U.S. Highlights

- A light week on economic data was filled with Fed speeches and a trickle of news flow on the upcoming meeting between Presidents Trump and Xi. We do not expect to see a major breakthrough this weekend, but rather an agreement to continue talking (forestalling at least for now the threat of additional tariffs).

- Chair Powell reiterated comments in his press conference last week that crosscurrents to the economic outlook had arisen relatively swiftly over the past month, leading the Fed to shift toward an increased willingness to cut rates.

- Economic data was mixed, with home sales and confidence falling, but consumer spending rising. With revisions, second quarter personal consumption is likely to top 3% annualized, enough to push economic growth to the 2% mark.

Canadian Highlights

- Economic growth was healthy in April, although the breadth of the expansion was somewhat lacking. Only 11 of 20 major industry groups reported increasing output.

- Business Outlook Survey results point to improved business sentiment in 19Q2.

- Oil prices were up slightly due to increased tensions in the Middle East and a larger-than-expected drawdown of U.S. inventories.

It was a relatively light week on economic data but heavy on Fed communication and key political events. All eyes will be on the G20 meeting this weekend, where Presidents Trump and Xi will meet on Saturday in Osaka to discuss U.S.-China trade relations.

Following the FOMC meeting last week, Fed speakers were out in full force explaining and defending the committee’s shift from patience to willingness to do more. Most notably, Chairman Powell reiterated that significant crosscurrents had hit the U.S. outlook in the period between the FOMC’s May and June decision. Among these, deteriorating business sentiment and slowing global growth rang the loudest.

Powell did not mention it explicitly, but the breakdown in trade negotiations between China and the U.S. was a key driver of the change in tack. That puts the focus squarely on the leaders of the two countries as they meet in Japan this weekend. Prior to the meeting, optimism that the two sides were getting close to a deal were stoked by Treasury Secretary, Steve Mnuchin, who said they were 90% of the way there. But, just as soon as he said this, doubt was cast by President Trump’s own interview that dangled the possibility of additional tariffs. At the same time, reports that China would come to the meeting with preconditions of its own, including the removal of all existing tariffs and restrictions imposed on Huawei, reined in optimism that a significant breakthrough is imminent. All in all, we expect little to come out of the meeting except an agreement to keep on talking.

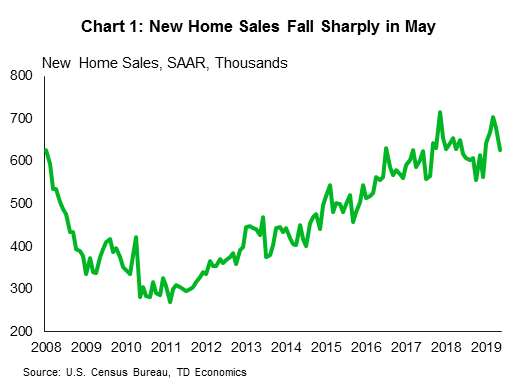

On the economic data front, the message was mixed. New home sales fell sharply in May, adding to the spate of challenging data for the housing sector (Chart 1). While lower mortgage rates should give some support to housing demand, this may be offset in part by increased economic uncertainty, leading would-be homebuyers to hold off on making big purchases. Indeed, measures of consumer confidence fell in May, with a drop in expectations for the future leading the pullback.

On the bright side, consumer spending is still holding up. Real personal consumption rose by 0.2% in May, and was revised up to 0.2% growth in April from a previously flat reading. With two of three months of the second quarter now recorded, spending growth looks to advance by well over 3% (annualized – Chart 2). Even with some weakness in investment and trade, second quarter economic growth appears likely to come in near the 2% mark.

Evidence that economic growth is holding up suggests that even as the Fed considers insurance cuts, it need not have to bring out the bazooka. While a 25-basis point cut in July seems increasingly likely, the Fed should be able to afford to save at least some of its bullets and refrain from a larger 50-basis point cut, as futures markets have begun to price. Still, we would hold off betting the farm on it until after next week’s June payroll report.

With Canada’s birthday just around the corner, we were treated to early birthday presents in the form of healthy April GDP and decent results from the Bank of Canada’s Business Outlook Survey (BOS).

Unwrapping April GDP, we saw 0.3% growth month-on-month following a big upturn in March (0.5%; Chart 1). The goods and services sectors posted gains of 0.4% and 0.2% respectively, moderating from the March pace. April’s expansion was somewhat lacking as only 11 of 20 major industry groups reported increasing output. The oil and gas sector had an exceptional showing, posting 4.5% growth, owing to reduced production restrictions. Growth in wholesale trade was also strong. All in all, this was a healthy report putting the Canadian economy on a path to record around 2.5% growth in Q2, nearly double the Bank of Canada’s forecasts in its April Monetary Policy Report. This will likely give the Bank of Canada more confidence to remain on the sidelines and not follow the Fed in cutting rates as ‘insurance’ later this year.

Business sentiment also seems to be improving in Canada as suggested by the second birthday present, 19Q2 BOS results. The composite BOS indicator rebounded to 0.2 from a downward revised -0.6 in Q1 (Chart 2). Indicators of future sales picked up from a low last quarter, while investment spending plans remained at healthy levels. Firms reported easing credit conditions, in line with the Senior Loan Officer Survey (SLOS), also released today. On the downside, however, the BOS did note that global trade uncertainty and weakness in the oil sector continued to hold back future sales. The overall BOS results were in line with this week’s June CFIB Business Barometer. The CFIB index rose for a third straight month with 11 out of 13 sectors recording gains. Taken together with the BOS results, improving business sentiment is a nice present for the Bank of Canada, joining the GDP data in providing them with comfort in the current level of monetary policy.

It wasn’t all good news. This week also saw more concerning developments in the Canada-China relationship. China barred all meat imports from Canada due to the discovery of fake veterinary health certificates for a batch of pork products. This will constrain the recent surge Canada has been seeing in its meat exports to China. If the situation is not resolved quickly, this may prompt the Canadian government to provide support to the meat industry.

Finally, markets moved a little lower this week, in part due to less optimism on the magnitude of expected Federal Reserve interest rate cuts. Moving in the opposite direction were oil prices (WTI), up 3% over the week, as increasing tensions in the Middle East and a larger-than-expected draw of inventories in the U.S. put upward pressure on prices. Expectations for an extension of production cuts at the OPEC+ meeting on Monday may also be providing some support for oil prices.

U.S. ISM Manufacturing Sales – June

Release Date: July 1, 2019

Previous: 52.1

TD Forecast: 51.0

Consensus: 51.2

We look for a new monthly decline in the manufacturing ISM index to 51.0, as we expect ongoing trade headwinds to have affected business sentiment in the June survey. Indeed, the average of the ISM-adjusted regional surveys signaled a 2pt decline from the May levels to 51.9, with retreats in five out of the six published surveys we track. We note, however, that most of these surveys were negatively biased by the US-Mexico trade spat given some responses had to be returned early in the month. That said, a recent spate of uninspiring growth in core durable goods orders and a weak Markit PMI survey also boost the odds for a downside surprise in June, in our view.

U.S. Employment – June

Release Date: July 5, 2019

Previous: 75k, unemployment rate: 3.6%

TD Forecast: 150k, unemployment rate: 3.6%

Consensus: 163k, unemployment rate: 3.6%

We look for payrolls to bounce to 150k in June, following the soft and below-expectations 75k print in the previous month. In particular, we expect job creation in the manufacturing sector to remain subdued, staying in the single-digit range for a third consecutive month. This should keep employment in the goods sector soft despite our anticipation for some minor improvement in construction sector jobs. Likewise, we forecast employment in the services sector to register a modest rebound following the weak 82k print in May. All in, the household survey should show the unemployment rate remained steady at 3.6%, while wages are expected to rise 0.3% m/m on the back of a favourable reference week. The latter should bring the annual print up a tenth to 3.2% in June.

Canadian International Trade – May

Release Date: July 3, 2019

Previous: -$1.0bn

TD Forecast: -$1.3bn

Consensus: N/A

TD looks for the goods trade deficit to widen to $1.30bn in May from $0.97bn. Stronger imports will serve as the main driver behind the wider deficit, although we also expect a modest increase in exports. The latter reflects a rebound in auto exports after temporary production shutdowns weighed heavily last month, which will be countered by a pullback in nominal crude exports. WTI prices (in CAD) fell by 4.1% in May although stronger rail shipments could provide an offsetting increase in volumes; even after the recent recovery, total crude exports by rail remain 35% below levels from December 2018.

Canadian Employment – June

Release Date: July 5, 2019

Previous: 27.7k, unemployment rate: 5.4%

TD Forecast: 5k, unemployment rate: 5.4%

Consensus: N/A

TD looks for the labour market to shift into a lower gear with job growth of 5k in June, which if realized will register as the second weakest month since August 2018. However, details should prove more uplifting than the headline print. Modest employment growth should be sufficient to keep the unemployment rate unchanged at a multi-decade low of 5.4%, and wage growth is poised to climb higher to 2.8% y/y owing to a muted increase last June. In fact, base-effects will become a significant tailwind to wage growth over the coming months; wages for permanent workers declining by 0.03% m/m on average from June-October 2018, which compares with an average increase of 0.45% m/m over the last six months. Elsewhere, we also look for a modest rebound in private employment after the loss of 20k private sector jobs last month.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals