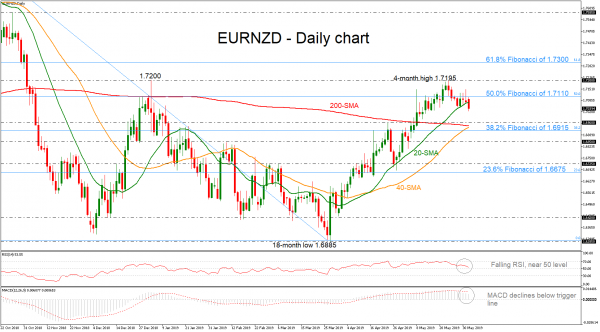

EURNZD is declining below the 20-day simple moving average (SMA) today, confirming the recent bearish structure in the near term. The RSI is moving towards the 50 level, while the MACD is holding below the trigger line but is still hovering above the zero line, increasing speculation for more downside pressure.

In case the pair maintains its short-term direction to the downside after the bounce off the four-month high of 1.7195, the bears will probably challenge the 1.6960 support, which stands near the 200-day SMA and the 40-day SMA. A break lower could find immediate support at the 38.2% Fibonacci of 1.6915.

On the flipside, an advance above the 50.0% Fibonacci retracement level of the downfall from 1.7585 to 1.6885, near 1.7110 could send the market towards the 1.7200 handle. A penetration of this key zone may drive the price towards the 61.8% Fibonacci of 1.7300.

Summarizing, if the price surpasses the four-month high it could turn the focus for more bullish orders until the next resistance, however, it is currently in a negative correction mode.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals