Sterling spiked higher overnight after UK Commons voted to reject no-deal Brexit. But there was no follow through buying as the Pound settles back into familiar range quickly. It’s indeed the weakest one for today so far, paring some of the gains. Focus will now turn to vote on Article 50 extension today. UK lawmakers finally have a chance to tell the world what they want, rather than what they don’t want. Following Sterling, Australian Dollar is the second weakest as weighed down by Chinese data, which suggest the slowdown could last longer. On the other hand, Dollar and Euro and the strongest ones for today.

Technically, we’d maintain that sustained break of near term resistance in the Pound is needed to confirm underlying momentum. That is, 1.3350 resistance in GBP/USD, 0.8474 support in EUR/GBP and 148.57 resistance in GBP/JPY. Otherwise, current rise in the Pound is viewed as part of near term volatility only. USD/CHF dropped notably overnight and is now close to 1.0027 minor support. As long as this support holds, we’d expect an eventual break of 1.0128 resistance in USD/CHF as recent up trend resumes. But break will mix up the outlook and turn focus back to 0.9926 support. USD/CAD breached 1.3301 minor support overnight with help from rally in WTI oil. This level will also be watched today too as indication of bearish reversal in USD/CAD.

In other markets, Nikkei is currently up 0.21%. Hong Kong HSI is up 0.05%. China Shanghai SSE is down -1.07%, back below 3000 handle. Singapore Strait Times is down -0.23%. Japan 10-year JGB yield is up 0.0061 at -0.04, staying negative. Overnight, DOW rose 0.58%. S&P 500 rose 0.69%. NASDAQ rose 0.69%. 10-year yield rose 0.0006 to 2.611. 30-year yield rose 0.0022 to 3.010, back above 3% handle.

UK passed non binding vote to reject no-deal Brexit

Sterling spiked higher after UK Commons passed yesterday a non-binding motion to reject no-deal Brexit under any circumstances. But the Pound quickly retreated again as focus will turn to vote today on whether to ask the EU for Article 50 extension. Also, question is on whether there would be a short extension of a long extension.

The final motion was voted for by 321 to 278, a majority of 43. The motion reads: “This House rejects the United Kingdom leaving the European Union without a Withdrawal Agreement and a Framework for the Future Relationship”.

The original motion was changed after the Spelman/Dromey amendment was narrowly passed by 312 to 308, just a mere majority of 4. The original motion reads: “This House declines to approve leaving the European Union without a Withdrawal Agreement and a Framework for the Future Relationship on 29 March 2019; and notes that leaving without a deal remains the default in UK and EU law unless this House and the EU ratify an agreement.”

Prime Minister Theresa May, however insisted that the votes do not change the fundamental problem. And the only way to rule out no-deal is to vote for a deal. She also warned that if MPs do not vote for a Brexit deal soon, she will have to seek a long article 50 extension, which would mean the UK having to take party in the European elections.

A European Commission spokesperson quickly responded:: “There are only two ways to leave the EU: with or without a deal. The EU is prepared for both. To take no deal off the table, it is not enough to vote against no deal – you have to agree to a deal. We have agreed a deal with the prime minister and the EU is ready to sign it.”

Trump in no rush to complete trade deal with China, still expecting a summit with Xi

Trump insisted that the trade negotiations with China is “going along well”. But he told reports at the White House that “”I’m in no rush. I want the deal to be right. … I am not in a rush whatsoever. It’s got to be the right deal. It’s got to be a good deal for us and if it’s not, we’re not going to make that deal.”

At the same time, Trump also acknowledged that Xi may be wary of going to a summit in the US without an agreement in hand. He said “I think President Xi saw that I’m somebody that believes in walking when the deal is not done, and you know there’s always a chance it could happen and he probably wouldn’t want that,”

Though, he’s still expecting a meeting with Chinese President Xi Jinping but “we’ll just see what the date is”. He is also open to complete the trade agreement before or after the summit. He added that “we could do it either way. We could have the deal completed and come and sign, or we could get the deal almost completed and negotiate some of the final points. I would prefer that.”

For now, Beijing made no reference to a Trump-Xi summit at the Mar-a-Lago Such summit is unlikely to happen this month. Tariffs imposed from both sides since last year are continuing to drag on the global economy with no end in sight. And there is nothing done that stops China from IP theft, forced technology transfer and market distortion through state-owned enterprises.

Weak Chinese data point to longer slowdown

A batch of January-February economic data is released from China today which showed that the slowdown is going to extend for longer. In particular, poor employment data could trigger more forceful measures from the Chinese government to maintain social stability.

Industrial production growth slowed to 5.3% ytd yoy in February, down from 6.2% and missed expectation of 5.5%. That also the slowest pace since early 2002.

Retail sales growth dropped to just 8.2% ytd yoy, down from 9.0% but beat expectation of 8.1%. That’s nonetheless, the weakest growth since at least 2012. Unemployment rate also jumped sharply to 5.3%, up from 4.9% in December, highest in two years.

Nevertheless, investment offers some positive hope. Fixed assets investment grew 6.1% yoy, up from 5.9% and beat expectation of 6.0%. Real estate investment rose 11.6% yoy, hitting the strongest growth figure since November 2014.

Suggested reading: Slowdown in China Remains Pronounced Even After Adjusting for Seasonal Factors

Elsewhere

Australia consumer inflation expectation rose to 4.1% in March. UK RICS house price balance dropped to -28 in February. German CPI final will be release in European session, with Swiss PPI. Later in the day, Canada will release new housing price index. US will release new home sales, jobless claims and import price index. And of course, another Brexit vote in the UK parliament will be watched.

GBP/USD Daily Outlook

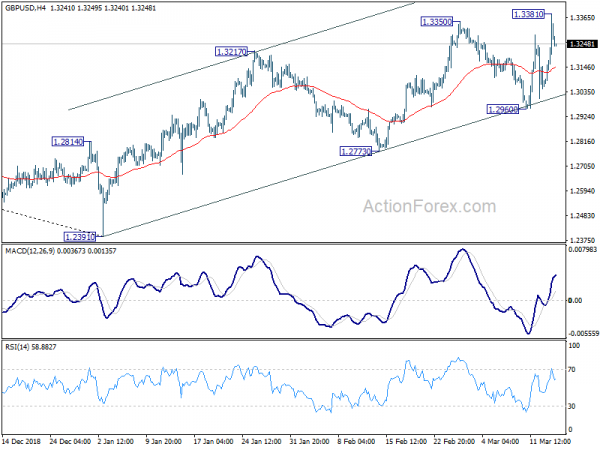

Daily Pivots: (S1) 1.3136; (P) 1.3259; (R1) 1.3462; More….

GBP/USD spiked higher to 1.3381 and breached 1.3350 resistance. But it quickly retreated back into prior range. Intraday bias remains neutral first. For now, as long as 1.2960 support holds and further rise is in favor. Sustained break of 1.3350/3381 will resume whole rebound from 1.2391 low to 61.8% retracement of 1.4376 to 1.2391 at 1.3618 next. However, on the downside, firm break of 1.2960 will indicate that rebound from 1.2391 has completed earlier than expected at 1.3350. Deeper fall would then be seen to 1.2773 support for confirmation.

In the bigger picture, medium term decline from 1.4376 (2018 high) should have completed at 1.2391. Rise from 1.2391 is now seen as the third leg of the corrective pattern from 1.1946 (2016 low). Further rise could be seen through 1.4376 in medium term. On the downside, though, break of 1.2773 support will dampen this view. Focus will be turned back to 1.2391 low and break will resume the fall from 1.4376 to 1.1946.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 0:00 | AUD | Consumer Inflation Expectation Mar | 4.10% | 3.70% | ||

| 0:01 | GBP | RICS House Price Balance Feb | -28% | -24% | -22% | |

| 2:00 | CNY | Fixed Assets Ex Rural YTD Y/Y Feb | 6.10% | 6.00% | 5.90% | |

| 2:00 | CNY | Industrial Production YTD Y/Y Feb | 5.30% | 5.50% | 6.20% | |

| 2:00 | CNY | Retail Sales YTD Y/Y Feb | 8.20% | 8.10% | 9.00% | |

| 6:45 | CHF | SECO Economic Forecasts | ||||

| 7:00 | EUR | German CPI M/M Feb F | 0.50% | 0.50% | ||

| 7:00 | EUR | German CPI Y/Y Feb F | 1.60% | 1.60% | ||

| 7:30 | CHF | Producer & Import Prices M/M Feb | -0.10% | -0.70% | ||

| 7:30 | CHF | Producer & Import Prices Y/Y Feb | -1.00% | -0.50% | ||

| 12:30 | CAD | New Housing Price Index M/M Jan | 0.00% | 0.00% | ||

| 12:30 | USD | Import Price Index M/M Feb | 0.30% | -0.50% | ||

| 12:30 | USD | Initial Jobless Claims (MAR 09) | 225K | 223K | ||

| 14:00 | USD | New Home Sales M/M Jan | 0.30% | 3.70% | ||

| 14:00 | USD | New Home Sales Jan | 623K | 621K | ||

| 14:30 | USD | Natural Gas Storage | -149B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals