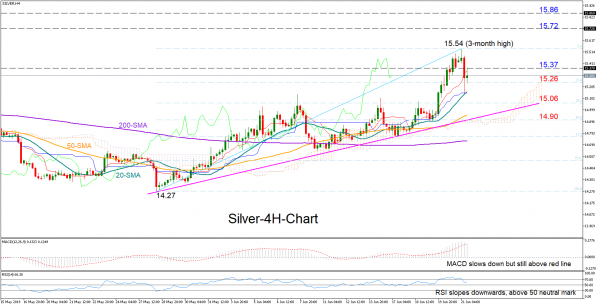

Silver reversed to the downside early on Friday but the 20-period simple moving average (SMA) in the four-hour chart managed to halt the bearish correction as it did a few days ago. The RSI and the MACD lost momentum as well, endorsing the negative move in the price. Yet, as long as both indicators remain in bullish area – the former above 50 and the latter above its red signal line – chances for a sharp downfall are weak.

The 23.6% Fibonacci of 15.24 of the 14.27-15.43 upleg is currently keeping the market action under control. Lower, the bears will try to overcome the 20-period SMA at 15.15 and meet a stronger obstacle around the 38.2% Fibonacci of 15.06. A decisive close below the 50% Fibo of 14.90 and the ascending line drawn from the 14.27 bottom could be more harmful, potentially signaling the start of a downtrend.

Note: our company created a profitable forex robot with low risk and stable profit 50-300% monthly!

In case of an upside reversal, the bulls would have to deal with the 15.37 level first before meeting the three-month high of 15.54 registered earlier today. Another step higher may also face resistance somewhere between 15.72 and 15.86.

Overall, silver is maintaining a bullish profile as long as it holds above the 15.00 mark.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals