if we reach a reasonable solution”. And, he said “I would not set any artificial boundaries here”, regarding the time of the delay.

German Economy Ministry expects moderate growth in Q1, weak manufacturing and prospering services

German Economy Ministry said in its March economic report that the economy has a subdued start to 2019. And the country “has become more troubled due to higher risks and uncertainties in the external environment.” This applies in particular to manufacturing with significant fall in production in January. The “weak phase” is likely to continue due to “sluggish foreign demand”.

Though, the ministry expects growth to continue in other sectors, in particular most service sectors. This was underlined by “recent significant increase in employment” those sectors. With the contrasting tension between weak manufacturing and prospering services, GDP will likely increase “at best moderate” in Q1.

The government lowered 2019 growth forecast to 1.0% back in January and will update the projections again in April.

Ifo lowers 2019 Germany growth forecast from 1.1% to 0.6%, but upgrades 2020 forecasts

German ifo Institute lowers 2019 growth forecast for Germany from 1.1% to 0.6%. Though, 2020 growth forecast is revised up from 1.6% to 1.8%.

Timo Wollmershaeuser, Head of ifo Business Cycle Analysis and Forecasts said: “The current production difficulties in German manufacturing are likely to be overcome only gradually. The industry will largely fail to act as an economic engine in 2019. Global demand for German products is weak, as the international economy continues to lose momentum.

But he emphasized that “domestic driving forces are still intact”. Number of people employed should continue to rise even though pace is slowing. Unemployment rate is expected to fall from 5.2% to 4.7-4.9%. Also, Wollmershaeuser added: “This year, strong wage increases, a low inflation rate, reductions in taxes and social security contributions as well as an expansion of public transfers should result in a large increase in real incomes of households. This will bolster private consumption and the construction industry.”

Released from Germany, CPI was finalized at 0.5% mom, 1.6% yoy in February. From Swiss, PPI rose 0.2% mom, -0.7% yoy in February, versus expectation of -0.1% mom, -1.0% yoy.

Weak Chinese data point to longer slowdown

A batch of January-February economic data is released from China today which showed that the slowdown is going to extend for longer. In particular, poor employment data could trigger more forceful measures from the Chinese government to maintain social stability.

Industrial production growth slowed to 5.3% ytd yoy in February, down from 6.2% and missed expectation of 5.5%. That also the slowest pace since early 2002.

Retail sales growth dropped to just 8.2% ytd yoy, down from 9.0% but beat expectation of 8.1%. That’s nonetheless, the weakest growth since at least 2012. Unemployment rate also jumped sharply to 5.3%, up from 4.9% in December, highest in two years.

Nevertheless, investment offers some positive hope. Fixed assets investment grew 6.1% yoy, up from 5.9% and beat expectation of 6.0%. Real estate investment rose 11.6% yoy, hitting the strongest growth figure since November 2014.

Suggested reading: Slowdown in China Remains Pronounced Even After Adjusting for Seasonal Factors

GBP/USD Mid-Day Outlook

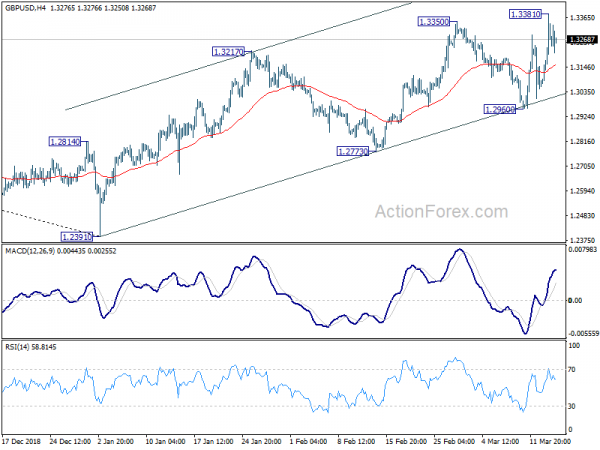

Daily Pivots: (S1) 1.3136; (P) 1.3259; (R1) 1.3462; More….

Intraday bias in GBP/USD remains neutral first. For now, as long as 1.2960 support holds and further rise is in favor. Sustained break of 1.3350/3381 will resume whole rebound from 1.2391 low to 61.8% retracement of 1.4376 to 1.2391 at 1.3618 next. However, on the downside, firm break of 1.2960 will indicate that rebound from 1.2391 has completed earlier than expected at 1.3350. Deeper fall would then be seen to 1.2773 support for confirmation.

In the bigger picture, medium term decline from 1.4376 (2018 high) should have completed at 1.2391. Rise from 1.2391 is now seen as the third leg of the corrective pattern from 1.1946 (2016 low). Further rise could be seen through 1.4376 in medium term. On the downside, though, break of 1.2773 support will dampen this view. Focus will be turned back to 1.2391 low and break will resume the fall from 1.4376 to 1.1946.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:00 | AUD | Consumer Inflation Expectation Mar | 4.10% | 3.70% | ||

| 00:01 | GBP | RICS House Price Balance Feb | -28% | -24% | -22% | |

| 02:00 | CNY | Fixed Assets Ex Rural YTD Y/Y Feb | 6.10% | 6.00% | 5.90% | |

| 02:00 | CNY | Industrial Production YTD Y/Y Feb | 5.30% | 5.50% | 6.20% | |

| 02:00 | CNY | Retail Sales YTD Y/Y Feb | 8.20% | 8.10% | 9.00% | |

| 06:45 | CHF | SECO Economic Forecasts | ||||

| 07:00 | EUR | German CPI M/M Feb F | 0.50% | 0.50% | 0.50% | |

| 07:00 | EUR | German CPI Y/Y Feb F | 1.50% | 1.60% | 1.60% | |

| 07:30 | CHF | Producer & Import Prices M/M Feb | 0.20% | -0.10% | -0.70% | |

| 07:30 | CHF | Producer & Import Prices Y/Y Feb | -0.70% | -1.00% | -0.50% | |

| 12:30 | CAD | New Housing Price Index M/M Jan | -0.10% | 0.00% | 0.00% | |

| 12:30 | USD | Import Price Index M/M Feb | 0.60% | 0.30% | -0.50% | 0.10% |

| 12:30 | USD | Initial Jobless Claims (MAR 09) | 229K | 225K | 223K | |

| 14:00 | USD | New Home Sales M/M Jan | 0.30% | 3.70% | ||

| 14:00 | USD | New Home Sales Jan | 623K | 621K | ||

| 14:30 | USD | Natural Gas Storage | -149B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals