Wednesday May 15: Five things the markets are talking about

Global stocks are struggling to maintain Tuesdays gains as U.S futures have pared some of their earlier overnight advances, while Euro stocks have edged lower. In Asia, China led equity gains overnight despite weaker data (industrial production, retail sales) on investor bets that authorities would increase stimulus.

The ‘big’ dollar continues to tick higher but remains confined to another tight range, while sovereign bond yields trade atop of their two-month lows on the breakdown of Sino-U.S trade negotiations. Nevertheless, financial markets remain on edge as the White House announced it was preparing tariffs on the remaining +$300B of Chinese imports.

Elsewhere, in commodities, oil has pared some of its recent gains on reports that growth in U.S crude stocks is easing market concerns over tighter supplies worries after a drone attack in Saudi Arabia had highlighted the defencelessness of the country’s energy infrastructure.

Heightened intraday volatility is expected at least until Trump meets his counterpart, Xi Jinping, at next month’s G-20 summit.

On tap: Canadian CPI and U.S retails sales are due out at 08:30 am EDT. Down-under, Aussie unemployment numbers are due later this evening.

1. Stocks, a mixed bag

In Japan, the Nikkei ended higher overnight in another whippy session, breaking a seven-day losing streak, on market hopes that China would introduce fresh stimulus to support a slowing economy. The Nikkei share average ended +0.6% higher, while the broader Topix, which hit a four-month low on Tuesday, rallied +0.6%.

Note: Data overnight showed that China retail sales slumped to the lowest since 2003 in April. Sales grew +7.2% y/y, missing forecasts of an +8.6% gain, and a marked slowdown from March’s +8.7%. Also, Industrial production rose just +5.4% y/y after March’s spurt to +8.5%.

Down-under, Aussie shares rebounded overnight on expectations that RBA interest rates may be cut while a fall in the AUD boosted miners. Expectations of a rate cut increased after domestic wage growth stalled in Q1. The S&P/ASX 200 index rose +0.7% at the close of trade. The benchmark fell -0.9% on Tuesday. In S. Korea, the Kospi gained +0.6%.

In China, stock benchmarks rebounded roughly +2%, lifted by consumer shares, as weak industrial output and retail sales data reinforced expectations of fresh stimulus, while a slight softening in rhetoric from Trump also helped to ease trade tensions. China’s blue-chip CSI300 index rose +2.3%, while the Shanghai Composite Index gained +1.9%. In Hong Kong, the Hang Seng index ended up +0.5%, while the China Enterprises Index gained +0.4%.

In Europe, regional bourses trade mainly lower across the board erasing initial gains after some risk-aversion flows coming in U.S futures following China’s Foreign Ministry comments on trade tensions.

U.S stocks are set to open in the ‘black’ (+0.0%).

Indices: Stoxx600 -0.10% at 375.98, FTSE +0.30% at 7,263.30, DAX -0.16% at 11,972.48, CAC-40 -0.35% at 5,322.88, IBEX-35 -0.20% at 9,109.19, FTSE MIB -0.69% at 20,748.50, SMI -0.05% at 9,399.00, S&P 500 Futures -0.01%

2. Oil prices fall as U.S stockpiles rise, but ME tensions support pullbacks

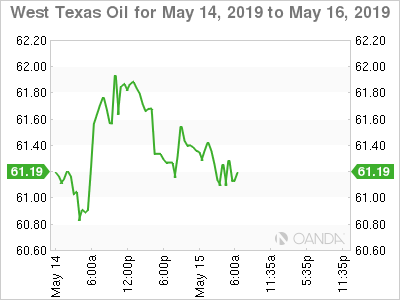

Oil prices are under pressure after U.S data showed a surprise rise in crude stockpiles and as Chinese industrial output grew less than expected in April. However, deeper pullbacks are well supported by ongoing tensions in the Middle East.

Brent crude futures are at +$71.06 a barrel, down -18c, or -0.3%, from Tuesday’s close. Brent ended +1.4% higher in yesterday’s session. U.S West Texas Intermediate (WTI) crude futures are at +$61.33 per barrel, down -45c, or -0.7%. WTI closed up +1.2% in the previous session.

Data from the API yesterday showed that U.S crude stockpiles unexpectedly rose last week, while gasoline and distillate inventories increased. Crude inventories climbed by +8.6M barrels in the week to May 10 to +477.8M, compared with analyst expectations for a decrease of -800K barrels.

Note: Crude stocks at the Cushing, Oklahoma, delivery hub rose by +2.1M barrels.

Expect dealers to take direction from today’s U.S Energy Department’s EIA report (10:30 EDT).

Oil prices have found support on deeper pullbacks after Saudi Arabia indicated yesterday that armed drones struck two of its oil pumping stations, two days after the sabotage of oil tankers near the UAE. The U.S remains on alert of “possibly imminent threats to U.S forces in Iraq” from Iran-backed forces.

Ahead of the U.S open, gold prices have steadied, retreated from their four-week high print Tuesday on investor optimism surrounding Sino-U.S trade. Spot gold is steady at +$1,296.49 an ounce, while U.S gold futures have edged +0.1% higher to +$1,297.20 an ounce.

3. German Bund Yield Slips to three-year lows

Germany’s 10-year Bund yield has fallen to its lowest level since October 2016 as a combination of weak Chinese data, Sino-U.S trade tensions, and anti-austerity rhetoric from the Italian government is supporting a safe-haven bid in bonds. Germany’s 10-year yield was last down -2.5 BPS to -0.098%.

Unlike Italian government bond yields, which have surged again this morning as anti-austerity movements gain in Southern Europe, stoking concerns about high spending. Yesterday, deputy Prime Minister Matteo Salvini said that Rome was ready to break EU fiscal rules. Two-year BTP yields jumped nearly +8 bps to +0.8%, the highest since December 2018.

Elsewhere, the yield on U.S 10-year Treasuries fell -1 bps to +2.40%, the lowest in almost seven weeks, while in the U.K, the 10-year Gilt yield has dipped -3 bps to +1.078%, the lowest in six weeks.

4. Dollar stuck in a contained vortex

Markets risk-off demise has eased a tad this morning with the ‘big’ dollar index trading a tad higher than the previous three-sessions.

EUR/USD (€1.1206) with an inline preliminary German GDP number (see below), the single unit continues to trade in its range of €1.12 to €1.126 while the Bund yield continues to be negative and trades atop of its three-year low yield.

GBP/USD (£1.2911) remains in a downward spiral as talks on Brexit continue at a slow pace. Parliament has set the date to vote on the Brexit bill during the first week of June.

USD/CAD (C$1.3473) with Canadian CPI due out today (08:30 am EDT), the CAD continues its sideways trading between C$1.34 and C$1.35 and this despite last Friday’s “unbelievable” Canadian employment numbers.

Turkey has raised to +0.1% from zero a tax on some foreign exchange sales, marking the country’s latest policy change to discourage a months-long trend of Turks selling the beleaguered TRY for more stable USD and EUR. The move comes after intervention by state banks that have spent billions of dollars in foreign markets to support the lira. TRY has weakened to $6.0670 outright, on market worries of possible U.S sanctions over a Turkish plan to buy a Russian S-400 missile defence system.

5. German Economy Rebounds

Data this morning showed that the German economy rebounded in Q1 after narrowly avoiding recession in Q4, 2018.

Europe’s largest economy expanded +0.4% in Q1, driven by robust private consumption and domestic construction according to the national statistics agency Destatis.

German business executives remain cautious, however, suggesting that any recovery could be short-lived. German exports faces renewed headwinds from Sino-U.S trade tensions and ongoing uncertainty around the U.K’s Brexit departure from the EU.

Note: In the crucial auto sector, Continental AG, Daimler AG, Volkswagen AG and BMW AG all posted sharply lower Q1 earnings.

The latest escalation of the U.S-China trade battle “has created a fresh downturn in sentiment among German engineering companies.”

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals