The financial markets are generally quiet in Asian session today, with stock indices stuck in tight range. Sterling turned mixed after knee-jerk reactions to new Brexit chaos overnight. The Pound is probably as clueless the UK government on what’s next for Brexit. Australian Dollar pares back some of this week’s gain as Q4 house price dropped more than expected. Overall, Aussie is the weakest one for now, followed by Dollar. Yen is the strongest, followed by Kiwi.

Technically, there isn’t any critical development yet. EUR/USD continues to lose upside momentum there is no indication of completion of rebound from 1.1176 yet. Yesterday’s rally resumption in oil prices provided no lift to Canadian Dollar. USD/CAD is stuck in tight range above 1.3289 even though more downside in in favor. AUD/USD, despite yesterday’s rebound, is held below 1.7121 minor resistance, thus maintains near term bearishness. Sterling remains non-committal, range-bound in GBP/USD, EUR/GBP and GBP/JPY.

In Asia, Nikkei closed down -0.10%. Hong Kong HSI is down -0.07%. China Shanghai SSE is down -0.03%. Singapore Strait Times is up 0.01%. Japan 10-year JGB yield is down -0.004 at -0.04. Overnight, DOW rose 0.25%. S&P 500 rose 0.37%. NASDAQ rose 0.34%. 10-year yield rose 0.009 to 2.602, back above 2.6 handle. But 30-year yield dropped -0.009 to 3.011.

Sterling clueless on Brexit chaos

Overnight, UK Commons Speaker John Bercow invoked a rule to forbid Prime Minister Theresa May to bring back the same Brexit deal for another meaningful vote, unless there are substantial changes in the proposition. The 415-year-old Parliamentary convention is for “sensible use of the House’s time and proper respect for the decisions that it takes”. Without being forewarned, the government just said: “We note the speaker’s statement. This is something that requires proper consideration”, without further elaboration.

Now, it’s near impossible for a Brexit deal to be passed this week and hence, Article 50 extensions won’t be a short one. The Sun newspaper reported that May is drafting a letter to European Council President Donald Tusk to request a delay of 9 to 12 months. Some suggested one way to bring back the Brexit deal for another vote is having EU granting another Brexit date than March 29, thus, making the proposition substantially different. Another way is to end the current parliamentary session early without dissolving it, and start a new session. The same deal could then be voted for in “another” session.

But then, the fundamental question is not solved. That is, is there enough votes to the current Brexit deal through?

Australia house price dropped -2.4% qoq, -5.1% yoy in Q4

Australia house price index dropped -2.4% qoq in Q4, deepened from Q3’s -1.5% qoq and missed expectation of -2.0% qoq. Sydney led the way by dropped -3.7% qoq, followed by Melbourne at -2.4%. Hobart (up 0.7%) and Adelaide (up 0.1%) bucked the trend.

Through the year growth in residential property prices fell 5.1% yoy in the December quarter 2018. Falls were recorded in Sydney (-7.8 per cent), Melbourne (-6.4% yoy), Darwin (-3.5% yoy), Perth (-2.5 % yoy) and Brisbane (-0.3% yoy).

Chief Economist for the ABS, Bruce Hockman said: “While property prices are falling in most capital cities, a tightening in credit supply and reduced demand from investors and owner occupiers have had a more pronounced effect on the larger property markets of Sydney and Melbourne.”

RBA awaits more data to resolve tensions in domestic data

In the March meeting minutes, RBA noted the “tension” between ongoing improvement in job data and slowdown in output growth in H2 2018. Leading indicators pointed to further tightening in the job market and wages growth picked up in Q4. Growth slowed but business and public spending remained positive. However, there continued to be “considerable uncertainty” around consumption outlook, given fall in house prices.

Taken into account the available information, RBA judged that current monetary policy stance was “supporting jobs growth and a gradual lift in inflation”. But “significant uncertainties around the forecasts remained”. The scenarios of a rate hike and rate hike were “more evenly balanced” than over the preceding year. And, “it would be appropriate to hold the cash rate steady while new information became available that could help resolve the current tensions in the domestic economic data.”

Elsewhere

New Zealand Westpac consumer confidence dropped to 103.8 in Q1, down from 109.1. UK job data will be a major focus in European session, together with German ZEW economic sentiment. Swiss will also release trade balance. Later in the day, US factory orders will be featured.

GBP/USD Daily Outlook

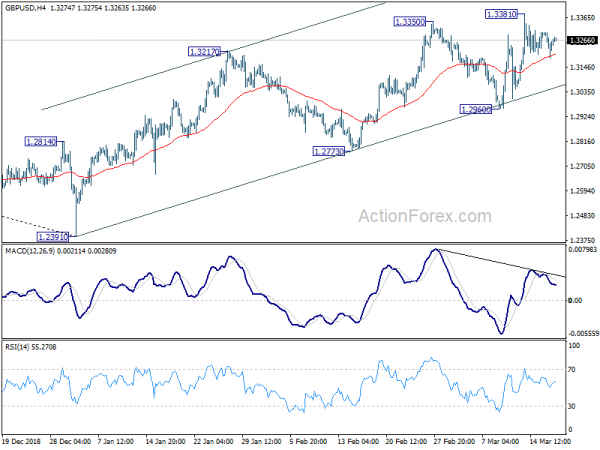

Daily Pivots: (S1) 1.3190; (P) 1.3247; (R1) 1.3309; More….

GBP/USD dipped to 1.3184 but drew support from 4 hour 55 EMA and recovered. After all, it’s staying in consolidation from 1.3381 and intraday bias remains neutral first. Further rise is expected as long as 1.2960 support holds. On the upside, firm break of 1.3381 will target 61.8% retracement of 1.4376 to 1.2391 at 1.3618 next. However, on the downside, firm break of 1.2960 will indicate that rebound from 1.2391 has completed earlier than expected. Deeper fall would then be seen to 1.2773 support for confirmation.

In the bigger picture, medium term decline from 1.4376 (2018 high) should have completed at 1.2391. Rise from 1.2391 is now seen as the third leg of the corrective pattern from 1.1946 (2016 low). Further rise could be seen through 1.4376 in medium term. On the downside, though, break of 1.2773 support will dampen this view. Focus will be turned back to 1.2391 low and break will resume the fall from 1.4376 to 1.1946.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 20:00 | NZD | Westpac Consumer Confidence Q1 | 103.8 | 109.1 | ||

| 0:30 | AUD | House Price Index Q/Q Q4 | -2.40% | -2.00% | -1.50% | |

| 0:30 | AUD | RBA Minutes Mar | ||||

| 7:00 | CHF | Trade Balance (CHF) Feb | 2.88B | 3.04B | ||

| 9:30 | GBP | Jobless Claims Change Feb | 13.1K | 14.2K | ||

| 9:30 | GBP | Claimant Count Rate Feb | 2.80% | |||

| 9:30 | GBP | ILO Unemployment Rate 3Mths Jan | 4.00% | 4.00% | ||

| 9:30 | GBP | Average Weekly Earnings 3M/YoY Jan | 3.20% | 3.40% | ||

| 9:30 | GBP | Weekly Earnings ex Bonus 3M/Yo Jan | 3.40% | 3.40% | ||

| 10:00 | EUR | German ZEW Economic Sentiment Mar | -11 | -13.4 | ||

| 10:00 | EUR | German ZEW Current Situation Mar | 13 | 15 | ||

| 10:00 | EUR | Eurozone ZEW Economic Sentiment Mar | -15.1 | -16.6 | ||

| 14:00 | USD | Factory Orders Jan | 0.30% | 0.10% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals