Dollar strengthens mildly in early US session as supported by strong personal spending growth in March. Though, upside is capped by steadily cooling core inflation. For now, today’s set of data is not decisive enough to trigger a breakout in the greenback yet. Dollar would likely engage in more consolidative trading, awaiting FOMC, ISM indices and NFP later in the day.

Staying in the currency markets, Australian and New Zealand Dollars are the strongest one for today so far. Both are just digesting some of recent losses. There is little chance of bullish reversal yet as inflation data from both countries pointed to rate cuts down the road. Yen is the weakest one for today, followed by Swiss Franc as risk sentiments are steady globally, while German 10-year yield recovers.

In Europe, currently, FTSE is up 0.23%. DAX is flat. CAC is up 0.05%. German 10-year yield is up 0.0265 at 0.008, turned positive. Earlier in Asia, Hong Kong HSI rose 0.97%. China Shanghai SSE dropped -0.77%. Singapore Strait Times rose 1.49%. Japan started 10-day holiday today.

Strong US personal spending supports Dollar, core inflation cools steadily

In March, US personal income rose 0.1% mom, or USD 11.4B, much lower than expectations of 0.4% mom. Personal spending rose 0.9%, or USD 123.5B, higher than expectation of 0.7% mom. That’s the strongest growth in nearly a decade. Headline PCE was unchanged at 1.5% yoy while core PCE slowed from 1.7% yoy to 1.6% yoy.

In February, personal income rose 0.2% mom or USD 35.6B. Personal spending rose 0.1% mom or 11.7B. Headline PCE accelerated from 1.4% yoy to 1.6% yoy. Core PCE slowed from 1.8% yoy to 1.7% yoy.

US Mnuchin hopes to finish China trade deal with two more rounds of talks

US Treasury Secretary Steven Mnuchin told Fox Business Network that he hoped to finalize a trade agreement with two more rounds of talks. In particular, he indicated that the issue regarding enforcement is now close to finished. He said, “We hope within the next two rounds, in China and in DC, to get to the point where we can either recommend to the president that we have a deal or recommend that we don’t”. Mnuchin said. “I think there is a strong desire from both sides to see if we can wrap this up or move on.”

Mnuchin and Trade Representative Robert Lighthizer will be in Beijing on Tuesday to start another round of trade talks with China. This week’s meeting will cover issues including intellectual property, forced technology transfer, non-tariff barriers, agriculture, services, purchases, and enforcement. Chinese Vice Premier Liu He will lead a delegation to Washington for additional discussions starting on May 8.

Eurozone economic sentiment dropped for the 10th month to 2+ year low

Eurozone Economic Sentiment Indicator dropped -1.6 to 104.0 in April, missed expectation of 105.0. That’s the 10th consecutive month of decline and the lowest level in more than two years. Amongst the largest Eurozone economies, the ESI rose only in the Netherlands (+0.4), while it decreased in France (-1.0) and Italy (-1.0) and, more significantly so, in Germany (-1.5) and Spain (-2.6). Industrial Confidence dropped to -4.1, down from -1.6 and missed expectation of -2.0%. Services Confidence was unchanged at 11.5, matched expectation. Consumer Confidence was finalized at -7.9.

Business Climate Indicator dropped -0.12 to 0.42, below expectation of 0.49. Managers’ views of the past production, their production expectations, and their assessments of overall order books and the stocks of finished products declined significantly. Meanwhile, there was some relief in the appraisals of export order books.

Also released, Eurozone M3 money supply rose 4.5% yoy in March, above expectation of 4.2% yoy.

USD/CHF Mid-Day Outlook

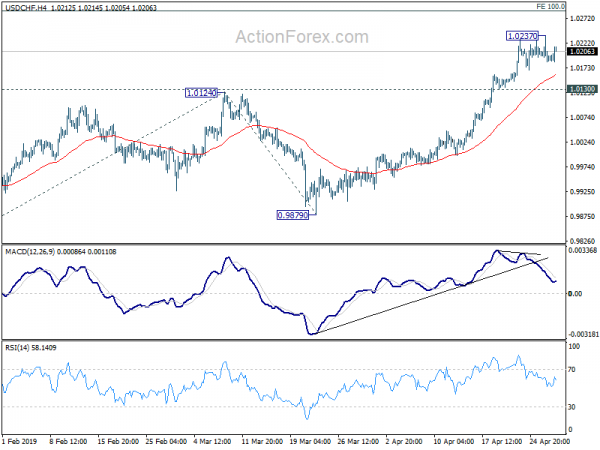

Daily Pivots: (S1) 1.0176; (P) 1.0206; (R1) 1.0229; More…

USD/CHF recovers mildly in early US session but stays below 1.0237 temporary top. Intraday bias remains neutral and more consolidation could be seen. In case of another retreat, downside should be contained by 1.0130 minor support to bring rise resumption. Prior break of 1.0128 resistance confirmed resumption of up trend from 0.9186. On the upside, above 1.0237 will target 100% projection of 0.9716 to 1.0124 from 0.9879 at 1.0287, and then 1.0342 key resistance. However, break of 1.0130 will indicate short term topping and bring deeper retreat first.

In the bigger picture, medium term up trend from 0.9186 is extending. Current rise should target 1.0342 resistance next. For now, we’d be cautious on strong resistance from there to limit upside, until we see medium term upside acceleration. On the downside, break of 0.9879 support is needed to indicate reversal. Otherwise, outlook will stay bullish in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 08:00 | EUR | Eurozone M3 Money Supply Y/Y Mar | 4.50% | 4.20% | 4.30% | |

| 09:00 | EUR | Eurozone Business Climate Indicator Apr | 0.42 | 0.49 | 0.53 | 0.54 |

| 09:00 | EUR | Eurozone Economic Confidence Apr | 104 | 105 | 105.5 | 105.6 |

| 09:00 | EUR | Eurozone Industrial Confidence Apr | -4.1 | -2 | -1.7 | -1.6 |

| 09:00 | EUR | Eurozone Services Confidence Apr | 11.5 | 11.5 | 11.3 | 11.5 |

| 09:00 | EUR | Eurozone Consumer Confidence Apr F | -7.9 | -7.9 | -7.9 | -7.2 |

| 12:30 | USD | Personal Spending Feb | 0.10% | 0.20% | 0.10% | |

| 12:30 | USD | PCE Deflator M/M Feb | 0.10% | 0.00% | -0.10% | |

| 12:30 | USD | PCE Deflator Y/Y Feb | 1.50% | 1.20% | 1.40% | |

| 12:30 | USD | PCE Core M/M Feb | 0.10% | 0.10% | 0.10% | |

| 12:30 | USD | PCE Core Y/Y Feb | 1.70% | 1.70% | 1.80% | |

| 12:30 | USD | Personal Income Mar | 0.10% | 0.40% | 0.20% | |

| 12:30 | USD | Personal Spending Mar | 0.90% | 0.70% | 0.10% | |

| 12:30 | USD | PCE Deflator M/M Mar | 0.20% | 0.10% | ||

| 12:30 | USD | PCE Deflator Y/Y Mar | 1.50% | 1.50% | ||

| 12:30 | USD | PCE Core M/M Mar | 0.00% | 0.10% | ||

| 12:30 | USD | PCE Core Y/Y Mar | 1.60% | 1.70% | 1.70% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals