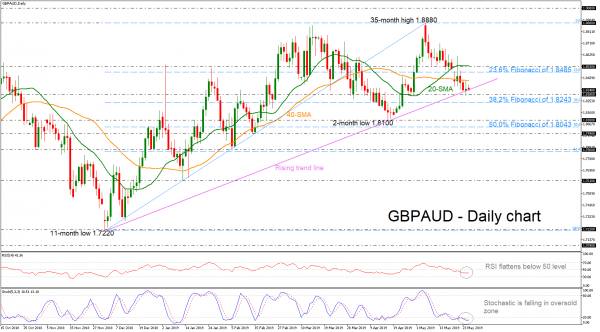

GBPAUD has touched the ascending trend line, which has been holding since December 2018, trading below the flat short-term moving averages. The RSI is moving sideways below the neutral threshold of 50, while the stochastic oscillator is moving in the oversold territory, turning even lower.

If the price slips further below the 1.8305 barrier and the rising trend line, immediate support could be faced from the 38.2% Fibonacci retracement level of the upleg from 1.7220 to 1.8880 near 1.8243. Further declines could flirt with the 1.8100 significant psychological level, shifting the bullish bias to neutral.

On the upside, the price could touch the 23.6% Fibonacci of 1.8485 and the 1.8530 resistance, which overlaps with the 20-day simple moving average (SMA). More advances could open the way for more bullish actions until the 35-month high of 1.8880.

Overall, GBPAUD seems to be in negative correction after the downfall from 1.8880. However, if the price remains below the short-term SMAs and drops beneath the ascending trend line, investors could become more confident on the downside.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals