The peak of the vacation season is approaching, which usually entails a decline in business activity, including that in financial markets. On the one hand, a decrease in the volatility of major currency pairs, which is already low, entails a fall in profits, but on the other hand, it also reduces potential losses in the event of a failed position.

We have repeatedly discussed in our previous forecasts, the trade wars led by US President Trump with both China and Europe, and the possibility of a global economic crisis and local recessions, Brexit and other political risks, prospects for a rate increase by the Fed and quantitative easing in the Eurozone, as well as many other factors influencing the formation of both short-term and long-term trends. If we talk about the mood of experts in the coming months, for the most part they expect that the US dollar will be able to strengthen its position in relation to other leading world currencies.

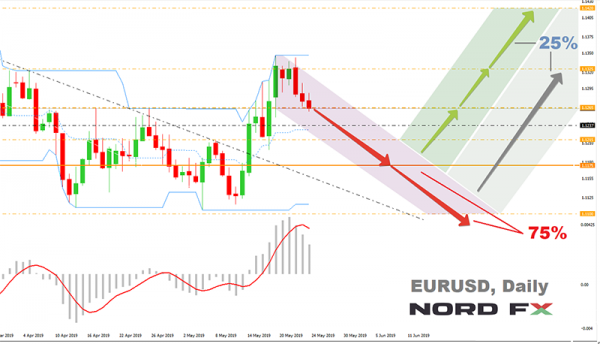

EUR/USD. Here, 75% of analysts, supported by 80% of indicators on MN, believe that the pair will definitely make another attempt to update the lows of spring 2019 and will finally break through support in the 1.1100 zone. The targets for the bears are 1.0900 and 1.0800 (of course, a possible margin of ± 25÷35 points must be considered). According to the remaining 25% of experts, the zone of 1.1100 is the fall limit, and the pair will now go to the zone 1.1530-1.1650. Most trend indicators and oscillators on W1 are also colored green.

USD/CHF. The euro and the Swiss franc are quite strongly correlated: the European currency is falling against the dollar, and the Swiss currency is losing ground at the same time. That is why here, just as in the case of EUR/USD, most experts (75%) have preferred the “American”. According to them, the pair is expected to rise, first to the level of 1.0130, and then 100 points higher, to the height of 1.0230. By the way, about 15% of the oscillators on W1 and MN are already signaling that the pair is oversold. An alternative view is presented by a quarter of experts who do not see the dollar above the symbolic 1.0000 level. In their opinion, no more than 0.9600-0.9700 francs will be given for the “American” in the second half of the summer.

NZD/USD and AUD/USD. We only talk about those pairs In this review, regarding the future of which most experts have already more or less formed an opinion. One of these pairs is NZD/USD: here 85% of the votes have been cast for the bears. If this prediction turns out to be correct, the New Zealand kiwi may fall to the low of 10/08/2018 in the zone of 0.6420. 90% of the oscillators on both timeframes, W1 and MN, agree with this forecast.

Bears have scored a bit less support when voting for the future of the nearest “colleague” of the New Zealander, the Australian dollar. Those turned out to be only 60%. True, they have been supported by almost 85% of trend indicators and oscillators on W1 and MN. The purpose of the bears is to update the June 17 lows, reaching the bottom in the zone of 0.6750-0.6800. 20% have favored the growth of the pair to the height of 0.7300, and another 20% have predicted a calm movement along the Pivot Point at the level of 0.7000.

And there are two more pairs, the forecasts for which have seemed to us quite interesting. Both are tied to the British pound, these are GBP/JPY and EUR/GBP.

70% of analysts believe that the pair GBP/JPY has reached its bottom at 135.65, and now it is expected to grow first to the height of 141.50, and then a rise above the horizon 143.75 is not excluded. Those experts who expect a tough Brexit and the UK exit from the EU without a deal see the pair at 131.00.

Even though the British currency fell against the euro throughout May and early June, most analysts are looking at the future of the pound rather optimistically. Just as in the case of GBP/JPY, 70% have voted for the growth of the pound and the decline of the EUR/GBP pair to the zone of 0.8600-0.8680. The next target is the lows of March 2019 in the area 0.8470. As for the bulls, they aim to rise above the high of 01/01/2019, breaking the height of 0.9100.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals