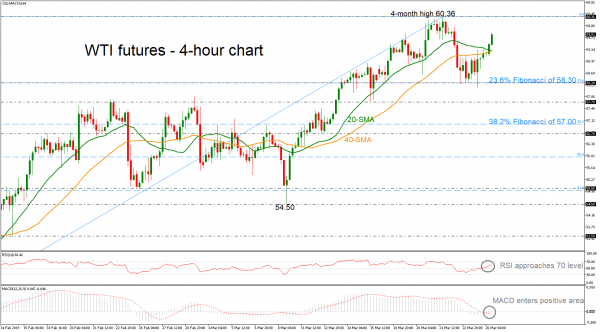

WTI crude oil futures have come under renewed buying interest, rising back above the 20- and 40-simple moving averages (SMAs) in the 4-hour chart after the market found strong support at the 23.6% Fibonacci retracement level of the upleg from 51.60 to 60.36, around 58.30.

Looking at momentum oscillators, they suggest further upside pressures may follow in the short-term. The RSI is holding above its neutral 50 line and is also pointing upwards, detecting bullish momentum. The MACD, already positive, lies above its trigger and zero lines.

If the bulls hold the control, price advances may stall initially near the latest high of 60.36. Another positive extension could find resistance at the 61.45 barrier, where the market topped on November 2018, increasing bullish sentiment. More upside pressures could drive the commodity towards the next hurdle of 63.20, taken from the peak on November 2018.

In case of a successful penetration to the downside of SMAs, oil prices could rest near the 23.6% Fibonacci which coincides with the 58.30 support. Even lower, the next stop could be around the 57.70 support level, while deeper the price could touch the 38.2% Fibonacci of 57.00.

To conclude, the market is in an ascending tendency over the last month following the rebound on the 51.60 support barrier.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals