Types of Algorithm Trading Strategies in FX Talking Points:

- The rise of algorithms in FX

- Execution algorithm and high-frequency trading dominate the market

- The difference between high-frequency trading and execution algorithm

When looking at algorithmic trading, we can see that it has become more and more popular because of its speed and ability to minimize risk. It accounts for a large portion of trades, which is why it is important for traders to understand the different trading strategies.

What Is the Purpose for Algorithm Trading Strategies?

Since algorithm trading is based on a rule-based process, it has the ability to avoid human behavioral biases that can otherwise create large risks and losses. However, to successfully use this method, rules need to be pre-decided, and there is absolutely no place for subjectivity hence, why it is referred to as a rule-based process.

What Are the Main Types of Algorithms Trading Strategies Used?

Two types of popular algorithms are execution and high-frequency focused algorithms. An execution algorithm focuses on minimizing the market impact and fair price. The second is high-frequency trading, which focuses on profits by consistently looking for patterns.

How Does Execution Algorithms Work?

Execution algorithms look to break down large orders to avoid sending out a signal to other market participants. The main strategies used are the following:

- Volume weighted average price (VWAP)

- Implementation Shortfall

- Market Participation Algorithm

Each strategy has a different approach. The VWAP calculates the volume of trades at different points throughout the day by multiplying the price by the size of the trade and dividing it by the total volume. The purpose is to see whether the price paid to trade was favorable and by doing so, it needs to be compared to the VWAP. If the trading price was higher than the VWAP, then the trader received an unfavorable price and if the price was below the VWAP, then the price was favorable.

When looking at VWAP, it works best for small trades and in nontrending markets. The reason for this is because VWAP is calculated by averaging the volume of trades and if a firm were to place a large trade, they may account for the majority of the volume traded that day. This will result in their average price to equal to the VWAP, which can make the firm look like the price they paid was reasonable whereas it may have been fairly high.

The implementation shortfall may be best used to minimize opportunity cost since trading is done at the beginning of the trading period. Another benefit is being able to see the break down of different components that allow you to see how much your idea would cost.

Unfortunately, this method is not very common since many traders are not familiar with this strategy and more data is needed in comparison to the other strategies. However, one major benefit to this strategy is that there is less chance for gaming. Whereas with VWAP, traders can use the current price to estimate the VWAP. By doing so, traders can choose to either trade now or to wait until the next day so that they may appear like they performed better than the VWAP.

The last strategy, market participation algorithm, focuses on fraction of volume. For instance, if the participation rate is 5%, whatever number of shares is being traded, the firm will participate in 5% of the total volume to reduce market impact and transaction cost.

How Does High-Frequency Trading Work?

Although algorithm for execution focuses on how to trade to avoid market impact, high frequency trading algorithm focuses on how, when and what to trade in order to come up with strategies to exploit opportunities and to consistently outperform competitors.

High-frequency trading accounts for a large portion of trades in the market. Other than HFT being computer based and extremely fast, it also trades with small spreads because of its ability to create liquidity, which is one of the reasons why it has gained such popularity.

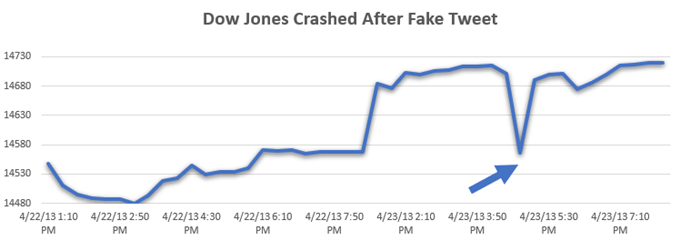

High-frequency trading is programmed to incorporate fundamental analysis in its decision making. This is done by reading millions of webpages at the same time. However, it can be influenced by algorithm predators. For instance, on April 23, 2013,Associated Press’ Twitter account was hacked. The hacker sent a tweet saying that there were two explosions at the White House and President Barack Obama was injured. This triggered a trading signal and resulted in a crash. Although the crash was brief and recovered after AP addressed the tweet, it still illustrates how the misuse of information can make the algorithm act up.

Source: Bloomberg

Although using algorithms provide many benefits, it is important to remember that it is still computerized and it’s not 100% correct since it cannot incorporate all scenarios. It is subject to errors and due to its speed, it is difficult to detect and correct these errors, which is why traders are still needed.

Helpful Resources:

What I Learned Managing an Algo Fund – DailyFX

My Perilous Path to Algo Trading – DailyFX

DailyFX Podcast:

How Quant Skills Can Help the Non-Quant Trader With Mathew Verdouw, Optuma CEO

It’s a Quants World

Written by—Nancy Pakbaz, CFA

Follow Nancy on Twitter @NancyPakbazFX

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals