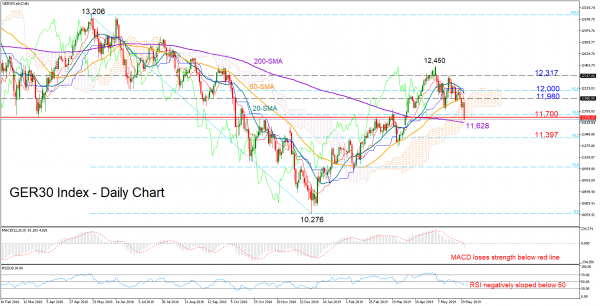

GER30 index dived below a former key support area of 11,700 on Friday, signalling the continuation of the bearish action. The RSI is backing this view as well as the indicator keeps losing ground under its 50 neutral mark, while the MACD is giving extra negative warnings as long as it extending negative momentum below its red signal line.

Traders however could wait for a decisive close below the 200-day simple moving average and the Ichimoku cloud before rapidly increasing selling volumes. Should the market move accordingly, losses could last until the 38.2% Fibonacci of 11,397 of the downleg from 13,206 to 10,276.

On the flip side, a clear breakout of the 11,980-12,000 area, where the 20- and the 50-day SMAs are currently positioned could open the way towards the previous peak of 12,317.

Meanwhile in the medium-term timeframe, the bullish cross between the 50- and the 200-day SMAs suggests that the market trend is likely to hold on the upside.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals