The week ahead features two key interest rate decisions from the Reserve Banks of Australia and New Zealand, as well top-tier data from the Eurozone, China and the US. Speculators will be hoping that the pickup in volatility will continue next week after what has been a very quiet few months in some major FX markets. Their wishes may certainly come true if we see more surprises in next week’s economic events.

Monday could be a quieter session compared to the volatile conditions market participants witnessed on Friday as a result of the mixed-bag US jobs report. UK markets will be closed due to a bank holiday, which could mean smaller-than-usual ranges for the GBP/USD and other pound crosses. It is going to be a busy first half of the week for the euro and the single currency will be tested on Monday with the release of Eurozone retail sales, Sentix investor confidence and final PMIs. We have noted some improvement in Euro-area data of late, with core CPI inflation jumping to 1.2% on Friday, a six-month high. Let’s see if the momentum continues this week…

Tuesday: More Eurozone data will follow on Tuesday in the form of German factory orders. Investors are watching German data closely after the recent soft patch in macro pointers at the eurozone’s economic powerhouse. If the euro is to head back towards $1.15s again, it will need the support of a strong German economy.

Ahead of German factory orders data on Tuesday, it is likely that the Aussie dollar will have moved sharply in overnight trading in reaction to the interest rate decision from the Reserve Bank of Australia. The RBA has recently opened the door for a rate cut following a soft patch in Aussie data and the AUD has responded by depreciating noticeably. Last week, a very poor inflation report from Down Under hit the Aussie hard, with headline CPI remaining flat quarter-over-quarter and disappointing a rise of 0.2% expected. With building permits also slumping more than 15% this week, a growing number of analysts expect the RBA to trim benchmark interest rates to 1.25% from 1.50% at the moment.

The Reserve Bank of New Zealand is meeting on Wednesday but it is not clear whether it will cut interest rates at this meeting, although it could surprise given that the RBA is likely to trim its own interest rates the day before in order to prevent the NZD/AUD appreciating sharply. New Zealand data has also deteriorated in recent months, with quarterly employment data this week showing a surprise drop of 0.2% quarter-over-quarter when expectations were pointing to a 0.5% increase. Like the RBA, the RBNZ has also prepared the markets for a potential rate cut over the past couple of months.

Wednesday: China will also be in focus on Wednesday with the release of the latest trade figures. The world’s second largest economy has been in the spotlight due to its ongoing trade dispute with the US and investors have been quick to blame any weakness in data on that. Undoubtedly, any surprise improvement in trade figures will help underpin risk-sensitive assets. Meanwhile Chinese CPI will be published a day later on Thursday.

Global growth will remain a key talking point when the European session gets underway on Wednesday, as Germany’s latest industrial production data is published. A day earlier, we will have had German factory orders. So by Wednesday, we should have a better understanding about the health of some of the world’s largest economies.

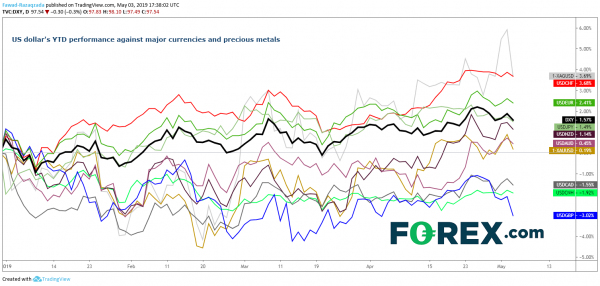

Friday will also be another busy day for data after a quiet-ish Thursday. We will have the first quarter UK GDP estimate, as well as construction and industrial data. The pound, which has outperformed her major rivals so far this year, could gain further ground should the latest economic pointers beat expectations. Meanwhile, Canada’s monthly employment report and U.S. consumer inflation data will be released during the North American session, meaning it will be a particularly busy day for the USD/CAD. With Friday’s US employment report showing decent jobs figures but slightly weaker wages growth, it will be interesting to see the latest inflation reading and what this might mean for interest rates outlook. A weak CPI print could seriously dent the dollar’s rally.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals