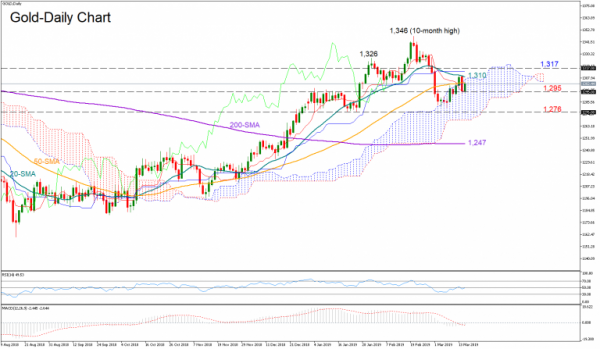

Gold is trying to recover Thursday’s losses, which emerged after a failure to surpass the 20-day moving average (MA) but the technical indicators suggest that positive momentum may not pick up steam yet, at least as long as the RSI holds around its 50 neutral mark and the MACD keeps moving softly along its red signal line.

The 1,1295 level could provide nearby support to downside corrections, while lower a more descent barrier may arise around 1,276 as any break below this point may confirm the end of the August uptrend. Yet only a decisive close below the 200-day MA currently at 1,247 would shift the neutral medium-term picture into a bearish one.

If the price manages to crawl above the 20-day MA (1,310), traders could look for resistance within the 1,317-1,326 area. Should the bulls violate this region, bringing at the same time the upside trend back into focus, a more crucial battle could start around the 1,346 top.

In brief, gold could follow a sideways move in the short term, while in the medium term, the bullish outlook has somewhat faded after the drop back to the 1,300 round level.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals