Australian Dollar continues to be the spotlight of the week. It’s knocked down by RBA Governor’s comment that they’s going to consider cutting interest rates in June meeting. It’s actually slightly earlier than market expectations of an August cut. The selloff is more than enough to reverse post election gains Aussie. New Zealand Dollar is following as the second weakest for today.

Risk markets are steady today despite weakness in US stocks overnight, in particular NASDAQ. US announced temporary measures to ease sanctions on China’s Huawei. But there was little optimism among Asian investors. Though, risk aversion is not apparent with Yen and Swiss Franc mixed. For now, Canadian Dollar and US Dollar are the strongest ones for today so far.

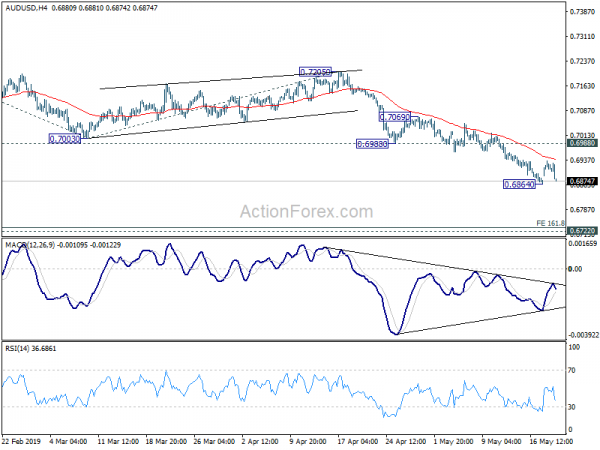

Technically, 0.6864 temporary low in AUD/USD is back in focus immediately. Break will resume recent fall from 0.7295 towards 0.6722 low. Similarly, EUR/AUD is looking at 1.6262 temporary top for resuming recent rally. Yen crosses are still staying in consolidation. For now, recoveries in EUR/JPY and GBP/JPY are notably weaker than USD/JPY’s. Sterling is losing some downside momentum against Dollar and Euro. But there is no sign of bottoming in the Pound yet.

In Asia, currently, Nikkei is down -0.17%. Hong Kong HSI is up 0.15%. China Shanghai SSE is up 1.48%, back above 2900 handle. Singapore Strait Times is down -0.41%. Japan 10-year JGB yield is down -0.0013 at -0.049. Overnight, DOW dropped -0.33%. S&P 500 dropped -0.67%. NASDAQ dropped -1.46%. 10-year yield rose 0.023 to 2.416, closed above 2.4 handle but remains vulnerable.

RBA to consider cutting interest rate at June meeting

In a speech delivered today, RBA Governor Philip Lowe said the central bank will consider the case for cutting interests in the upcoming meeting in two weeks’ time n June. After weak inflation reading and surge in unemployment rate in Q1, RBA might pull ahead the anticipated rate cut(s) for the second half.

Lowe said “accumulating evidence is that the Australian economy can support an unemployment rate of below 5 per cent without raising inflation concerns”. Such judgement is also “consistent with the experience overseas”. Meanwhile, recent flow of data suggests it’s “less likely” that “current policy settings are sufficient to deliver lower unemployment.”

There are few options ahead to lower unemployment rate. These include further monetary easing, additional fiscal support and structure policy changes. But he emphasized “relying on just one type of policy has limitations, so each of these is worth thinking about.”

Lowe concluded the speech noting: “A lower cash rate would support employment growth and bring forward the time when inflation is consistent with the target. Given this assessment, at our meeting in two weeks’ time, we will consider the case for lower interest rates.”

Some readings on RBA minutes released today too:

US grants housekeeping temporary exemptions on restrictions on Huawei

The US Commerce Department announced limited exemptions on products of Chinese telecom giant Huawei. The move is seen as for keeping the house in order, so as to prevent internet, computer and cell phone systems from crashing

Under the move, Huawei and its 68 non-US affiliates will be granted 90 days temporary general license to have limited engagement in transactions involving the export, reexport, and transfer of items.

With the arrangement, “this license will allow operations to continue for existing Huawei mobile phone users and rural broadband networks”. The Commerce Department said it will evaluate whether to extend the exemptions beyond 90 days.

Fed Powell: Another sharp increase in business debt could increase vulnerabilities appreciably

In a speech delivered yesterday, Fed Chair Jerome Powell said that “business debt has clearly reached a level that should give businesses and investors reason to pause and reflect.” He pointed to corporate borrowing which hit record level of 35% of assets. And, he warned “another sharp increase…could increase vulnerabilities appreciably”.

Though, Powell also emphasized the debt problem is not at the level of systemic threat as the sub-prime mortgage markets. “As of now business debt does not present the kind of elevated risks to the stability of the financial system that would lead to broad harm,” he said.

Responding to some questions, Powell said “today’s inflation dynamics are very different from even 25 years ago. Globalization and technology may be playing a role”. Also, it was premature to make a judgement about the impact trade and tariff issues could have on monetary policy.

Fed Bullard: If low inflation persists, will push FOMC more to cut interest rates

In an interview with Handelsblatt published yesterday, St. Louis Fed President James Bullard said t”he wind has completely turned” in Fed’s monetary policy since January. FOMC has approached his view that there should be no more rate hikes for 2019.

Bullard said at this stage of the business cycle, he’d normally expect at least 2% inflation. But core CPI is only 1.6% and “that worries me”. He also noted that “If that persists, I will push the FOMC more to lower interest rates and try to bring inflation expectations down to two percent.”

Regarding the impact of trade war with China on the economy, Bullard said “that depends on how long they last”. “To really hurt the US, the dispute would have to continue for some time,” he added. He also noted the worry is “even bigger” in Asia or Europe. US has “such a large and diversified economy” and hence, the impact as a whole is “relatively small”.

Fed Bostic: Lack of hitting inflation target not a material failure

Regarding market pricing of Fed’s rate cut, Atlanta Fed President Raphael Bostic told CNBC that “the market is ahead of where I am”. And, “I would say I’m not expecting a rate cut to be imminent, certainly not by September. Things would need to happen in order for that to play out.”

On inflation, Bostic noted “in general, my view is as long as we don’t see inflation running away, that would the sign that our policy is basically at a neutral level”., And, “we could sustain that for a long time and we don’t have to move.”

On the other hand, Bostic was also unconcerned with downward inflation pressure. He said “I’m not super-concerned about that today, and mainly it’s because when you look at inflation expectations, they haven’t started to trail away in a significant way away from our target”.

Nevertheless, he added, “if I started to see a trend moving away to one and a half or one and a quarter [percent] for inflation expectations, then I’d be concerned. But right now, I don’t see our lack of hitting that target … as being a material failure.”

UK Hammond: Real risk of new PM seeking damaging no-deal Brexit

According to pre-released extract of a speech on Tuesday, UK Chancellor of Exchequer Philip Hammond is set to criticize that advocating for “no deal” Brexit is to “hijack” the result of the Brexit referendum held nearly three years ago.

Hammond will said there are some “on the populist right” who claim that only leaving without a deal is a “truly legitimate Brexit”. However, “the 2016 Leave campaign was clear that we would leave with a deal”. Thus, “to advocate for ‘no deal’ is to hijack the result of the referendum, and in doing so, knowingly to inflict damage on our economy and our living standards. Because all the preparation in the world will not avoid the consequences of no deal.”

Hammond will also warned that “there is a real risk of a new Prime Minister abandoning the search for a deal, and shifting towards seeking a damaging no-deal exit as a matter of policy … in order to protect an ideological position which ignores the reality of Britain’s economic interests and the value of our Union.”

World Trade Outlook Indicator stays at nine-year low, significant risks on the downside

World Trade Outlook Indicator (WTOI) is unchanged at 96.3 in May, same as February’s reading, which was the lowest level since 2010. The indicator suggests that world trade growth is likely to remain weak into Q2. Also, recent major trade measures announced were not included in the the calculations yet. Thus, outlook would worsen further ahead if heightened trade tensions are not resolved or if macroeconomic policy fails to adjust to changing circumstances.

WTO also recapped that in the April forecasts, global merchandise trade growth would slowed to 2.6% in 2019, down from 3.0% in 2018. Though, rebound is expected to 3.0% in 2020. However, “there are significant downside risks to the 2019 forecast. Any rebound in 2020 would depend on reduced trade tensions and/or improved macroeconomic performance. ”

Looking ahead

BoE’s inflation report hearing will be a focus in European session today. Eurozone will release consumer confidence. US will release existing home sales.

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.6886; (P) 0.6911; (R1) 0.6931; More…

AUD/USD’s recovery was limited below 4 hour 55 EMA and drops notably today. But it’s staying above 0.6864 temporary low and intraday bias remains neutral first. In case of another recovery, upside should be limited by 0.6988/7069 resistance zone to bring fall resumption. On the downside, break of 0.6864 will turn bias to the downside and extend the fall from 0.7295 to 161.8% projection of 0.7295 to 0.7003 from 0.7205 at 0.6733, which is close to 0.6722 low.

In the bigger picture, with 0.7393 key resistance intact, medium term outlook remains bearish. The decline from 0.8135 (2018 high) is seen as resuming long term down trend from 1.1079 (2011 high). Decisive break of 0.6826 (2016 low) will confirm this bearish view and resume the down trend to 0.6008 (2008 low). However, firm break of 0.7393 will argue that fall from 0.8135 has completed. And corrective pattern from 0.6826 has started the third leg, targeting 0.8135 again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | RBA Minutes May | ||||

| 08:30 | GBP | BoE Inflation Report Hearings | ||||

| 10:00 | GBP | CBI Trends Total Orders May | -5 | -5 | ||

| 14:00 | EUR | Eurozone Consumer Confidence May A | -7.7 | -7.9 | ||

| 14:00 | USD | Existing Home Sales Apr | 5.35M | 5.21M |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals