Euro rises broadly today as PMI data showed no further deterioration in sentiments in Eurozone. Underlying growth momentum remained weak, but there were more tentative signs of improvement in Germany and France. Swiss Franc remains firm on Middle East Tension. It’s reported that Trump has given Iran a warning that attack was imminent, even though he emphasized he’s against war. Dollar is also recovering after this week’s dovish Fed selloff. On the other hand, New Zealand Dollar and Sterling are the weakest ones for today so far, followed by Aussie. Canadian Dollar shows little reactions to retail sales miss.

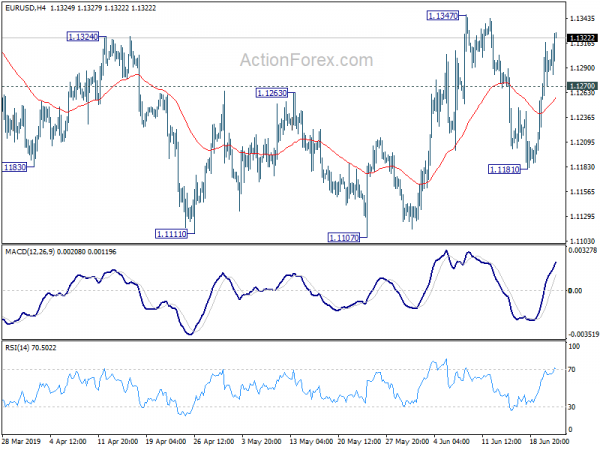

Technically, 1.1347 resistance in EUR/USD is now a focus before weekly close. Break will add to the case of medium term bottoming and target 1.1448 resistance next. EUR/JPY appears to have defended 120.78 support. Break of 121.92 minor resistance will extend the consolidation from 120.78 with another rise to 123.18 resistance. EUR/GBP’s strong rebound also suggests solid support from 0.8871 minor support. This affirms near term underlying momentum for 0.9101 key resistance.

In Europe, currently, FTSE is up 0.04%. DAX is down -0.05%. CAC is down -0.05%. German 10-year yield is up 0.0255 at -0.291, back above -0.3. Earlier in Asia, Nikkei dropped -0.95%. Hong Kong HSI dropped -0.27%. China Shanghai SSE rose 0.50% to 3001.98, back above 3000 handle. Singapore Strait Times rose 0.21%. Japan 10-year JGB yield dropped -0.0038 to -0.169.

Canada retail sales rose 0.1%, ex-auto sales rose 0.1%

In April, Canada retail sales rose 0.1% mom, below expectations of 0.2% mom. Ex-auto sales rose 0.1% mom, also below expectation of 0.4% mom. Looking at some details, sales were up in 7 of 11 subsectors, representing 74% of retail trade. Higher sales at gasoline stations (1.2%) and food and beverage stores (0.4%) were the main contributors to the gain. Geographically, sales Ontario (0.9%) and Alberta (1.6%) continued their upward trend. Retail sales in Quebec (-1.3%) were down for the first time in 2019. In British Columbia, sales decreased -0.5%

Fed Clarida: Case for more monetary accommodation increased

Fed Vice Chair Richard Clarida said in a Bloomberg interview that he saw higher uncertainty in the last six to eight weeks. But he still expects economic expansion to continue. He noted “the economy’s baseline outlook is good” with “sustained growth, a strong labor market and inflation near our objective”.

However, he also acknowledged “there was broad agreement around the table that the case for providing more accommodation has increased”. And, he said Fed has “the tools necessary to sustain expansion, a strong labor market and stable prices, and as appropriate we will deploy those tools to achieve those goals.”

St. Louis Fed President James Bullard dissent in this week’s FOMC decisions to keep interest rate unchanged at 2.25-2.50%. He said today that “inflation measures have declined substantially since the end of last year and are presently running some 40 to 50 basis points below the FOMC’s 2% inflation target”.

Bullard added, “I believe that lowering the target range for the federal funds rate at this time would provide insurance against further declines in expected inflation and a slowing economy subject to elevated downside risks.”

Eurozone PMIs: Overall growth remains subdued, pace restricted by uncertainty and risk aversion

Eurozone PMI Manufacturing rose to 47.8 in June, up from 47.7 but missed expectation of 48.0. It’s also staying well below 50 level. PMI Services rose to 53.4, up from 52.9 and beat expectation of 53.0. It’s the highest level in 7 months. PMI Composite rose to 52.1, up from 51.8, also the highest in 7 months.

Chris Williamson, Chief Business Economist at IHS Markit said: “Overall rate of expansion remains weak, with the survey data indicative of eurozone growth of just over 0.2% in the second quarter.” Also, “growth trends between the core and the periphery have widened” with improvements in Germany and France but “rest of the region is sliding closer towards stagnation.”

He added: “The overall rate of growth consequently remains subdued, and a further deterioration in business confidence about the year ahead suggests the pace of expansion will continue to be restrained by uncertainty and risk aversion. Concerns about weaker economic growth at home and in export markets, rising geopolitical risks and trade wars continue to dominate the picture and dampen business spending, investment and sentiment.”

German PMI Manufacturing rose to 45.4, up from 44.3 and beat expectation of 44.6. But it’s staying well below 50. PMI Services, rose to 55.6, up from 55.4 and beat expectation of 55.3. PMI Composite was unchanged at 52.6. Markit said “there are tentative signs that the worst has passed “. But “longer-term outlook for the German private sector remains weak”

France PMI Manufacturing rose notably to 52.0, up from 50.6 and beat expectation of 50.9. That’s also the highest level in 9 months. PMI Services rose to 53.1, up from 51.5 and beat expectation of 51.6. It’s the highest level in 7 month. PMI Composite rose to 52.9, up from 51.2, a 7-month high. Markit said “taking into account the strong finish to the quarter, PMI data now points to around 0.3% QoQ GDP growth.”

BoE Carney: Gatt 24 only applies if you have a withdrawal agreement with EU

BoE Governor Market Carney emphasized in a BBC interview that in event of no-deal Brexit, tariffs will “automatically” apply with EU. This is in contradiction to Boris Johnson’s claim that UK could use the so called “Gatt 24” rule to trade with EU under current terms. Carney also warned that no-deal, no-transition Brexit should be a choice taken with “absolute clarity”.

Carney explained that “the Gatt rules are clear… Gatt 24 applies if you have a [withdrawal] agreement, not if you’ve decided not to have an agreement, or you have been unable to come to an agreement”. And, “we should be clear that not having an agreement with the European Union would mean that there are tariffs, automatically, because the Europeans have to apply the same rules to us as they apply to everyone else.”

Also, he noted around three quarters of UK businesses have already done as much as they could for no-deal Brexit preparation. However, he emphasized “it doesn’t meant they are fully ready, in fact far from it”.

Japan PMI Manufacturing dropped to 49.5, further loss of momentum

Japan PMI Manufacturing dropped to 49.5 in June, down from 49.8, and missed expectation of 50.0. Markit noted there was the fastest drop in new orders since June 2016. However, there was resilient output trend as manufacturers reduce backlogs of work to greatest extent since January 2013.

Tim Moore, Associate Director at IHS Markit said: “June survey data reveals a further loss of momentum across the manufacturing sector, as signalled by the headline PMI dropping to a three-month low. Softer demand in both domestic and international markets contributed to the sharpest fall in total new orders for three years. A soft patch for automotive demand and subdued client confidence in the wake of US-China trade frictions were often cited by survey respondents.”

Japan CPI core slowed to 0.7%, core-core slowed to 0.5%

Japan national CPI (all items) slowed to 0.7% yoy in May, down from 0.9% yoy and matched expectations. CPI core (all items, less fresh food) slowed to 0.8% yoy in May, down from 0.9% yoy, but beat expectation of 0.7% yoy. CPI core-core (all items, less fresh food and energy) slowed to 0.5% yoy, down form 0.6% yoy, matched expectations.

BoJ left monetary policies unchanged yesterday. But Governor Haruhiko Kuroda pledged to ramp up stimulus “without hesitation” if the economy loses momentum. There are speculations that BoJ could act as early as in July, given that ECB and Fed have both turned more dovish this week. For the very least, BoJ could change its forward guidance and pledge to keep interest rates low longer.

Australia PMIs improved, green shoots emerging

Australia CBA PMI Manufacturing rose to 51.1 in June, up from 51.0. CBA PMI Services rose to 53.3, up from 51.5. Commonwealth Bank of Australia noted that output and new business both expanded at the steepest rates for seven months. Solid increase in outstanding workloads lead firms to raise their staffing levels for the second month in a row. Input costs jumped as sharpest pace since last November. But selling price inflation remained modest.

CBA Senior Economist, Gareth Aird said: “The economy has been in a soft patch, but there are some green shoots emerging. The combination of monetary policy stimulus, forthcoming tax rebates and strong employment growth has contributed to the sharpest lift in the index since late last year. While the overall level of the composite index signals modest growth, we are taking some comfort from the direction the index is heading.”

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1239; (P) 1.1278; (R1) 1.1329; More……

EUR/USD’s rebound from 1.1181 extends higher today and intraday bias remains mildly on the upside for 1.1347 resistance first. Break there will add to the case of medium term bottoming and target 1.1660 key fibonacci level next. On the downside, below 1.1270 minor support will turn intraday bias back to the downside for 1.1181 support instead.

In the bigger picture, considering bullish convergence condition in daily and weekly MACD, a medium term bottom could be in place at 1.1107 after hitting 61.8% retracement of 1.0339 (2016 low) to 1.2555 (2018 high) at 1.1186. Hence, for now, risk will stay on the upside as long as 1.1107 low holds. Break of 1.1347 will extend the rebound towards 38.2% retracement of 1.2555 to 1.1107 at 1.1660. However, sustained break of 1.1107 will confirm resumption of down trend from 1.2555.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:00 | AUD | CBA PMI Manufacturing Jun P | 51.7 | 51 | ||

| 23:00 | AUD | CBA PMI Services Jun P | 53.3 | 51.5 | ||

| 23:30 | JPY | National CPI Core Y/Y May | 0.80% | 0.70% | 0.90% | |

| 00:30 | JPY | PMI Manufacturing Jun P | 49.5 | 50 | 49.8 | |

| 07:15 | EUR | France Manufacturing PMI Jun P | 52 | 50.9 | 50.6 | |

| 07:15 | EUR | France Services PMI Jun P | 53.1 | 51.6 | 51.5 | |

| 07:30 | EUR | Germany Manufacturing PMI Jun P | 45.4 | 44.6 | 44.3 | |

| 07:30 | EUR | Germany Services PMI Jun P | 55.6 | 55.3 | 55.4 | |

| 08:00 | EUR | Eurozone Manufacturing PMI Jun P | 47.8 | 48 | 47.7 | |

| 08:00 | EUR | Eurozone Services PMI Jun P | 53.4 | 53 | 52.9 | |

| 08:30 | GBP | Public Sector Net Borrowing (GBP) May | 4.5B | 3.3B | 5.0B | 6.2B |

| 12:30 | CAD | Retail Sales M/M Apr | 0.10% | 0.20% | 1.10% | 1.30% |

| 12:30 | CAD | Retail Sales Ex Auto M/M Apr | 0.10% | 0.40% | 1.70% | 1.80% |

| 13:45 | USD | US Manufacturing PMI Jun P | 50.5 | 50.5 | ||

| 13:45 | USD | US Services PMI Jun P | 51 | 50.9 | ||

| 14:00 | USD | Existing Home Sales May | 5.29M | 5.19M |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals