The forex markets are relatively mixed this week, in particular Sterling. Pound is staying inside familiar range even though the Parliament finally seized control over Brexit from the government. Focus will turn to Wednesday’s indicative votes but it’s uncertain whether the government will follow the results. Prime Minister May is still working on getting support for her Brexit deal and could make a come back this week. The eventual outcome remains far from certain.

Staying in the currency markets, Australian and Canadian Dollar are so far the strongest ones for today. But there is no sign of range breakout yet. Yen is the weakest one as risk sentiments stabilized, followed by New Zealand Dollar and Swiss Franc. Dollar is mixed despite extended decline in treasury yields. The markets could have probably listened to what former Fed Chair Janet Yellen said. That is, current yield curve inversion doesn’t necessarily suggest recession, but just Fed rate cut. Fed funds futures are pricing in more than 70% chance of a cut by December.

In Asian, Nikkei closed up 2.15%, recovering much of yesterday’s loss. Hong Kong HSI is down -0.15%. China Shanghai SSE is down -1.51%, lost 3000 handle. Singapore Strait Times is up 0.32%. Japan 10-year JGB yield is up 00164 at -0.068, staying negative. Overnight, DOW rose 0.06%. S&P 500 dropped -0.08%. NASDAQ dropped -0.07%. 10-year yield dropped -0.035 to 2.420.

UK Parliament seized control over Brexit, to vote on alternatives on Wednesday

The UK Parliament seized control over Brexit from the government after passing a cross-party amendment by 329 to 302 late Monday. The amendment was tabled by former Tory minister Oliver Letwin involving Labour’s Hilary Benn. It gives MPs a series of votes on alternatives to Prime Minister Theresa May’s Brexit deal, including a second referendum, staying the the customs union, no-deal and even revoking article 50.

Three Conservative ministers resigned from the government to support the amendment, including Foreign Affairs Minister Alistair Burt, Health Minister Steve Brine and Business Minister Richard Harrington. A total of 29 Conservatives rebelled to vote for the amendment.

The Brexit department issued a quick email statement after the vote. It criticized that the results “upends the balance between our democratic institutions and sets a dangerous, unpredictable precedent for the future.” And it warned that “while it is now up to parliament to set out next steps in respect of this amendment, the government will continue to call for realism – any options considered must be deliverable in negotiations with the EU.

Earlier in the day before the vote, May declined to commit to abide by the outcome of the indicative votes. She said: “No government could give a blank cheque to commit to an outcome without knowing what it is. So I cannot commit the government to delivering the outcome of any votes held by this house. But I do commit to engaging constructively with this process.”

Fed Rosengren: Balance runoff didn’t cause Q4 market turbulence

Boston Fed President Eric Rosengren defended against claims that Fed’s balance sheet run-off caused financial markets turbulence during last Q4. He said, “concerns about the international economy, potential trade disputes, and a U.S. government shutdown are much more plausible explanations”. Rosengren pointed out that the balance reduction is “still quite gradual”. Meanwhile, equity markets experienced a “substantial recovery” in the first two months this year, even though the runoff was “slightly faster” than in Q4.

Also, as Fed purchased long-term securities, it encouraged investors to “big up” the price and lower rates on other higher-duration securities. Thus, there was spillover to a wide array of other asset prices. With “quantitative tightening”, Treasury yields and term premia would move higher. But back in December, treasury rate indeed feel and term premium remained quit low. That shouldn’t be the reaction to the balance sheet runoff.

Looking forward, Rosengren said it’s “unrealistic to expect the Federal Reserve’s balance sheet to return to the size it was before the financial crisis”. Meanwhile, in a hypothetical next recession, central banks will have little room to reduce short-term rates. Thus, there will be increased need to utilize the balance sheet as stimulative tool of monetary policy.

Canada Freeland: Illegal US 232 steel tariffs should be removed to move ahead with USMCA

After meeting with US Trade Representative Robert Lighthizer in Washington yesterday, Canadian Foreign Minister Chrystia Freeland warned that the US steel tariffs raised serious questions on support for ratification of the new NAFTA, now known as USMCA.

She said “the existence of these tariffs for many Canadians raises some serious questions about NAFTA ratification”. And, “in order to move ahead with that deal, I think Canadians feel the right thing is, there should be no 232 tariffs or retaliatory tariffs between our two countries.”

Freeland raised the issue to Lighthizer clearly and emphasized “these tariffs are completely unacceptable to Canada,” repeating the words “illegal,” “unjustified” and “absurd” several times in describing them.

BoJ opinions: Downside risks to economy clearly heightening recently

In the summary of opinions at the March 14/15 monetary policy meeting, BoJ noted that “while uncertainties regarding overseas economies started to become apparent from around last autumn, slowdowns have materialized.”. And, “reflecting these developments, downside risks to Japan’s economy clearly have been heightening recently.”

Also, it is concerning that developments toward an economic downturn could heighten, depending on developments in overseas economies and the effects of the scheduled consumption tax hike.

On monetary policy, BoJ maintained that it should “persistently continue with the current monetary policy stance”. But it also emphasized that “in case developments in economic activity and prices undergo a phase shift, it is important to make preemptive policy responses.”

RBA Ellis: Nexus between labor, households and housing are crucial to economic outlook assessment

RBA Assistant Governor Luci Ellis said in a speech that the disconnect between “apparently weak national accounts” and “noticeably stronger labor market data” can be traced to the “household sector”. In contrast to the positive picture implied by the labor markets, she noted that “growth in household income has been slow”. Besides, “growth in consumption has weakened recently”.

While there were talks of “wealth effects” from fall in house prices on spending, Ellis noted that the link is “a bit more subtle than” simply that rise in wealth boost spending directly. At the same time, fundamentally demand for housing rests on the household sector’s confidence and capacity to take on the financial commitments involved in the purchase or rental of a home. Without enough income, and so without a strong labour market, that confidence and capacity would be in doubt.

Ellis emphasized that “the nexus between labour markets, households and housing are crucial to our assessment of the broader outlook.

On the data front

Japan corporate service price rose 1.1% yoy in February versus expectation of 1.2% yoy. New Zealand trade surplus came in at NZD 12M versus expectation of NZD -200M deficit. Germany Gfk consumer sentiment dropped to 10.4 in April, below expectation of 10.8.

Looking ahead, UK will release BBA mortgage approvals in European session. US will release housing starts and building permits, house price indices later in the day. But most attention will likely be on consumer confidence.

GBP/USD Daily Outlook

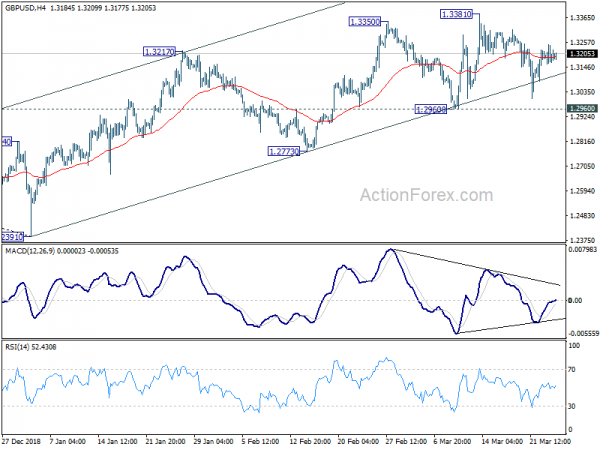

Daily Pivots: (S1) 1.3158; (P) 1.3202; (R1) 1.3244; More….

GBP/USD is staying in range of 1.2960/3381 and intraday bias remains neutral first. More consolidation could be seen. For now, as long as 1.2960 support holds, further rally remains in favor. On the upside, firm break of 1.3381 will resume the rebound from 1.2391 to 61.8% retracement of 1.4376 to 1.2391 at 1.3618 next. However, on the downside, decisive break of 1.2960 will indicate that rebound from 1.2391 has completed earlier than expected. Deeper fall would then be seen to 1.2773 support for confirmation.

In the bigger picture, medium term decline from 1.4376 (2018 high) should have completed at 1.2391. Rise from 1.2391 is now seen as the third leg of the corrective pattern from 1.1946 (2016 low). Further rise could be seen through 1.4376 in medium term. On the downside, though, break of 1.2773 support will dampen this view. Focus will be turned back to 1.2391 low and break will resume the fall from 1.4376 to 1.1946.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Trade Balance (NZD) Feb | 12M | -200M | -914M | -948M |

| 23:50 | JPY | BOJ Summary of Opinions | ||||

| 23:50 | JPY | Corporate Service Price Y/Y Feb | 1.10% | 1.20% | 1.10% | 1.00% |

| 7:00 | EUR | German GfK Consumer Confidence Apr | 10.4 | 10.8 | 10.8 | 10.7 |

| 9:30 | GBP | BBA Mortgage Approvals Feb | 39.4K | 40.6K | ||

| 12:30 | USD | Housing Starts Feb | 1.22M | 1.23M | ||

| 12:30 | USD | Building Permits Feb | 1.32M | 1.32M | ||

| 13:00 | USD | House Price Index M/M Jan | 0.40% | 0.30% | ||

| 13:00 | USD | S&P/Case-Shiller Composite-20 Y/Y Jan | 4.00% | 4.18% | ||

| 14:00 | USD | Consumer Confidence Index Mar | 132 | 131.4 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals