Global market sentiments appeared to be given a strong boost by trade data from China. The much larger than expected rise in export is seen as positive sign of global demand. While there were some weak spots in the set of data, investors are enjoying the rally anyway. The optimism is particular apparent in German 10-year yield jumps through 0.04 handle. US 10-year yield is also pressing 2.55 handle.

In the currency markets, Australian Dollar is the strongest one with tight link to Chinese economy. Euro is second strongest, partly supported by flows linked to Japanese bank’s plans to buy a German aviation finance business. Also, EU is seen as having healthy trade growth with China. Yen is currently the weakest, followed by Dollar. From the data, US is clearly lagging behind in trade due to its down policies.

In Europe, currently, FTSE is up 0.20%. DAX is up 0.64%. CAC is up 0.38%. German 10-year yield is up 0.050 at 0.043. Earlier in Asia, Nikkei rose 073%. Hong Kong HSI rose 0.24%. China Shanghai SSE dropped -0.04%. Singapore Strait Times rose 0.03%. Japan 10-year JGB yield rose 0.0096 to -0.049.

Strong rebound in China exports suggest recovery in global trade, but US exports to China shrank -31.8% in Q1

China trade surplus widened to USD 32.6B in March, well above expectation of USD 8.1B. Exports jumped 14.2% yoy in USD 198.7B, well above expectation of 7.7% yoy. That’s seen as as sign of rebound in global trade activity. Imports, however, dropped -7.6% yoy to USD 166.0B, much weaker than expectation of -0.1% yoy. It’s an indication that domestic demand in China has yet to recover. Cumulative from January to March, expects rose 1.4% yoy to USD 551.8B. Imports dropped -4.8% yoy USD 475.4B. Trade surplus was at USD 76.3B.

Looking at some details, total trade between US and China shrank -15.4% in Q1, comparing with last year, as result of trade war. In particular, imports from US dropped a massive -31.8% yoy in the quarter. On the other hand, imports from Canada jumped 25.9% yoy and imports from Brazil surged 23.8% yoy. Overall trade growth with EU remained healthy.

From January to March cumulative, in USD term, with EU: Total trade rose 5.9% yoy to USD 162.6B. Exports to EU rose 8.8% yoy to USD 97.8B. Imports from EU rose 1.8% yoy to USD 64.8B. Trade surplus was at USD 33.0B.

With US: Total trade dropped -15.4% to USD 119.6B. Exports to US dropped -8.5% to USD 91.1B. Imports from USD dropped -31.8% to USD 28.5B. Trade surplus was at USD 62.6B

With AU: Total trade rose 5.7% to USD 37.9B. Exports to AU rose 9.7% to USD 11.0B. Imports from AU rose 4.1% to USD 26.9B. Trade deficit was at USD 15.9.

UK Hammond: Another Brexit referendum is very likely to be put to parliament at some stage

UK Chancellor of Exchequer Philip Hammond said new referendum was “a proposition that could and, on all the evidence, is very likely to be put to parliament at some stage”.

But any new referendum could probably take six months to organize. Thence, time would be tight even though Brexit date is delayed to October 31.

Also, Hammond added: “The government’s position has not changed. The government is opposed to a confirmatory referendum and therefore we would not be supporting it.”

Bundesbank Weidmann: German growth plausible to be just 0.8% this year

Bundesbank President Jens Weidmann warned that German economy could slow sharply in 2019. Growth rate could eventually be lower than 1%. He pointed to IMF’s new projections of just 0.8% for this year and noted that’s entirely plausible. It’s just half the rate of 1.6% Bundesbank projected back in December.

Weidmann also added, “Fiscal policy, as the minister (Finance Minister Olaf Scholz) said, is already expansionary in Germany and we estimate the impact of fiscal policy on GDP for this year to be between one quarter to one half percentage point.”

German economy ministry: Less dynamic, but still upward trend

German Economy Ministry said in the April Economic Report today that the economy continues to show a “mixed picture”. Service and construction are “expanding strongly”. However, “global oriented manufacturing is still in a weak phase”.

The reported note that both global industrial production and world trade were on the decline at the end of 2018. And this “continued in January 2019 in industrial production. Trade had a “slightly recovery” but remained below last year’s level.

PMI was at lowest since June 106 while Ifo reflected a “gloomier mood”. And, “in light of the indicators and the accumulation of global risks, international organizations are predicting a less dynamic, but still upward, global trend.”

Also, “industrial economy is likely to remain subdued in the face of declining foreign demand and high international risks.”

Japan-US trade talks to start next week for exchanging views

Japan Economy Minister Toshimitsu Motegi announced today that the first round of Japan-US trade talks will start next week on April 15-16 in Washington. He said he’d intend to exchange view frankly with US Trade Representative Robert Lighthizer. It’s believed that a core topic is Japan’s near USD 70B trade surplus, with nearly two-thirds from auto exports.

Finance Minister Taro Aso reiterated Japan’s intention to “further expand trade and investment between” between the two countries, in a “mutually beneficial manner”. He also pointed to the joint statement made last September. However, Japan has been very clear on its intention to defend the multilateral trade pact TPP that it leads, and US quitted under Trump. Hence, no matter what Japan is going to offer to the US, they won’t be something better than what’s offered to TPP partners.

IMF Gopinath: Auto tariffs could be more damaging to US-China trade war

IMF chief economist Gita Gopinath warned that auto tariffs could be more damaging to the world economy than US-China trade war. She said on the sidelines of IMF and World Bank annual meeting, “we are concerned about what auto tariffs would do to the global economy at a time when we are more in the recovery phase.”

Trade conflicts of the US and others, including China, EU, Canada and Japan could spill over into the auto sector. And that could have severe damage to the global manufacturing supply chains, She warned, “that would actually be far more costly for the world economy than just the U.S.-China trade tensions that we had.”

In the US, the Commerce Department has already submitted Section 232 national security report on auto imports earlier this year. Trump will have until May 17 to decide whether he wants to extend punitive tariffs from steal to auto, and from rival in China to allies in EU, Canada and Japan.

EUR/USD Mid-Day Outlook

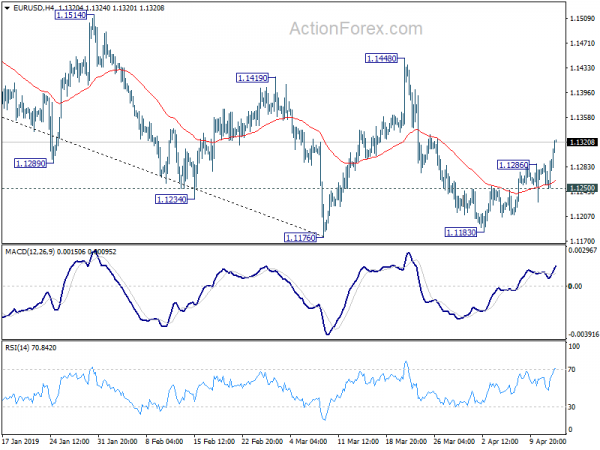

Daily Pivots: (S1) 1.1241; (P) 1.1264; (R1) 1.1278; More…..

EUR/USD’s rise from 1.1183 short term bottom extends to as high as 1.1324 so far today. Intraday bias remains on the upside for 1.1448 resistance, and above. For now, we’d expect strong resistance between 1.1448/1569 to limit upside. On the downside, below 1.1250 minor support will turn bias to the downside. Decisive break of 1.1176 will resume the down trend from 1.2555.

In the bigger picture, medium term weakness was revived as the weak rebound from 1.1176 was rejected well below 55 week EMA and failed to sustain above 55 day EMA. Focus is back on 1.1176 low, with 61.8% retracement of 1.0339 (2016 low) to 1.2555 (2018 high) at 1.1186. Decisive break there will resume whole down trend from 1.2555. Such decline target 1.0339 low next. On the upside, firm break of 1.1569 resistance is needed to be the first sign of medium term bottoming. Otherwise, downside breakout will be in favor.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | BusinessNZ Manufacturing PMI Mar | 51.9 | 53.7 | ||

| 01:30 | AUD | RBA Financial Stability Review | ||||

| 06:50 | CNY | Trade Balance (USD) Mar | 32.6B | 8.1B | 4.1B | |

| 06:50 | CNY | Exports Y/Y Mar | 14.20% | 7.70% | -20.70% | |

| 06:50 | CNY | Imports Y/Y Mar | -7.60% | -0.10% | -5.20% | |

| 06:50 | CNY | Trade Balance CNY Mar | 221B | 2B | 34B | |

| 06:50 | CNY | Exports Y/Y CNY Mar | 21.30% | 5.80% | -16.60% | |

| 06:50 | CNY | Imports Y/Y CNY Mar | -1.80% | 1.00% | -0.30% | |

| 09:00 | EUR | Eurozone Industrial Production M/M Feb | -0.20% | -0.60% | 1.40% | 1.90% |

| 12:30 | USD | Import Price Index M/M Mar | 0.60% | 0.40% | 0.60% | 1.00% |

| 14:00 | USD | U. of Mich. Sentiment Apr P | 98.3 | 98.4 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals