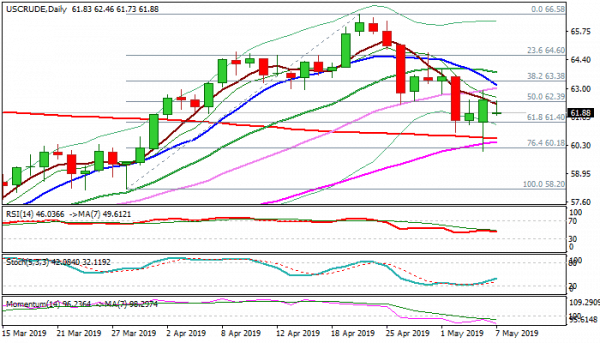

WTI oil holds in narrow range directionless mode on Tuesday, following Monday’s strong rejection at converged 200/55SMA’s ($60.64/49) and repeated failures to close below cracked Fibo pivot at $61.40 (61.8% of $58.20/$66.58 upleg).

This indicates that bears face strong headwinds, but factors that strongly influence near-term price action are mixed and lack direction signal.

Renewed trade tensions between US and China pressure oil price, as traders fear that escalation of conflict would affect global demand, while sanctions on Iran and Venezuela threaten of shortage in oil market and support the price.

Daily techs are also mixed as positive impact from rising bearish momentum and daily MA’s (10/20/30) in bearish setup is offset by reversed stochastic and support from converging 200/55SMA’s.

Initial bearish signal can be expected on eventual close below $61.40 Fibo support, with confirmation on sustained break below 200SMA.

At the upside, converging 30/10 SMA’s ($63.05/21) mark initial resistances, followed by 20SMA ($63.78), sustained break of which would generate reversal signal and shift near-term focus higher.

API weekly crude stocks report is due later today and can provide fresh signals, along with Wednesday’s release of US EIA crude inventories report.

Res: 62.46, 63.04, 63.38, 63.78

Sup: 61.73, 61.40, 60.64, 60.03

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals