The question is often asked as to how to best identify a pullback and avoid getting caught in a trend reversal. There are a few different factors to consider, but it boils down to two key components – context and price action.

Whether you are a new trader building a foundation or an experienced trader struggling (happens to the best), here are 4 ideas to help you Build Confidence in Trading

In terms of context, where in the trend is price most likely at? Beginning, middle, or closer to the end? One way to understand this better is to dial out to a higher time-frame to see where the market may be coming from or headed and if any major longer-term obstacles could stand in the way which might cause the trend to change. Always keep in mind the hierarchy of longer-term time-frames taking precedence over shorter ones – i.e. Weekly > Daily > 4-hr and so on…

Long-term level warns of trend reversal (weekly > daily)

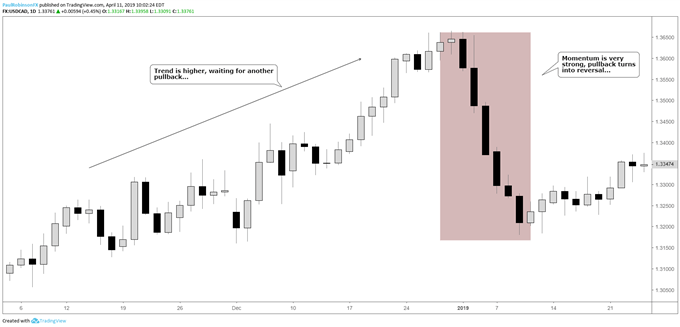

Price action matters a lot in gauging whether it is a pullback or a reversal. Let’s say for example a market is trending higher and you think it could continue on but want to wait for a correction before entering. If a downturn in momentum is strong and continuous then it is likely signalling a larger reversal rather than a healthy, tradeable pullback.

Downward momentum strong and persistent

To help reduce the risk of getting caught buying or shorting a trend reversal, it is a good idea to wait for momentum to turn back in your favor. And even better yet at support for a long and resistance for a short. This gives you a better shot at timing it right and also a reference point from where to set your stop. Candlestick analysis can be a highly effective method for identifying turns in momentum by using some of the basic candlestick reversal patterns.

The entire Becoming a Better Trader series in one location, check it out.

Pullback to trend-line, candlestick reversal

For the full conversation and set of examples, please check out the video above…

—Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals