U.S. Highlights

- Equity markets rebounded this week as the U.S. administration delayed its decision on auto tariffs for six months.

- Housing starts and retail sales data for April support the narrative of healthy domestic spending this quarter.

- That said, externally oriented industries appear to be getting caught in the downdraft of weak foreign demand. Formerly resilient, U.S. manufacturing activity has softened this year, in line with global developments.

Canadian Highlights

- Canada’s housing market showed further signs of stabilization in April with home sales rising 3.6%. Still, the market is highly fragmented between east and west. Activity is weak and relatively oversupplied in markets west of Ontario, but strong and relatively tight in Ontario and eastward.

- The Bank of Canada released its annual Financial System Review this week outlining its assessment of vulnerabilities to financial stability. Little surprise, the level of household debt topped the list. However, with slowing credit growth and tighter mortgage lending conditions this vulnerability was characterized as moderating relative to previous years.

- Inflation ticked up to 2.0% in April as energy prices advanced. Core inflation measures, on the other hand, ticked down, and on average are running just below the Bank of Canada’s target.

U.S. equity markets managed to shrug off much of last week’s losses after rumors earlier this week, confirmed by the White House this morning, that the U.S. administration would delay a decision on auto tariffs for six months. However, this somewhat-renewed sense of optimism in equities was not shared by the bond market. U.S. Treasury yields hit lows last seen in late 2017, just prior to fiscal stimulus being announced. Moreover, markets are raising their bets that the Fed’s next move will likely be a rate cut rather than a rate hike.

Unease about U.S. economic performance is building for good reason. Economic growth is set to moderate this year after a blowout, stimulus-fueled 2018. Foreign demand remains weaker than last year, while geopolitical risks and trade policy uncertainty appear to be on the rise. Moreover, high frequency indicators are beginning to diverge. Domestic demand remains resilient, but externally oriented industries are combatting stronger headwinds.

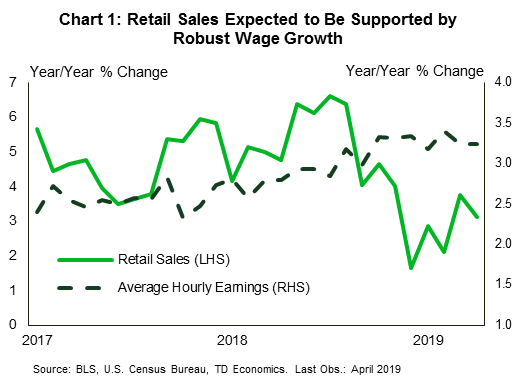

Data for retail sales and housing starts for April support the view that the domestic economy remains healthy. Although retail sales pulled back in April, this came after a very strong March. Some payback was to be expected. Even with the decline, the strength in March, alongside continued income gains supports a very healthy 3% quarterly annualized rate of expansion in consumer spending in the second quarter (Chart 1).

Housing starts, on the other hand, surprised to the upside. After December’s dip, housing starts appear to have regained stronger footing, but activity has been choppy through April. Home builder sentiment is improving as well, reaching a 7-month high in May. Moderating home price growth, combined with lower mortgage rates, rising wage growth, and decades-low vacancy rates should support more homebuilding in the months to come.

All told, the data this week remains consistent with our forecast for the U.S. economy to expand at a 2% annualized pace this quarter, largely on the back of a more confident consumer. That said, signs continue to build that this may be as good as things get for the rest of this year. Cracks are beginning to appear in what was previously a very resilient manufacturing sector. Industrial production contracted 0.5% in April, the third contraction monthly contraction this year. This mirrors the declining pace of output reported in the ISM manufacturing survey (Chart 2). Softer auto sales are partly to blame, as motor vehicle assemblies have fallen 12.8% since December’s peak.

Although manufacturing is a relatively small share of the U.S. economy (about 11%), its performance is still considered a harbinger of the direction of the U.S. economy largely due to its sensitivity to changes in foreign demand. On that front, there are some signs that the global economy is gradually improving. However, escalating trade and geopolitical risks threaten to derail this nascent recovery.

Global equity markets had a raucous week as China announced countermeasures in response to increased U.S. tariffs. Canada was pulled along for the ride, but despite declines early in the week it looks to have managed to scrape by with a modest gain as the week came to a close.

In terms of economic data, the key release this week was data on home sales, new listings and prices. Signs of a stabilization in housing demand continued in April. Canadian home sales rose 3.6%, accelerating from an upwardly-revised 2.3% reading in March. Sales were up across most provinces, with only Manitoba seeing a pullback.

The Canadian housing story remains one of stark divergence between markets in Western Canada and those in the east. There are two sub-threads here. First, weakness in energy-producing provinces is not confined to housing. Fortunately, major markets in Saskatchewan and Alberta saw solid sales gains in home sales in April, evidence perhaps of underlying economic improvement that has also been echoed in recent jobs reports. Still, these markets remain over-supplied with sales to new listings ratios generally in buyers’ market territory (Chart 1).

In Vancouver, the story is not about economic weakness. The B.C. economy has been one of Canada’s fastest growing, and seemingly immune to the slowdown in this important sector. Instead, the cumulative impact of higher mortgage rates, measures to stem foreign demand at the provincial level, and tighter mortgage lending standards at the national level have combined to pull the chair out from under home sales. In April, sales in Greater Vancouver hit a new cycle low. The sales to new listings ratio is deep in buyer’s market territory, suggesting yet further price declines on the horizon.

In Central and Eastern Canada the story is one of either stability following past adjustments, or of outright strength. Sales were up again in the Greater Toronto Area in April, raising the sales to new listings ratio further into balanced market territory. In markets in the province’s east, such as Ottawa, sales are close to record highs and well into seller’s market territory, contributing to healthy price gains. The same is true in Quebec, where both sales and prices are up and with tight markets look to remain so.

The performance of the housing market is of central concern to the Bank of Canada, which noted these divergences in its Financial System Review (FSR) released this week. Overall, the Bank judges imbalances in housing markets to have moderated, but remain a source of vulnerability.

The Bank’s number one vulnerability is the intrinsically related one of elevated household debt. This risk too is seen as moderating, reflecting a slowdown in household credit growth and reduction in the share of new mortgage debt going to highly-indebted households (Chart 2). Still, given its potential to exacerbate an economic downturn, this is one the Bank of Canada will watch closely.

Canadian Retail Sales – March

Release Date: May 22, 2019

Previous: 0.8%, ex-auto: 0.6%

TD Forecast: 1.4%, ex-auto: 1.3%

Consensus: 1.2%, ex-auto: 1.0%

TD looks for retail sales to build on recent gains with a 1.4% advance in March, reflecting broad strength in household goods consumption. Gasoline stations and motor vehicle sales should lead the move, with the former benefitting from a 10% m/m increase in the price at the pump. This will allow the ex-autos measure to come in near the headline print at 1.3%, although sales should see more modest gains (0.8%) when excluding gasoline as well. Core retail sales rose by 0.4% in February for their first increase since September and we expect this performance to continue into March on the heels of a sharp increase in consumer goods imports and strong labour market data. Real retail sales should underperform the headline print owing to the sharp increase in gasoline prices although we still expect to see an increase of roughly 0.8% m/m. This is consistent with a flat print on Q1 after soft data in January and February, although stronger retail volumes will provide a solid handoff to Q2.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals